The year is off to a big start with 24 companies raising $569 million in the first week of 2016. However, three-quarters of that ($425 million) was additional debt for three big alt-lenders: Finovate alum LoanNow ($50 million) along with CommonBond ($275 million) and Qredits ($100 million).

The year is off to a big start with 24 companies raising $569 million in the first week of 2016. However, three-quarters of that ($425 million) was additional debt for three big alt-lenders: Finovate alum LoanNow ($50 million) along with CommonBond ($275 million) and Qredits ($100 million).

The $138 million in new equity last week was 25% more than the $110 million from the same week a year ago. And the number of deals was up 40% (24 compared to 17).

In addition to LoanNow, Finovate alums attracting new capital included:

Here are the deals by size from 1 Jan to 8 Jan 2016:

CommonBond

Person-to-person student loan lender

Latest round: $275 million Debt

Total raised: $319.7 million ($44.7 million Equity, $275 million Debt)

HQ: New York City, New York

Tags: Consumer, credit, lending, loans, underwriting, investing, P2P, student loans

Source: Crunchbase

Qredits

Dutch person-to-person SMB lender

Latest round: $100 million Debt

Total raised: Unknown

HQ: The Netherlands

Tags: SMB, credit, lending, loans, underwriting, investing, P2P, alt-lender, marketplace lender, European Investment Bank (lender)

Source: Crunchbase

NuBank

Brazilian neo-bank

Latest round: $52 million Series C

Total raised: $98.3 million

HQ: Sao Paulo, Brazil

Tags: Consumer, mobile, debit card, neobank, personal finance, PFM

Source: Crunchbase

LoanNow

Consumer alt-lender

Latest round: $50 million Debt

Total raised: $56 ($6 million Equity, $50 million Debt)

HQ: Santa Ana, California

Tags: Consumer, credit, lending, loans, underwriting, Finovate alum

Source: Finovate

Toast

Person-to-person lender

Latest round: $30 million Series B

Total raised: $30 million

HQ: Boston, Massachusetts

Tags: SMB, point-of-sale, merchants, restaurants, bars, credit/debit cards

Source: Crunchbase

Lendful Financial

Online alt-lender

Latest round: $15 million

Total raised: $15 million

HQ: Vancouver, British Columbia, Canada

Tags: Consumer, credit, lending, loans

Source: Crunchbase

freee

Online accounting

Latest round: $8.3 million Series D

Total raised: $55.5 million

HQ: Tokyo, Japan

Tags: SMB, accounting, billpay, invoicing

Source: Crunchbase

Street Contxt

Financial communications platform

Latest round: $8 million Series A

Total raised: $8 million

HQ: Toronto, Ontario, Canada

Tags: Advisers, wealth management, investing, enterprise

Source: Crunchbase

Gem

Blockchain technology

Latest round: $7.1 million Series A

Total raised: $7.1 million

HQ: Venice, California

Tags: Enterprise, bitcoin, cryptocurrency, database

Source: Finovate

Direct Match

Trading venue for U.S. Treasuries

Latest round: $6 million Series A

Total raised: $9 million

HQ: New York City, New York

Tags: Investing, trading, enterprise, SMB

Source: Crunchbase

StartEngine

Equity crowdfunding platform

Latest round: $5.5 million

Total raised: $5.5 million

HQ: Santa Monica, California

Tags: SMB, equity crowdfunding, capital, investing, P2P

Source: FT Partners

KnCMiner

Bitcoin mining hardware

Latest round: $3 million

Total raised: $32 million

HQ: Stockholm, Sweden

Tags: Bitcoin, cryptocurrency, hardware, blockchain

Source: Crunchbase

Xfers

Asian payment gateway

Latest round: $2.5 million Seed

Total raised: $2.5 million

HQ: Singapore

Tags: Consumer, payments, remittances

Source: Crunchbase

Snapcart

Consumer receipt manager

Latest round: $1.68 million

Total raised: $1.68 million

HQ: Jakarta, Indonesia

Tags: Consumer, debit/credit cards, mobile, spending, PFM

Source: Crunchbase

CUneXus Solutions

Consumer lending software for financial institutions

Latest round: $1 million

Total raised: $1.65 million

HQ: Santa Rosa, California

Tags: Consumer, credit, lending, loans, underwriting, enterprise, Finovate alum

Source: Finovate

Deposit Solutions

Deposit software for financial institutions

Latest round: $1.0 million Series A

Total raised: $7.0 million

HQ: Hamburg, Germany

Tags: Consumer, Peter Thiel (investor)

Source: Crunchbase

Zebpay

Person-to-person lender

Latest round: $1 million Series A

Total raised: $1.1 million

HQ: Singapore

Tags: Consumer, payments, P2P, bitcoin, blockchain, cryptocurrency, mobile

Source: Crunchbase

Toborrow

SMB P2P lender

Latest round: $350,000

Total raised: $2.74 million

HQ: Stockholm, Sweden

Tags: SMB, loans, credit, peer-to-peer, underwriting, crowdfunding, investing

Source: Crunchbase

Cuvva

Short-term automobile insurer

Latest round: $590,000

Total raised: $590,000

HQ: Edinburgh, Scotland, United Kingdom

Tags: Consumer, insurance, automobile, mobile

Source: FT Partners

Nestiny

Homebuyer education website

Latest round: $350,000 Angel

Total raised: $350,000

HQ: Manakin Sabot, Virginia

Tags: Consumer, mortgage, real estate, home buying, agents, lead gen

Source: Crunchbase

Buckit (StashLLC)

Consumer receipt manager

Latest round: $143,000 Seed

Total raised: $143,000

HQ: Toronto, Ontario, Canada

Tags: Consumer, debit/credit cards, mobile, spending, PFM

Source: Crunchbase

Agent Review

Insurance education and agent referrals

Latest round: Undisclosed

Total raised: Unknown

HQ: Bellevue, Washington

Tags: Consumer, insurance, agents, lead gen

Source: FT Partners

Patientco

Healthcare payment technology

Latest round: Undisclosed

Total raised: $3.75 million prior to latest round

HQ: Atlanta, Georgia

Tags: SMB, healthcare, payments

Source: FT Partners

Tiendo Pago

Short-term working capital provider

Latest round: Undisclosed

Total raised: Unknown

HQ: Lima, Peru

Tags: SMB, lending, loans, commercial lending, underwriting, alt-lender, Accion (investor)

Source: FT Partners

![]() A look at the companies demoing live to 1,500 fintech professionals. Register today.

A look at the companies demoing live to 1,500 fintech professionals. Register today.  Geraldine Critchley, Head of Product Marketing

Geraldine Critchley, Head of Product Marketing Antony Bream, U.K. Managing Director

Antony Bream, U.K. Managing Director

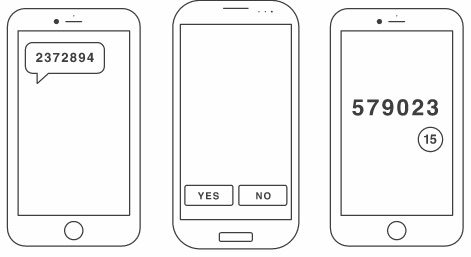

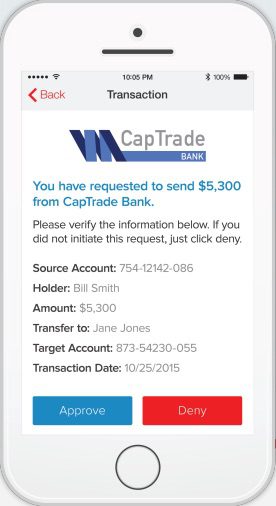

Here’s how Authy OneTouch works to authenticate a high-value money transfer:

Here’s how Authy OneTouch works to authenticate a high-value money transfer:

The year is off to a big start with 24 companies raising $569 million in the first week of 2016. However, three-quarters of that ($425 million) was additional debt for three big alt-lenders: Finovate alum

The year is off to a big start with 24 companies raising $569 million in the first week of 2016. However, three-quarters of that ($425 million) was additional debt for three big alt-lenders: Finovate alum

PayPal

PayPal

How it works

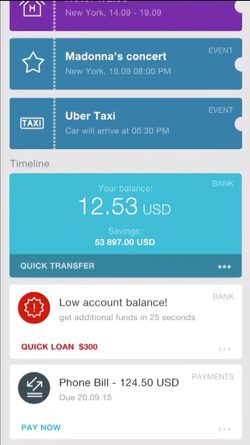

How it works “Payment is made using data in the app, delivery address and other details of the transaction,” says Tomasz Perski, e-commerce operations manager. “There are many shops inside the app, but once authorized, there is no need for login or password. The services and shops available are chosen by the bank (bank partners) or by Finanteq, and the app can also feature offers and discounts.”

“Payment is made using data in the app, delivery address and other details of the transaction,” says Tomasz Perski, e-commerce operations manager. “There are many shops inside the app, but once authorized, there is no need for login or password. The services and shops available are chosen by the bank (bank partners) or by Finanteq, and the app can also feature offers and discounts.”