Even if you don’t have young children, I’m sure you’ve noticed how even pre-teens these days are hunched over their smartphones. So, if you want to get your core customers’ kids engaged with the bank, your strategy pretty much must begin with, and can probably end with, mobile.

Even if you don’t have young children, I’m sure you’ve noticed how even pre-teens these days are hunched over their smartphones. So, if you want to get your core customers’ kids engaged with the bank, your strategy pretty much must begin with, and can probably end with, mobile.

Banks haven’t really been able to devote resources to mobile youth banking as yet. The financial crisis hit at the same time the iPhone came out (unrelated, I believe), so it wasn’t really until the dust settled a few years later that v1.0 (adult) mobile banking was introduced. Now, most banks have a solid v2.0 in place and can start developing niche services for certain segments of their customer base.

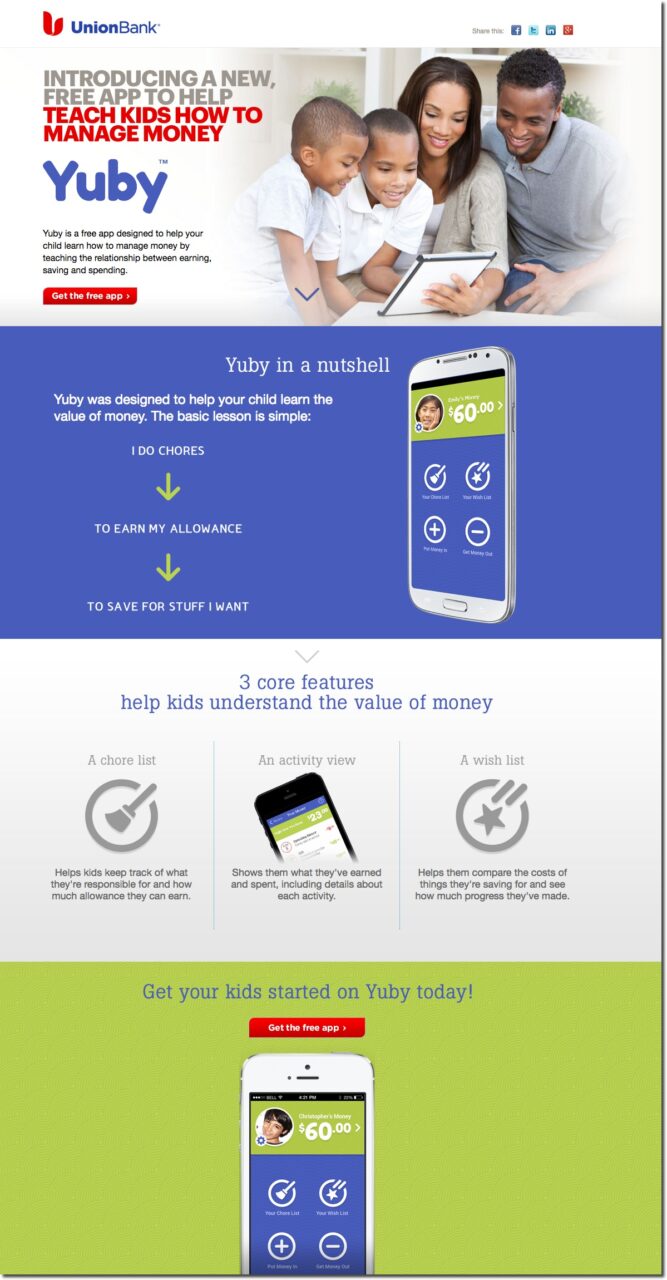

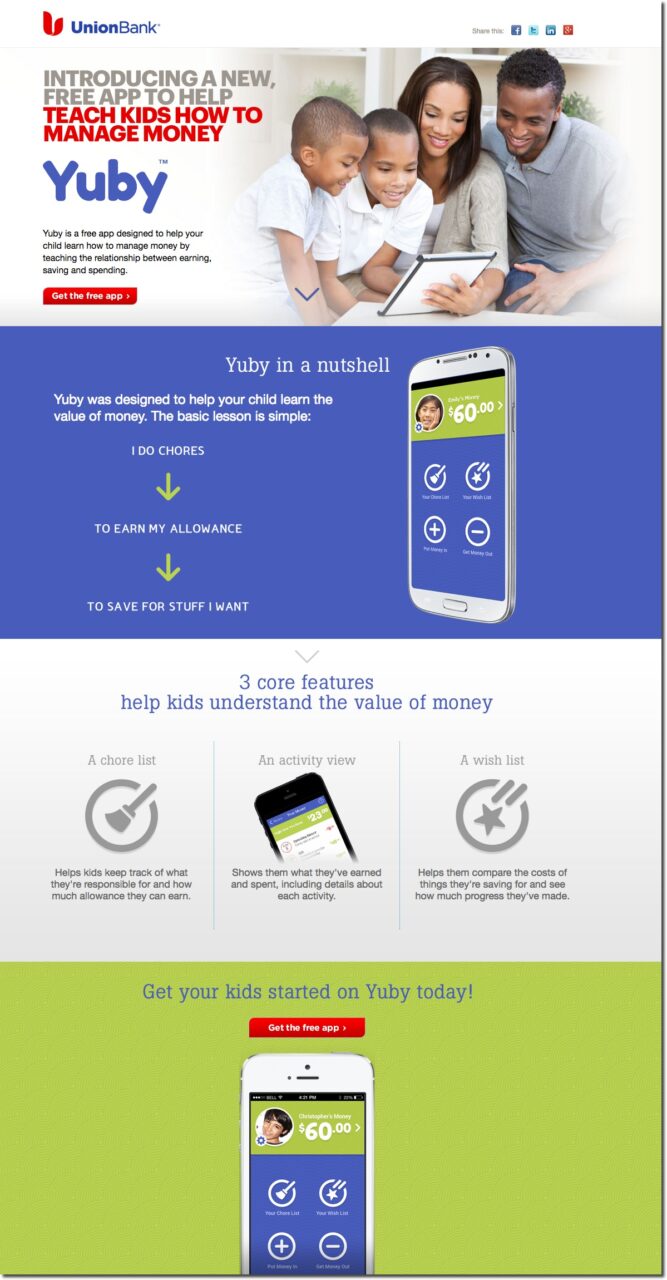

Union Bank is one of the early entrants in mobile youth banking. It launched a dedicated app a year ago (press release) called Yuby (see landing page below). It was built for them by Mutual Mobile, an app developer which has also worked for Finovate alum Clover.

How it works

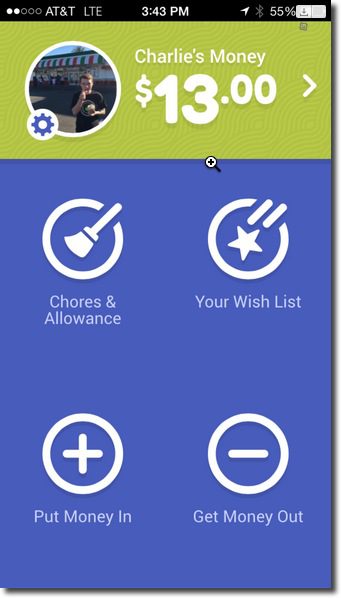

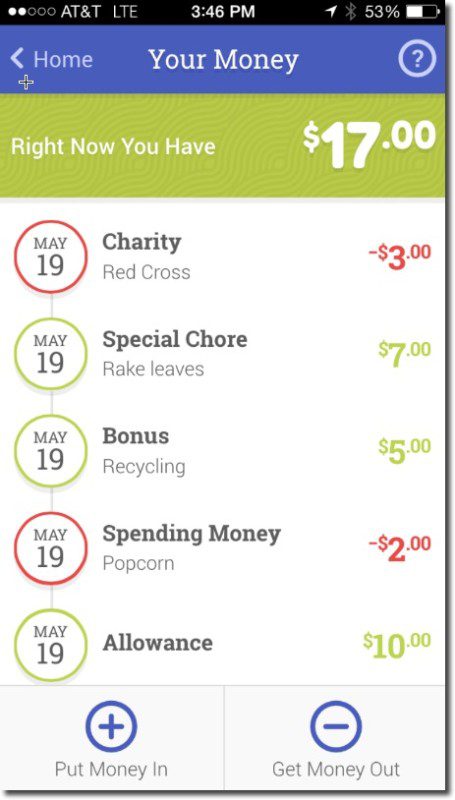

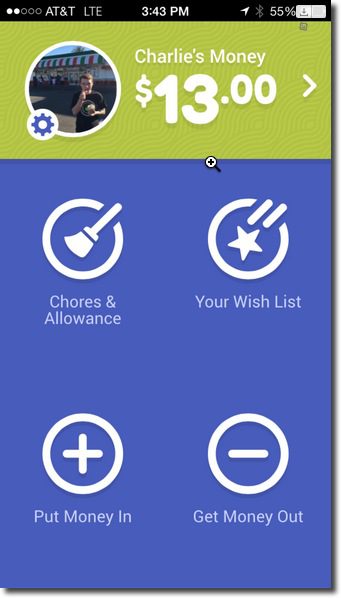

The app is very basic (see inset) and includes no ties to actual account data at Union Bank or anywhere else. Basically, it does just three things:

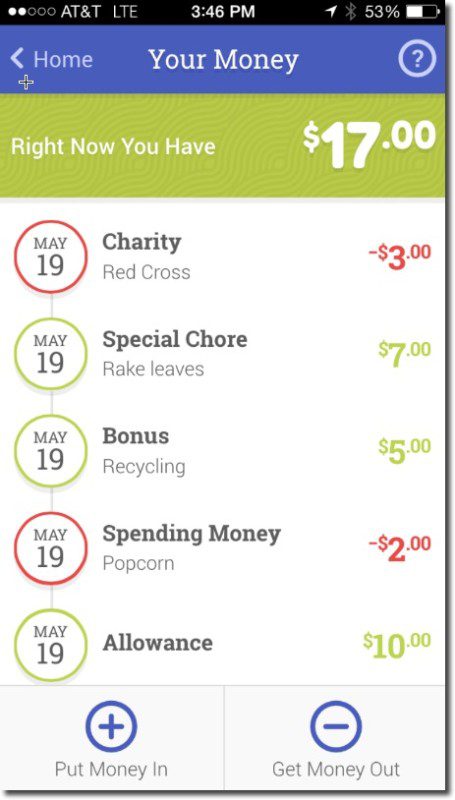

- Money tracking: Kids can add or subtract money from their virtual account, but only if a parent authorizes the transaction with a parental PIN—to be typed into the app on the child’s phone; there is no dedicated “parent app.” A simple transaction feed (below) shows the flow of funds in and out of the account.

Basic chore list: It’s easy to add a chore, but there is no tracking or integration with the child’s allowance.

Basic chore list: It’s easy to add a chore, but there is no tracking or integration with the child’s allowance.- Wish list: The app includes an area to establish multiple savings goals. And it automatically explains how long it will take to save for the goal if the child’s entire allowance is devoted to it.

Thoughts:

This is a great way to start. It’s a simple app, which means no integrations, no security audits, or compliance issues. No personal info is saved (other than a photo), so privacy is not an issue. Basically, it’s a mobile version of a sheet of paper and a pencil. But it’s much more engaging to port those simple functions to a mobile app, where a child/parent can always find it.

This is a good app for the grade-school set. However, it needs a functionality upgrade for the teen crowd. While older kids can still use it, once they are old enough for a debit or prepaid card, the app needs integration to actual bank accounts, both the child’s and parents’.

Resources:

At our Finovate events, we’ve seen a number of youth-banking use-cases presented, usually around debit and/or prepaid. The most recent from CBW Bank, who just last week showed us a glimpse of the future with an iOT integration that would allow parents to control fuel purchases for a specific vehicle (video coming later this week here).

There have been a number of memorable youth banking demos over the years, though none were specifically mobile-optimized. Of the six listed below, only FamZoo and PlayMoolah are known to be active at this time. The other four, in our view, were simply too early, or too complex, to make a business out of youth-banking services. Here are links to the demo videos:

Finally, there is Skill-Life’s Money Island, which was Finovate’s first youth-banking demo in fall 2009. The company was snapped up in 2010 and is now the basis of BancVue’s financial education service.

———

Union Bank Yuby Landing Page (link)