CoverHound, the company whose technology empowers consumers shopping for the best rates on insurance, has raised $14 million in new investment.

CoverHound, the company whose technology empowers consumers shopping for the best rates on insurance, has raised $14 million in new investment.

Participating in the Series B were existing investors Blumberg Capital, Bullpen Capital, and RRE Ventures, alongside new investors Core Innovation Capital, Route 66 Ventures, Thomas Lehrman, Tugboat Ventures, and American Family Ventures. The new funding takes CoverHound’s total capital to more than $23 million.

CoverHound CEO Keith Moore said the new funding will help the company grow its team, reach more insurance consumers, and forge new, “high profile partnerships.” “Welcoming more FinTech-focused investors to an already strong group has us well-positioned to provide the best possible consumer experience,” Moore said.

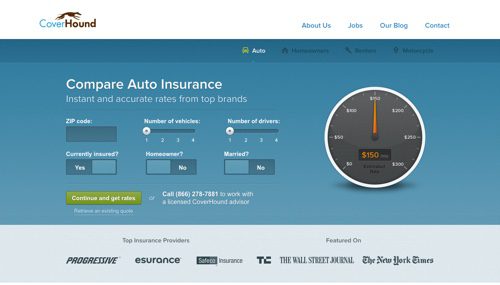

Enabling consumers to quickly and accurately comparison-shop on everything from smartphones to airplane tickets is one of the Internet’s greatest gifts to the consumer economy. CoverHound has leveraged this to build a platform that gives consumers a way to compare rates and prices on homeowners, automobile, renters, and motorcycle insurance. The company’s platform currently supports insurance from 21 carriers such as Progressive, Esurance, and Safeco; provides personalized quotes; and allows consumers to purchase a policy in minutes.

CoverHound founder Basil Enan and CEO (then CMO) Keith Moore at FinovateFall 2012.

Since its launch in 2012, CoverHound has sold 26,000 insurance policies; in 2014, it sold $17 million in insurance. The company was named “Best Money Saving Site for Auto Insurance” by Good Housekeeping in November 2013, and was named one of the “Top American Startups to Watch in 2014” by Huffington Post U.K.

Headquartered in San Francisco, CoverHound demoed its price-comparison technology at FinovateFall2012.