This is a sponsored post by Accusoft.

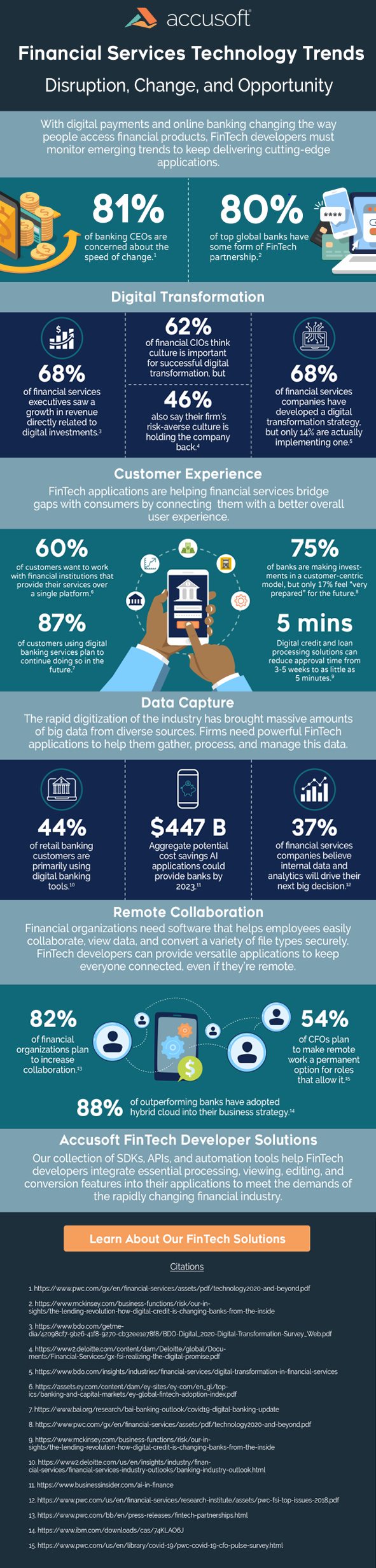

Fintech software plays an instrumental role in the financial services industry today, facilitating customer access to financial products in a manner that enhances operational efficiency and suits individual needs. The advent of digital technology continues to transform financial institutions’ operations, pushing developers to innovate new applications that can efficiently handle tasks previously distributed over numerous systems and software.

Among these capabilities, document viewing and sharing features stand out as vital for fintech applications. Developers often resort to a range of document lifecycle solutions to circumvent the complexity of building these functionalities from scratch. However, the financial industry faces unique challenges related to security and compatibility when choosing integration partners. Understanding the critical role Java plays in contemporary fintech application development is imperative to truly grasp these technical hurdles.

Why Java Is a Vital Component of Fintech Applications

As a versatile and robust programming language, Java is renowned for its widespread use across many industries, with the finance sector being one of its prominent areas of application. Its popularity is attributed to several intrinsic features that particularly suit the demands of the finance industry. Among these are its scalability, security, and platform-independent nature. In an industry where data is vast, sensitive, and continually growing, Java’s scalable framework allows for the easy handling of increased data loads and user requests.

The robust security features Java offers are crucial for financial applications that handle high-value data that is frequently targeted by cybercriminals. Java is also a platform-independent language, which ensures that financial applications can function seamlessly across different operating systems, thus enhancing their accessibility and usability. This unique blend of capabilities has made Java the preferred programming language of developers operating in the financial services industry.

Why Financial Applications Need Document Viewing and Sharing Capabilities

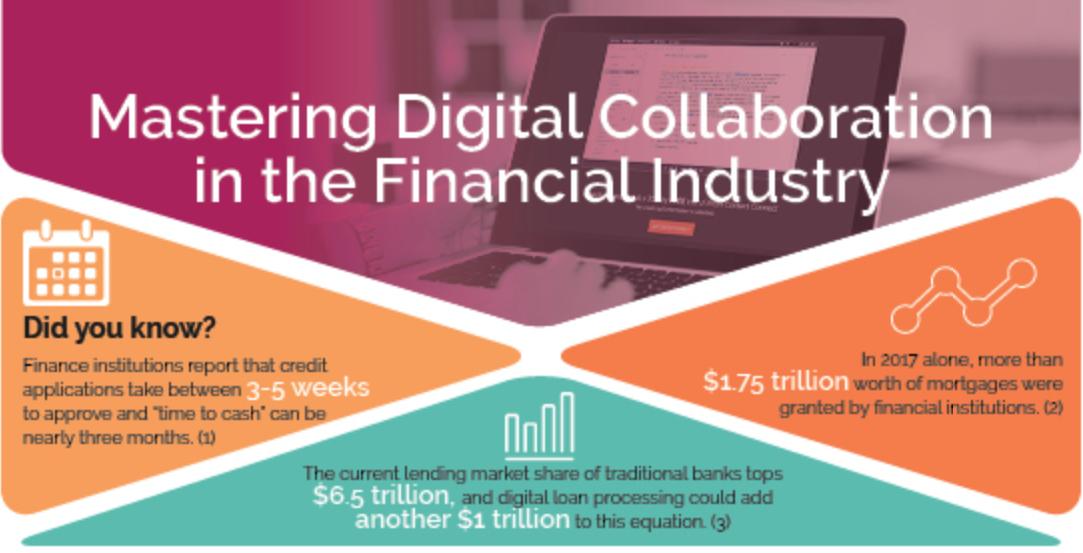

Document viewing and sharing capabilities are of paramount importance in the financial services industry due to several reasons. These applications often deal with an array of complex and sensitive information, such as transaction histories, financial reports, regulatory documents, and personal client data. Effective document viewing and sharing capabilities allow for seamless access to this crucial information, enabling users to make informed decisions swiftly.

Viewing and sharing features also foster enhanced collaboration among team members, as they can easily share and discuss relevant documents. Given the sensitive nature of financial data, secure document viewing and sharing is essential to protect this data from unauthorized access. Effective and secure document viewing and sharing capabilities not only enhance the efficiency and productivity within the financial services industry but also play a critical role in maintaining data security and integrity.

4 Key Benefits of Java-Based Viewing Integrations

There are a number of reasons why integrating Java-based solutions for document viewing and sharing directly into fintech applications is beneficial for developers and financial services organizations.

1. Enhanced Security

Security is a paramount concern in the development and deployment of financial applications, and leveraging Java-based viewing integrations can play a significant role in enhancing this aspect. The integrations can serve as a safeguard, acting as a centralized location for document viewing and thus offering an extra layer of protection to sensitive information. With financial data typically including a vast range of confidential and highly valuable details, the potential for unauthorized access is a considerable risk.

Java-based viewing integrations can substantially mitigate these threats. By consolidating document viewing into a single, secure platform, it becomes substantially more challenging for unauthorized users to gain access to sensitive documents. Consequently, the application becomes more robust in terms of its security framework, providing users with greater confidence in the protection of their data.

2. Greater Efficiency

Efficiency is a crucial factor in the overall user experience and performance of financial applications, and the implementation of Java-based viewing integrations can significantly enhance this area. The traditional process often requires users to open and close external document viewers, a procedure that can be cumbersome and time-consuming. However, with the integration of a Java-based document viewer, this extra step can be eliminated.

Viewing documents directly within the financial application itself reduces the need for constant switching between different software interfaces. This streamlining of the viewing process saves valuable time, reduces the potential for user errors, and enhances the overall productivity of the end user. Therefore, incorporating Java-based viewing integrations in financial applications not only simplifies the workflow for users but also creates a more streamlined and efficient user interface, leading to improved productivity and a better user experience.

3. Improved Scalability

Scalability is a critical feature that is imperative for the growth and evolution of financial applications, and the incorporation of Java-based viewing integrations can serve as a vital tool to cater to this requirement. Financial organizations continually grow and change, and the amount of data they manage and the number of customers they serve can exponentially increase over time. In such scenarios, it’s crucial that fintech software can scale effectively to meet these expanding demands.

Java-based viewing integrations excel in this area by being inherently scalable. They can be expanded or contracted as needed, ensuring that irrespective of the increasing number of users or the burgeoning quantity of data, users will always have unhindered access to the documents they need. This seamless scalability ensures that the document viewing process remains efficient and effective, thereby contributing to the robustness of the application and supporting the continued growth and success of the financial institution.

4. Smoother Compatibility

Java-based viewing and sharing integrations are invaluable for the financial industry due to their ease of integration with existing Java-based fintech applications. In the evolving world of financial technology, seamless integration is critical to ensure optimal system performance, and to avoid compatibility issues that could disrupt operations. Java’s platform-independent nature, combined with its robust and versatile capabilities, allows for smooth and effective integration with a broad range of applications. This harmonization reduces the technical challenges associated with integrating disparate technologies and contributes to an overall smoother user experience.

Streamlined integrations also enable financial institutions to harness maximum value from their existing fintech applications, reducing the need for significant system overhauls or investments in entirely new platforms. In this area, Java-based viewing integrations contribute to increased operational efficiency, a more streamlined workflow, and ultimately, enhanced service provision in the financial industry.

Implementing Java-based Document Features with VirtualViewer

Accusoft’s VirtualViewer is an advanced, Java-based HTML5 document viewer for fintech applications. It supports various formats, eliminating the need for multiple viewers and enhancing user experience. The viewer operates on any OS, offering flexible viewing without software installation. Rapidly render and access financial documents, boosting security and efficiency. A national mortgage lender achieved a 40% reduction in processing times with VirtualViewer.

VirtualViewer provides comprehensive document support for your Java-integrated applications across platforms. Its robust APIs equip your software with essential viewing and sharing capabilities, whether deployed on the cloud, on-premises, or in a hybrid setup. Installation takes less than ten minutes, and ready-to-use connectors facilitate swift integration with leading ECM applications like Alfresco, IBM, and Pegasystems.

Test VirtualViewer today with a free demo to explore all the functionalities for your Java-integrated application.

Our

Our