On Monday, Credible debuted its student loan refi platform at Jason Calacanis’s Launch Festival (see demo below). The demo was a judge favorite, with three of the five judges naming it their favorite among the eight demos in that session. And the company ended up taking home the trophy (and optional investment) as the best established company demo. The overall winner was Connect, an address book that maps your contacts from social networks.

On Monday, Credible debuted its student loan refi platform at Jason Calacanis’s Launch Festival (see demo below). The demo was a judge favorite, with three of the five judges naming it their favorite among the eight demos in that session. And the company ended up taking home the trophy (and optional investment) as the best established company demo. The overall winner was Connect, an address book that maps your contacts from social networks.

__________________________________

How it works

__________________________________

The business model is similar to Lending Tree. Users answer eight questions, all from memory:

1. Do you have a PRIVATE student loan? (Yes/No)

2. What year did you graduate? (choose 2001 to 2012)

3. What was the last school you graduated from?

4. Do you have graduate or postgraduate degree? (Yes/No)

5. What is your approximate income? (slider $0 to $200,000+)

6. What is your approximate student loan balance? (slider $0 to $200,000+)

7. What is the approximate interest rate on your student loan? (slider 2% to 15%+)

8. What is your approximate credit score? (slider very poor/300 to excellent/850)

Close = Enter your email address to get results

At the end of that 60-second quiz, as soon as the email is entered, Credible displays the potential savings from a student loan refi.

Interested borrowers select the Switch Lenders Now button, download their actual loan info through account aggregation technology (the demo showed Intuit powering an account scrape of Sallie Mae), complete a short loan, and upload a scan of their drivers license and last pay stub.

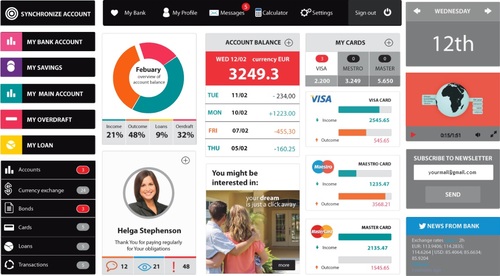

That info is sent off to student lenders who make actual credit offers to the user within two to three days (see screenshot #2).

In the 24 Feb 2014 demo, using an actual student from their beta launch, the three competing lenders shown were (may not be real quotes however):

- Wells Fargo at 3.75%

- SoFI at 5.88%

- CU Student Loans at 4.90%

___________________________________

About Credible

___________________________________

- San Francisco-based startup launched in Feb 2014

- Raised $500,000

- 30,000 borrowers registered during its beta test (carried out under previous incarnation, JoinStampede.com)

- Founder Stephen Dash worked at JP Morgan Chase

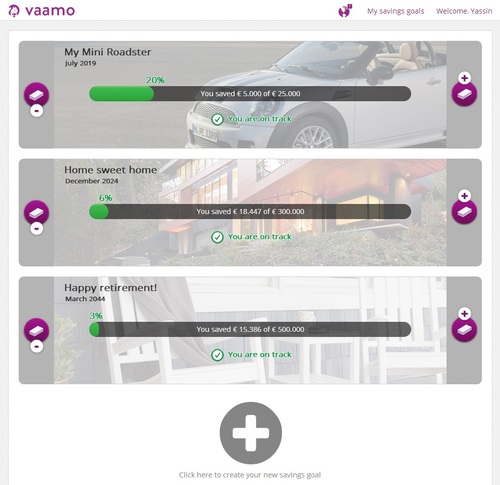

- Its goal is to move beyond student loans into “every bank and insurance service.”

__________________________________

Bottom line

__________________________________

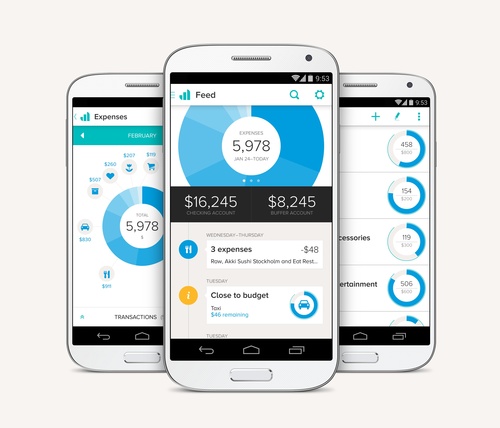

As proven by the success of Sofi ($400 million funded) and the buzz around Finovate alum Tuition.io, the student loan market is ripe for new thinking (I won’t say disruption, because debt consolidation is hardly a new concept). That said, existing financial institutions can play in this game, and win if they want to. We believe customers would be more likely to refi if it was delivered by their primary financial institution within the secure online (or mobile) environment.

And the great thing about saving your up-and-coming customers a few grand each year is that they are hardly going to jump ship to save $5 per month on a checking account.

—————————-

Exhibits

1. Credible wizard results

2. Competing offers

Credible demo (will launch in separate window set to begin demo at the 1 hour, 56 min mark; 25 Feb 2014)

Margin Maximizer Interactive from ProfitStars added to ICBA Preferred Service Provider program.

Margin Maximizer Interactive from ProfitStars added to ICBA Preferred Service Provider program.