Back at the beginning of the year, Coinbase reported a major investment of $75 million from a crew of investors including BBVA Ventures, USAA Bank and the New York Stock Exchange among several others.

We now know that one of those other investors was Reinventure Group, the venture capital arm of Westpac Banking Corporation.

The Coinbase blog today reported today the bitcoin company had earned a strategic investment from the Australia-based venture-capital firm that specializes in fintech startups. Coinbase says it hopes the partnership will help the company “bring bitcoin to new markets around the world.” No dollar figure was mentioned in the announcement.

A representative from Westpac said that the investment would yield “key insights into the use of digital currencies and associated technologies.” The rep also praised Coinbase’s “heavy” investment in “next generation security” as the best way to fulfill its mission of being “the most trusted bitcoin company in the world.”

Coinbase’s total capital stands at more than $106 million.

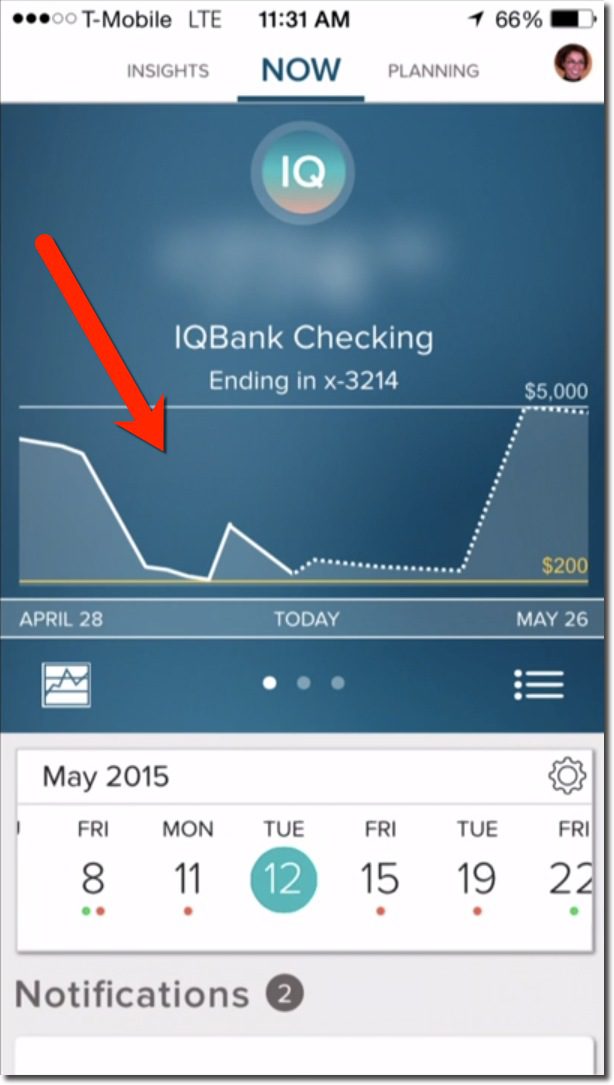

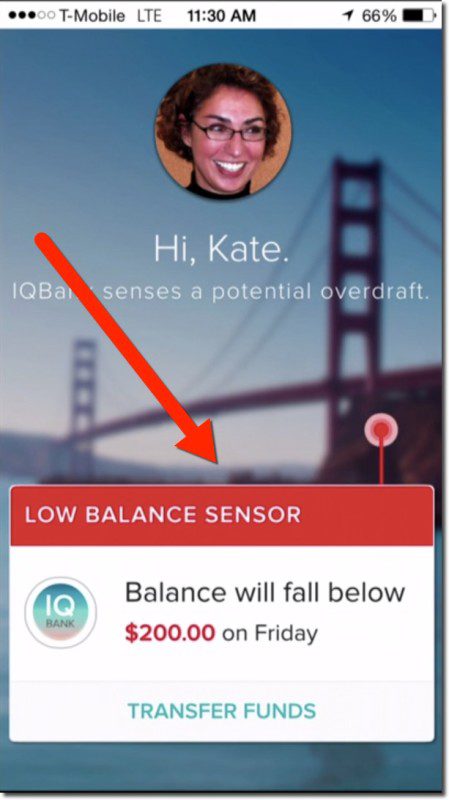

(Left to right): Business Development Managers Nahid Samsami and Roger Gu demonstrated Coinbase Instant Exchange at FinovateSpring 2014 in San Jose.

Coinbase specializes in enabling merchants to receive bitcoin payments without having to worry about the digital currency’s tendency toward price volatility. Coinbase holds more than one million digital wallets, and helps more than 28,000 merchants in more than 25 countries accept payments in bitcoin.

Recent news and notes from Coinbase include powering the new Bitcoin Index from the NYSE as of May, expanding to the U.K. and winning a spot on the AlwaysOn OnFinance’s Top 100 in April. Coinbase will also be upgrading its iOS and Android apps in February 2016 to support 11 additional languages.

Founded in July 2012 and headquartered in San Francisco, Coinbase made its Finovate debut at FinovateSpring 2014 in San Jose, where it demoed its Instant Exchange platform. Brian Armstrong is CEO.