“CRIF’s innovation combines lending via mobile devices with agile, business user-friendly technology to ensure business KPIs are met during the sales phase of the lending process. The demo shows new releases of CRIF Credit Framework’s technology, which is a Smart Process Application platform built specifically for the credit and lending space that is extremely adaptable to any business, compliance regulation, and country requirement.It consists of modular decision management, process management, and business intelligence products used to develop smart, dynamic applications for credit, risk management, and lending. Flexibility along with control and analytical features allow our customers to be faster, better, and more efficient.”

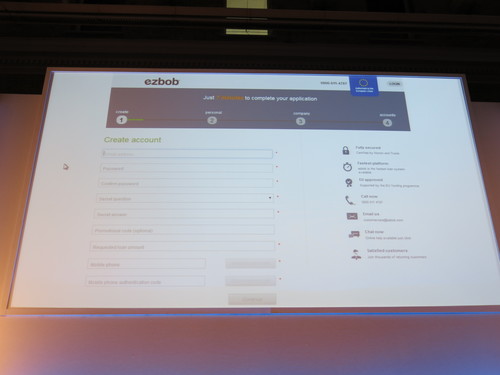

EZBOB Debuts its New Proprietary Business Lending Platform

This post is part of our live coverage of FinovateEurope 2014.

Making their way to the stage now is EZBOB, a web-based, fully-automated lending platform for SMEs.

“EZBOB’s lending platform was initially designed to provide an automated funding solution for online retailers, such as people operating online shops on eBay, Amazon, or those using PayPal.“At Finovate EZBOB is launching their new proprietary platform (EZ10.1), which allows for any of the 5 million SMEs in the UK to apply online in minutes and find out how much funding is available to them.“Now, all business applicants will enjoy EZBOB’s USP, which is a short online application with an automated lending decision and instant funding of up to 50,000 pounds.”

Product Launch: February 11, 2014

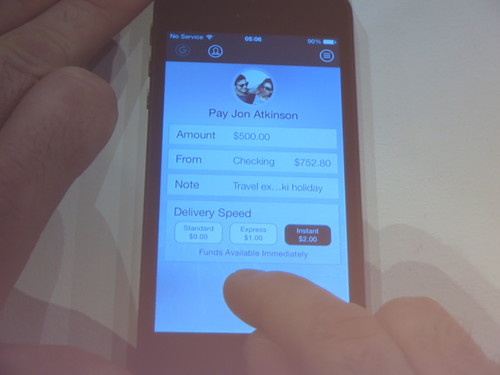

Fiserv Debuts New Version of Its Mobile & Tablet Banking Platform, Mobiliti

“We are demonstrating the next version of Mobiliti – our flagship mobile and tablet banking platform, with a focus on its completeness, intuitive design and disruptive capabilities.”

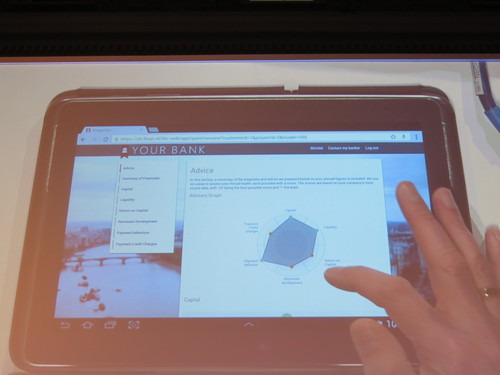

Topicus Finan Presents its Self Service Business Lending Solution

This post is part of our live coverage of FinovateEurope 2014.

The team from Topicus Finan is on stage right now, ready to demo Finan Financials.

“Self service for business lending as a service extension to face-to-face advice is something that modern clients expect from a bank. We are demonstrating the impact of self-service. The entrepreneur has the option of working with what-if scenarios to assess the financial impact of his investment in real time. A key aspect is that the entrepreneur is not aware of typical banking complexities. Instead, communication is centered on concepts he understands, like the cost of a new machine and turnover growth.”

ETRONIKA Debuts BANKTRON Multi-Channel Partnership Ecosystem

“BANKTRON introduces a brand new approach to the customer. By combining banking and partners, data analysis, personalization, loyalty, and even fraud prevention, we have laid a whole new ground for better customer interaction and value added product offering. BANKTRON enables the bank to provide personalized, tailored services to the customer via multiple channels, much attention drawn to the mobile.Our flagship product BANKTRON is enriched with data analysis, fraud prevention engines, and a customer loyalty platform, which increases customer engagement and eases the determination of a full customer’s profile based on behavioral patterns. Providing tailored marketing campaigns and enhancing fraud prevention – a way to retain a satisfied customer.”

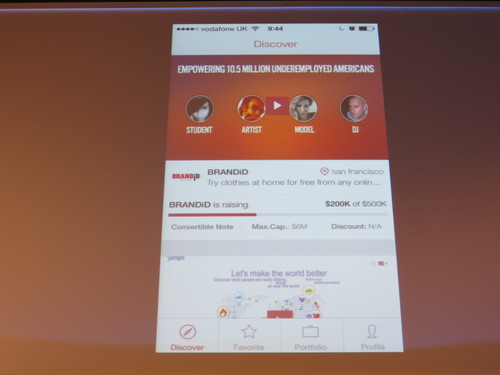

Kown’s New Platform Matches People with Investing Opportunities Based on Their Interests

“Kown provides an alternative for the traditional savings account. We match people with investing opportunities based on their interests, risk-graph and investment focus.”

CurrencyTransfer Launches its FX Price Feed Aggregator for SMEs

This post is part of our live coverage of FinovateEurope 2014.

Our next innovator is CurrencyTransfer, developer of technologies to make it easier for small and medium sized businesses to operate internationally.

“FX price feed aggregator and execution platform that takes the technology blue chip treasurers take for granted, and makes it accessible to the masses. We offer a price feed aggregation solution to problems SMEs trading internationally face, including: outdated phone based comparison, experiencing ‘honeymoon rates’ & dreadfully expensive bank foreign exchange rates.Our goal is to create efficiency & total price transparency in an expensive, and opaque international money transfer industry. Version 1 features include: bidding platform, trade execution, multi broker registration & post trade history.”

SaaS Markets Helps FIs Build, Brand and Launch Their Own App Stores

This post is part of our live coverage of FinovateEurope 2014.

Making their way to the stage is the team from SaaS Markets with their Enterprise Cloud Marketplace Platform for financial companies.

“Saas Markets’ MarketMaker platform allows financial companies to deploy a fully branded cloud marketplace containing proprietary apps and/or selected software from our catalog of over 1,500+ pre-qualified business applications, plus other cloud products and services – all in one convenient marketplace for your employees or business customers.”

Nous.net’s Spark Feed Leverages Trading Intuition Rather Than Software Algorithms

This post is part of our live coverage of FinovateEurope 2014.

Next up to the stage is Nous.net, a company that operates a next generation, free trading simulator

“Nous ‘Spark Feed’ is a real-time financial data service that helps you understand and predict the markets. Uniquely, Spark Feed uses the intuitive and analytical capabilities of tens of thousands of real people, not software algorithms. Their predictions are segmented by proven trading skill and then quantitatively blended.”

Recently partnered Jack Henry & Associates and Luminous Demo DataVault

“DataVault is a virtual safety deposit box that allows banking customers to upload, sort, and store personal and business documents in one secure place. Now customers can bank online with important documents just a click away.”

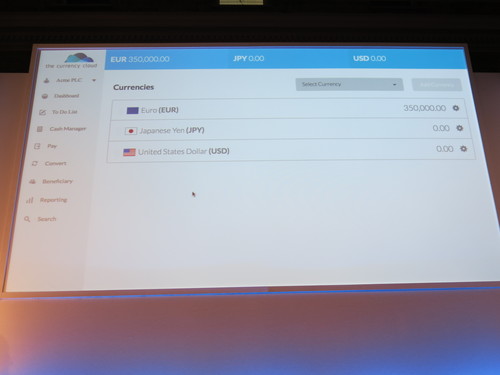

The Currency Cloud Revamps International Payments Platform

“This release will provide our clients access to an easy-to-use web console. Cross-border transactions tend to be expensive and inefficient (i.e., error prone) as the majority are executed through some type of manual process. While a variety of alternative international payment providers claim to offer relief, their services have limitations that often leave companies encountering the same issues of high costs, inadequate automation and deceptive pricing. We think global businesses deserve better, and have developed an entirely new model for international payments.”

• Current number of employees: 42• Money raised: $8M as of December 2013 – next round imminent.• Financial Data: transaction run rate is approximately $4B per calendar month and is projected to double every five to six months. Revenue run rate is currently $4.4M.• Customer Traction: we have on-boarded over 50 new direct clients with over 1,000 indirect customers since January 2013.

SQLI Launches Augmented Banking

“Augmented Banking is a new take at Online Banking. It is aimed at positioning a Bank at the very center of people’s digital lives.The core concept behind Augmented Banking is to collect a massive amount of information about a user’s digital life from multiple sources and to push it back to him as a visualization of his financial behavior.”