This week, a wide variety of fintech companies raised money—from blockchain security (BitFury) to B2B payments (Karmic Labs). But once again the lending sector attracted the most cash, accounting for $95 million, or 64% of the $150 million total.

This week, a wide variety of fintech companies raised money—from blockchain security (BitFury) to B2B payments (Karmic Labs). But once again the lending sector attracted the most cash, accounting for $95 million, or 64% of the $150 million total.

The biggest round of the week was a partial Series C totaling $44 million to Finovate alum Kreditech. Two other Finovate alums raised new rounds: $5 million to Karmic Labs and an undisclosed amount to Nearex.

In total, 15 companies raised $150 million, bringing the year-to-date total to $8.4 billion.

Here are the deals, by size, announced between 4 July and 10 July 2015:

KreditTech

Alt-lender and credit-scoring services

HQ: Hamburg, Germany

Latest round: $44 million Series C

Total raised: $307 million ($215 million debt; $92 million equity)

Tags: Lending, loans, consumer, credit score, underwriting, Finovate alum

Source: Crunchbase

LSQ Funding

Receivables financing

HQ: Maitland, Florida

Latest round: $40 million

Total raised: $140 million

Tags: Alt-lending, SMB, accounts receivables, underwriting

Source: FT Partners

BitFury

Blockchain and bitcoin security

HQ: San Francisco, California

Latest round: $20 million

Total raised: $60 million

Tags: Bitcoin, blockchain, virtual currency, security

Source: Crunchbase

SlimPay

Online payments

HQ: Paris, France

Latest round: $16.6 million

Total raised: $16.6 million

Tags: Payments, direct debit, bank account, mobile payments, SMB, consumer

Source: Crunchbase

Lendingkart

Online financing for small business working capital

HQ: Ahmedabad, India

Latest round: $10 million

Total raised: Unknown

Tags: SMB, lending, underwriting

Source: Crunchbase

Karmic Labs

B2B payments infrastructure

HQ: San Francisco, California

Latest round: $5 million Series A

Total raised: $7.7 million

Tags: Payments, SMB, enterprise, Dash (trade name), Finovate alum

Source: Finovate

FAMACO

Android-based NFC reader

HQ: Paris, France

Latest round: $4.4 million

Total raised: $5.4 million

Tags: Payments, loyalty, SMB, POS, point-of-sale, hardware, acquiring

Source: Crunchbase

BeneStream

Health insurance

HQ: New York City, New York

Latest round: $4.3 million Series A

Total raised: $7.6 million

Tags: Healthcare, enterprise, self-insure

Source: FT Partners

OneMove

Real estate transaction platform

HQ: Regina, Canada

Latest round: $2.3 million

Total raised: $12.2 million

Tags: Home buying, mortgage, homeowners insurance

Source: FT Partners

Self Lender

Credit-building service

HQ: Austin, Texas

Latest round: $1.5 million Seed

Total raised: $2.0 million

Tags: Lending, loans, consumer, credit score, underwriting, Finovate alum

Source: Crunchbase

Toast

Online remittances and P2P transfers

HQ: Singapore

Latest round: $750,000 Seed

Total raised: $750,000

Tags: Payments, person-to-person, international remittances, fx

Source: FT Partners

Fundible

Group buying platform

HQ: Cardiff, United Kingdom

Latest round: $170,000

Total raised: $170,000

Tags: Payments, social, purchase, merchants, SMB

Source: Pymnts.com

Nearex

Proximity payments

HQ: Singapore

Latest round: Undisclosed Series B

Total raised: Unknown

Tags: Micropayments, POS, SMB, merchants, mobile payments, Finovate alum

Source: Finovate

BrickVest

Real estate investing marketplace

HQ: London, England, United Kingdom

Latest round: Undisclosed

Total raised: $1+ million

Tags: Mortgage, real estate, investing

Source: Crunchbase

IndiaLends

Lending and borrowing marketplace

HQ: New Delhi, India

Latest round: Undisclosed

Total raised: Unknown

Tags: Loans, credit, consumer, P2P, peer-to-peer, underwriting, investing

Source: Crunchbase

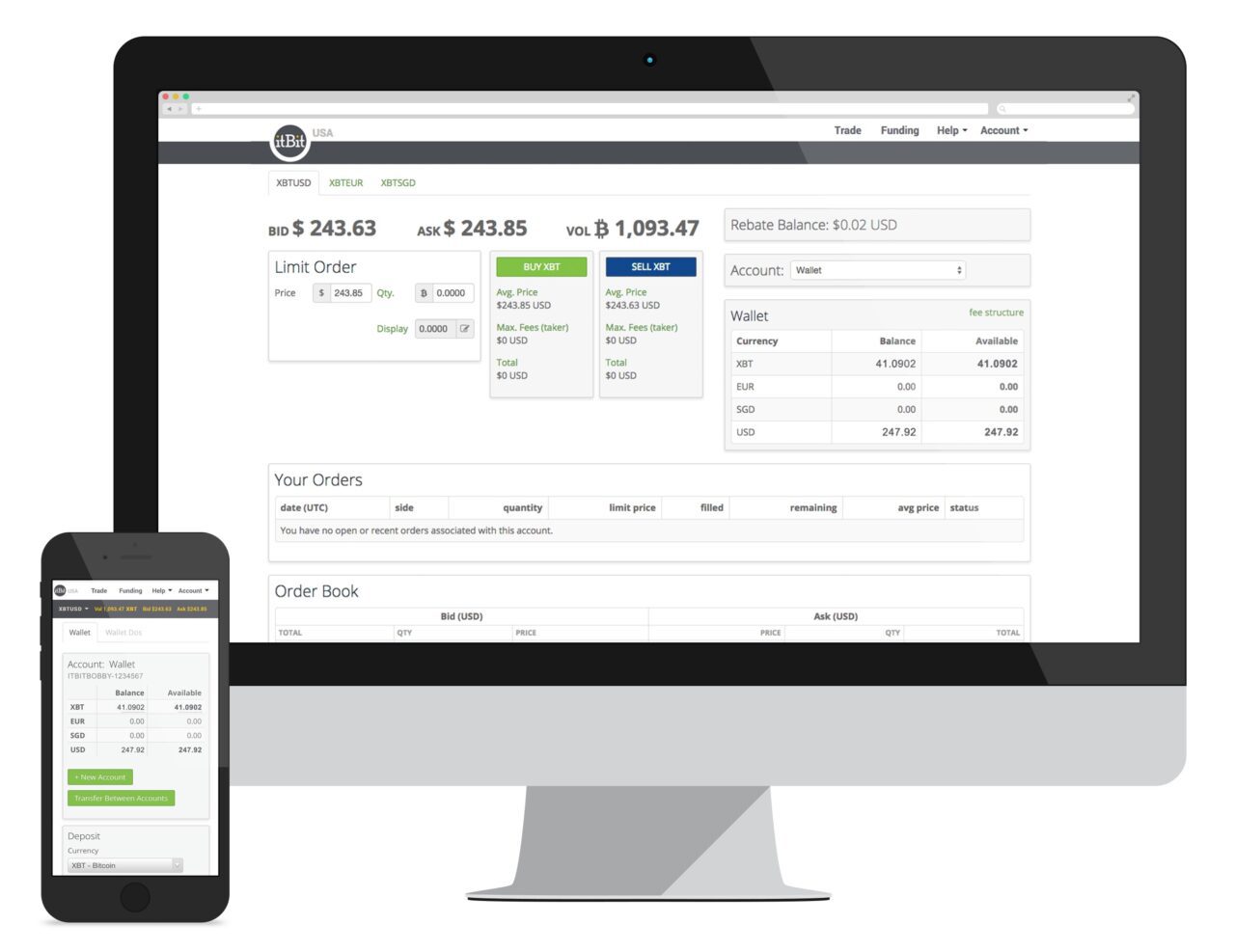

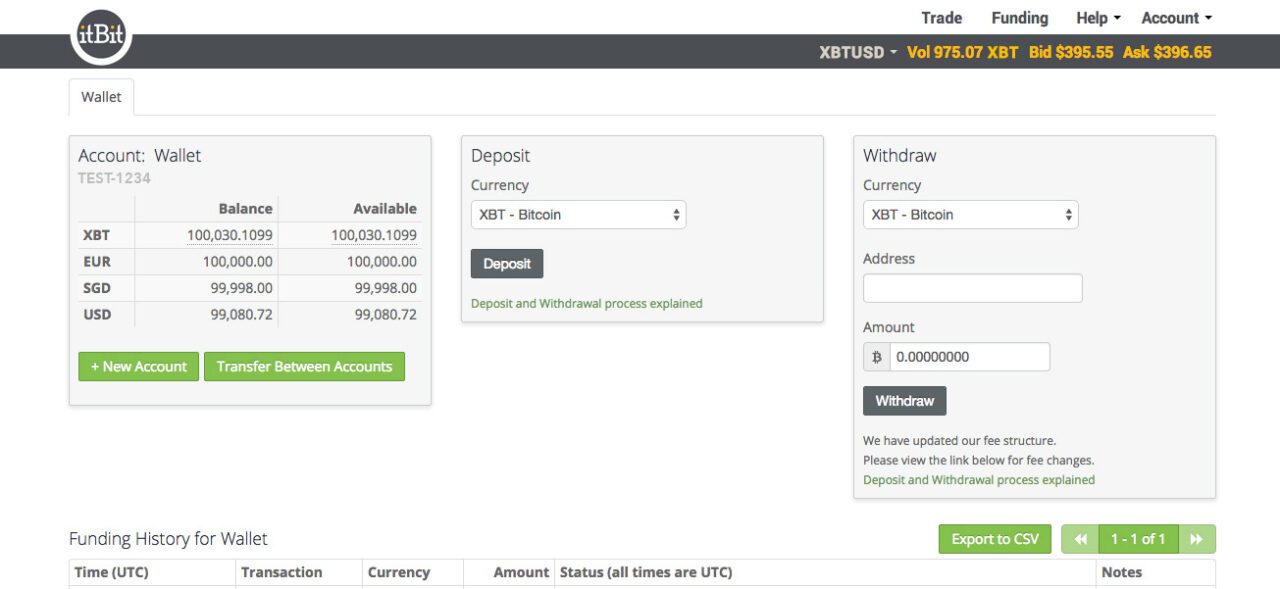

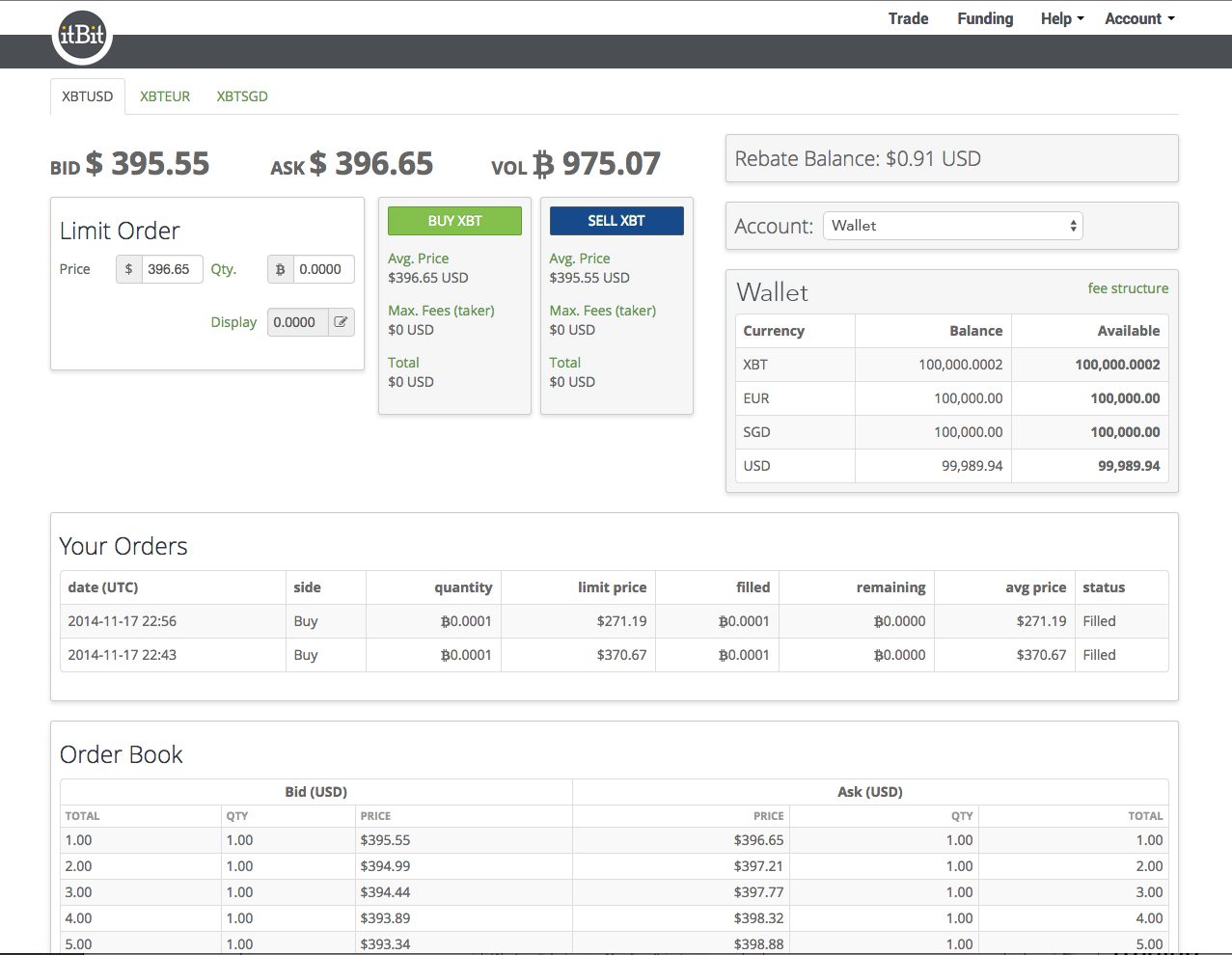

itBit has a trust company that is licensed by the New York State Department of Financial Services. The company selected New York state because the founders are based in NYC, and it is the most difficult state from which a license can be obtained. For this reason, the certification is recognized nationwide.

itBit has a trust company that is licensed by the New York State Department of Financial Services. The company selected New York state because the founders are based in NYC, and it is the most difficult state from which a license can be obtained. For this reason, the certification is recognized nationwide.

pany

pany