If there is one of area where innovation—and venture capital investment—is most abundant, it may be international money transfers.

If there is one of area where innovation—and venture capital investment—is most abundant, it may be international money transfers.

Whether it is the worker abroad looking for the best and safest way to send money back home, or the enterprise trying to find the best rates for converting thousands of dollars every day, the challenge of moving money across borders safely and efficiently is a growing one.

CurrencyTransfer.com is one of the pioneers. Founded in 2013 and headquartered in London, CurrencyTransfer.com works to bring about the same competitive pricing to small- and medium-sized businesses as that experienced regularly by large corporations.

SMEs trading up to £200 million annually can take advantage of CurrencyTransfer.com’s forex price-feed aggregator and execution platform, gaining access to competitive international payment quotes from a variety of providers all in one place.

We exchanged emails with Daniel Abrahams, CurrencyTransfer.com co-founder and managing director, to learn more about the company and its unique role in the money-transfer industry. His responses are below.

Finovate: You’ve earned some great press heading into into the end of 2014. What have you been doing that’s been attracting so much positive attention.

Daniel Abrahams: For a start, CurrencyTransfer.com is doing something different. We’re not a bank, we’re not a broker, nor are we a P2P matcher. We’ve built the world’s first online marketplace for international payments, saving businesses up to 85% in hidden fees. Thinking differently runs through everything we do, and this is certainly capturing the imagination of both journalists and end-users alike.

At the capital markets level, FTSE 100 companies have the basic right to get live, multiple-price feeds. We simple try to democratize this down to the everyday SME, deserving of the same access as the big guys.

Finovate: Where did the idea for CurrencyTransfer.com come from?

Abrahams: Personal pain. My co-founder and I were getting ripped off on our own currency exchange when traveling around Europe and living in Australia. We were shocked at hidden fees; namely, profit built into the exchange rate by banks and bureaus.

My co-founder Stevan and I also observed other verticals closely. In any industry where there is inefficiency, we see marketplaces disrupt. Whether it is the way we book flights, hotels, taxis—the list goes on. In such a huge, opaque industry, we spotted a real opportunity to bring transparency and efficiency.

Finovate: There are a variety of players in the currency-transfer space. How do you distinguish yourself from the rest of the pack?

Abrahams: It’s a hot space that has attracted a significant amount of VC funding over the past 24 months. I see distinct layers in the currency-transfer space, rather than any “winner-takes-all” scenarios. Some focus on cracking remittance, others 100% pure play digital private clients.

While we do onboard private clients, there is a minimum trade size and our sweet spot is regular business foreign exchange. We actively trade and onboard companies with many millions of pounds worth of FX exposure annually. The average transaction size is in excess of £25,000 and rising the whole time. These customers have very regular foreign-exchange exposure and often use our platform for more than just a basic spot-transfer.

We offer anything from same-day spot, up to 12-month forward, and whilst all transfers are booked online, we also offer a more managed service through in-house currency experts. For larger companies—our sweet spot—we learned they need and often want to have a trusted specialist on the other end of the phone.

Daniel Abrahams, managing director and co-founder; Stevan Litobac, technical director and co-founder; and Aviva Tabachnik, partnerships executive, demoed at FinovateEurope 2014.

Finovate: What are some of the biggest challenges on the technology side, in terms of building a platform that works well for users?

Abrahams: Marketplaces are notoriously tough to build. Building out a reliable system—one that works reliably across multiple external API systems—can be challenging as you have to amalgamate various different formats of data coming in from these providers.

The second biggest challenge is optimizing the speed of service across these providers when the customers are getting quotes.

Finovate: You’ve talked about building the world’s first multibroker KYC form. Tell us more about this project and why it’s such as big deal.

Abrahams: At CurrencyTransfer.com, we let customers set up a payment, aggregate LIVE rates, and book transfers—all within our web or mobile environment. This sounds easier to execute than it is.

For customers to get a live, bookable quote from non-bank FX suppliers, they need to be onboarded for compliance and anti-money laundering. When [creating the architecture for] our product, we realized we needed to onboard our customers with multiple providers in one hit. It would make no sense to fill in 5+ forms, then come back to our environment. You would lose stickiness and get quickly frustrated with the product and process. As a result, we coupled neat-tech with engaging with the various stakeholders behind the scenes to make this a reality for our customers.

Clients now never need fill out multiple forms, call up multiple brokers for an inaccurate and time-consuming rate-quote. Everything happens in one venue.

Finovate: Are you in the process of raising funds? If so, how is it going? What are some of the things that are impressing investors the most?

Abrahams: Yes. We’re looking to aggressively grow both side of the marketplace in 2015, and want to hit ambitious milestones we’ve set for ourselves. FinovateEurope was a great platform for announcing CurrencyTransfer.com, and as a result we’ve had a lot of inbound interest from both traditional VCs and, would you believe it, funds set up by banks. Investors like our fresh approach to the deep problem we’re tackling, the tech, and momentum we’ve built without raising a single penny of outside funding to date.

Finovate: You spend time in both London and Tel Aviv. How do you compare the two cities in terms of being fertile ground for fintech innovation.

Abrahams: We think we’re well set, marrying two of the best startup ecosystems in the world. Both are regularly seeing success stories and have growing fintech activity. London is certainly more mature when it comes to fintech, boasting more employees in the space than either New York or Silicon Valley.

In Israel, we’re seeing significant companies including, among others: Payoneer, eToro, and BillGuard to name a few. Budding entrepreneurs are looking at these successful companies, and are constantly looking at ways to cut costs or deliver better user experience than banks or legacy businesses. Bank Leumi, Citigroup, and Hapoalim are looking at ways to engage with startups through hackathons and accelerator programs. Innovative bitcoin startups are popping up the whole time.

At CurrencyTransfer.com, we organize a monthly FinTech Aviv, which brings together the smartest minds in the Israeli fintech ecosystem.

Finovate: You had an interesting column on the relationship between banks and startups. Overall, your outlook seemed very positive for both banks and fintech startups. Why do you think that the relationship between banks and startups is more mutually beneficial than we are sometimes led to believe (with the focus often on “disruption”)?

Abrahams: Banks are very good at certain things, and with the greatest respect, suck at others. Startups get UI/UX, and how to deliver a best-in-class customer experience. Startups want to push all boundaries with cost saving and product, but are not the smartest when it comes to the regulatory landscape and the intricacies of holding client funds. As such, I truly believe where there is a match (and there isn’t always), banks and startups will continue to lean on each other to revolutionize finance.

At CurrencyTransfer.com, we’re an open and democratic marketplace, and whilst cutting excessive bank fees by up to 85%, we are more than happy to engage with banks.

![]() Rippleshot made its Finovate debut at our spring conference in 2014. Based in Chicago and founded in June 2013, the company was co-founded by Canh Tran, CEO; Lucas Ward, CTO; Yueyu Fu, CPO; and Chief Scientist Randal Cox. Rippleshot was named one of ten “promising startups, to watch” by the 2014 FinTech Forward Rankings, and won “Startup Up and Comer” honors at the Chicago Innovation Awards in October.

Rippleshot made its Finovate debut at our spring conference in 2014. Based in Chicago and founded in June 2013, the company was co-founded by Canh Tran, CEO; Lucas Ward, CTO; Yueyu Fu, CPO; and Chief Scientist Randal Cox. Rippleshot was named one of ten “promising startups, to watch” by the 2014 FinTech Forward Rankings, and won “Startup Up and Comer” honors at the Chicago Innovation Awards in October. ![]() Israel-based BioCatch made its Finovate debut at FinovateFall 2014 in New York. BioCatch provides cloud-based behavioral authentication and threat detection for both mobile and online applications. The company recently launched its New Account Fraud Detection solution, and was featured in November 2014 by American Banker in its line-up of top 10 tech companies to watch.

Israel-based BioCatch made its Finovate debut at FinovateFall 2014 in New York. BioCatch provides cloud-based behavioral authentication and threat detection for both mobile and online applications. The company recently launched its New Account Fraud Detection solution, and was featured in November 2014 by American Banker in its line-up of top 10 tech companies to watch.

What matters most to millennials? According to Badarinath, location, fees, and mobile are the three areas where banks must be most sensitive to the shift in consumer preferences. Branches are not dead, he insists. But he also cited a poll showing that over 70% of millennials responding would rather go to the dentist than talk to a banker. Moreover, “fees” is a four-letter word for most millennial consumers, and a quality mobile experience is increasingly a minimum expectation for anyone under the age of 35.

What matters most to millennials? According to Badarinath, location, fees, and mobile are the three areas where banks must be most sensitive to the shift in consumer preferences. Branches are not dead, he insists. But he also cited a poll showing that over 70% of millennials responding would rather go to the dentist than talk to a banker. Moreover, “fees” is a four-letter word for most millennial consumers, and a quality mobile experience is increasingly a minimum expectation for anyone under the age of 35.

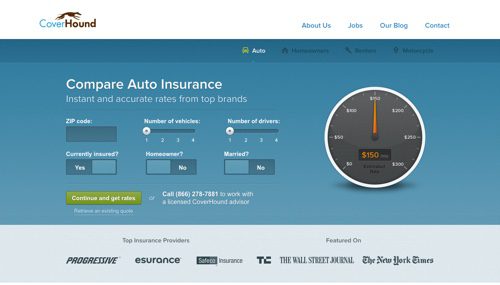

CoverHound

CoverHound