This post is part of our live coverage of FinovateFall 2015.

Quisk debuted its digital services platform:

Quisk debuted its digital services platform:

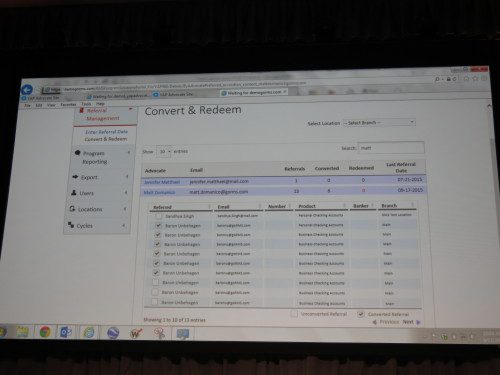

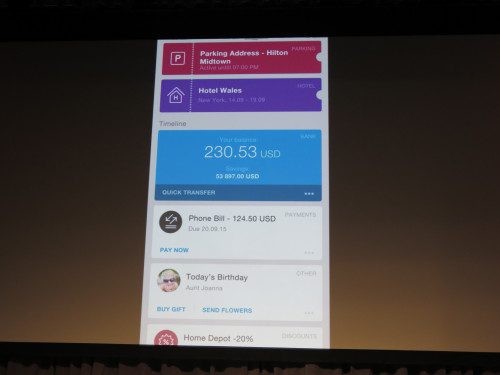

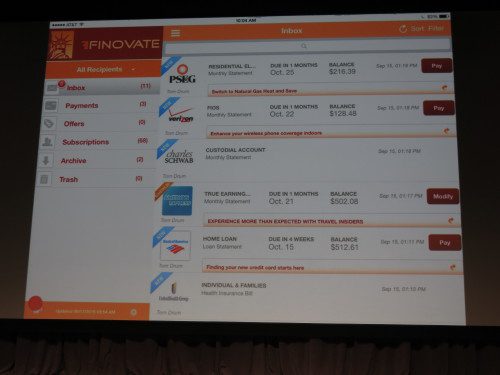

Quisk is demonstrating several consumer transactions, including person-to-merchant (P2M), person-to-person (P2P), and more, powered by its patented cloud-based digital services platform. Quisk works with banks to integrate its platform to back-end core banking platforms and offers an API for third-party developers.

Unlike current mobile-network 0perator-led mobile money initiatives, Quisk is the next generation of mobile money: bank-led, interoperable, and for a wider range of transactions. For consumers: Quisk is your money from your bank, but without the cash, without the cards, and without the wallet.

Presenters from left: CTO Praveen Amancherla and Dan Glessner, chief marketing officer

Product launch: September 2015

Metrics: $20 million+ raised; revenue in second half of 2015; active projects in two countries in the Caribbean and Middle East; ~30 employees (tech- and payments-industry veterans)

Product distribution strategy: Direct to business (B2B); through financial institutions

HQ: Sunnyvale, California

Founded: January 2010

Website: quisk.co

Twitter: @quiskpay