Germany’s Fidor Bank, one of the three or four most-progressive financial institutions on the planet (and a FinDEVr presenter next month) uses an interesting term when discussing its strategy with developers and third parties. They call it the FidorOS (bank as an operating system). Here’s how it’s described on the bank’s tech site:

Public APIs serve as a welcoming front door to new business clients. Fidor seeks B2B clients to do for banking what Apple did for mobile applications with iTunes. Easy to use; easy to integrate. The Fidor operating system is API-based.

I’m not sure the general public will ever think of their bank as an “operating system” (ChaseOS?), but it’s a good way to describe what the most developer-friendly FI and fintech players are looking to accomplish.

Will it work? Absolutely. Financial websites/apps will be stitched together with APIs just like every other website. Most banks already use at least one API, a third-party map to lay out bank locations. It’s just a matter of time before more behind-the-scene functions are enhanced or replaced with APIs, SaaS providers, and other integrations. It’s why Silicon Valley Bank bought API specialist Standard Treasury a few months ago.

Will it work? Absolutely. Financial websites/apps will be stitched together with APIs just like every other website. Most banks already use at least one API, a third-party map to lay out bank locations. It’s just a matter of time before more behind-the-scene functions are enhanced or replaced with APIs, SaaS providers, and other integrations. It’s why Silicon Valley Bank bought API specialist Standard Treasury a few months ago.

The exciting thing about the API revolution in banking is that it doesn’t have to end in a rush to the bottom price-wise. Banks, unlike many ecommerce players, are in an enviable position of selling much-desired trust, security, risk management, convenience, service and financial connectivity. And with huge regulatory barriers to entry, they don’t have to worry about being Amazoned or Netflixed out of business, at least not for a generation or three.

Banks are more like a cable TV company, albeit without the service-dulling monopoly powers (an important distinction), bundling together a wide variety of programming/services for a fat monthly fee. I see no reason why the BankOS of the future won’t be able to collect monthly subscription fees of $20 to $25 per person in each household ($30/mo single; $50/mo couple; $75/mo family) for a highly secure, and 100% guaranteed, financial “pipe” that brings transactions, insurance, loans, investments and payments into the home.

With the entire industry going through a down-to-the-studs rebuild, it’s a great time to be a builder—whether developer, designer, IT architect, product manager—in the financial services/fintech industry.

—-

—-

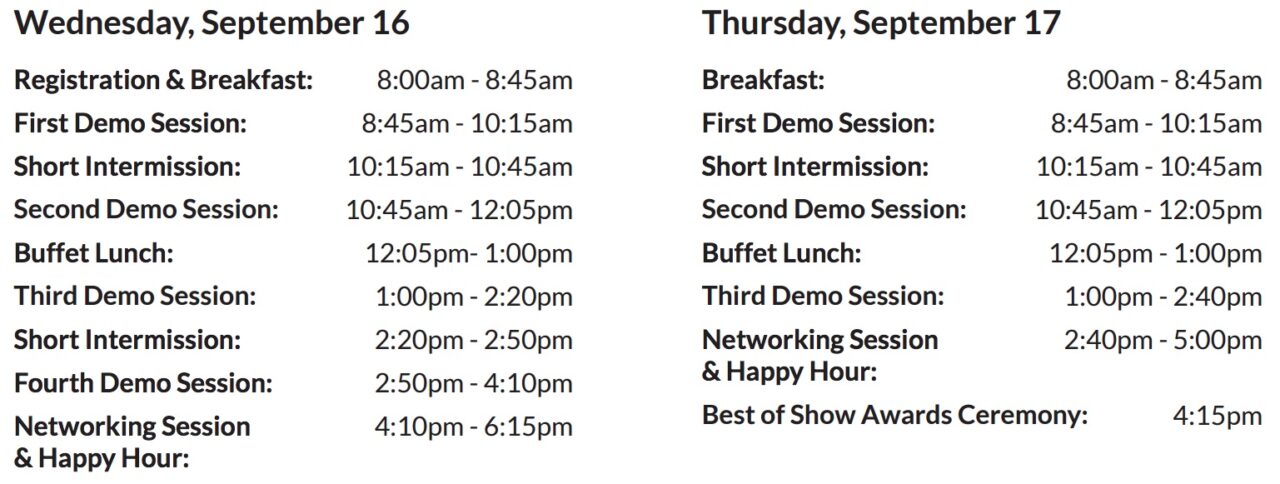

Join Fidor Bank as we delve into these issues and much more at our second annual FinDEVr conference on 6/7 October in rocking Mission Bay (future home of the Golden State Warriors, maybe). And don’t miss Finovate next week as well.

—-

Notes:

(1) See just how far ahead of the pack Fidor Bank was in its 2011 FinovateEurope demo

(2) Top slide from Fidor Bank’s Munich Developer Days (2015)

FinDEVr Previews highlight companies presenting new developer tools, platforms and integrations at FinDEVr 2015 San Francisco, 6/7 Oct. Early bird savings end Friday, so pick up your tickets today.

—-

—-