The New Year is off to an exciting start! FinDEVr New York, our first East Coast event for technologists, is only three months away and half the presenter roster is full. We’ve just added more than 10 new presenting companies to an already impressive list. And on 29/30 March, these companies will showcase their latest tools, technologies, APIs, platforms, case studies and tutorials for creating the next wave of fintech innovations in 15-minute, TED-style presentations.

For this East Coast expansion, we’re projecting an audience of more than 600 CTOs, developers, software architects, UX designers, VPs of engineering, product managers and other technologists. We hope you’re one of them! With ticket prices at their lowest early bird rates, now is the time to register. Super early bird tickets are on sale through this Friday, 15 January.

For this East Coast expansion, we’re projecting an audience of more than 600 CTOs, developers, software architects, UX designers, VPs of engineering, product managers and other technologists. We hope you’re one of them! With ticket prices at their lowest early bird rates, now is the time to register. Super early bird tickets are on sale through this Friday, 15 January.

Below is a list of the presenting companies so far (minus stealth companies), and we’ll announce the full roster closer to the event:

Interested in following news from these companies, along with last year’s presenting companies? Follow FinDEVr on Twitter and keep an eye out for our weekly FinDEVr APIntelligence blog posted every Wednesday.

FinDEVr New York 2016 is partnered with Bank Innovators Council, BankersHub, The BayPay Forum, Bitcoin Magazine, bobsguide, Byte Academy, Celent, Mercator Advisory Group, Payments & Cards Network, and Women Who Code.

Presenters

Presenters

Presenter

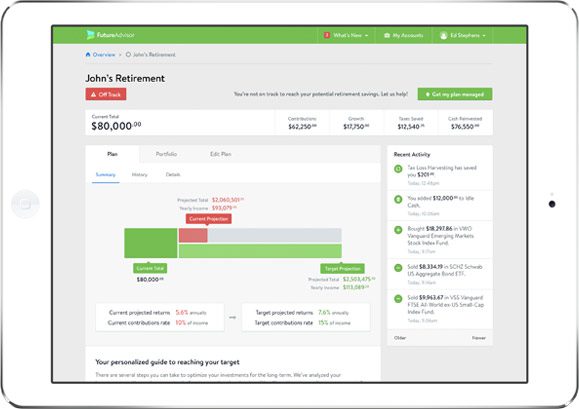

Presenter

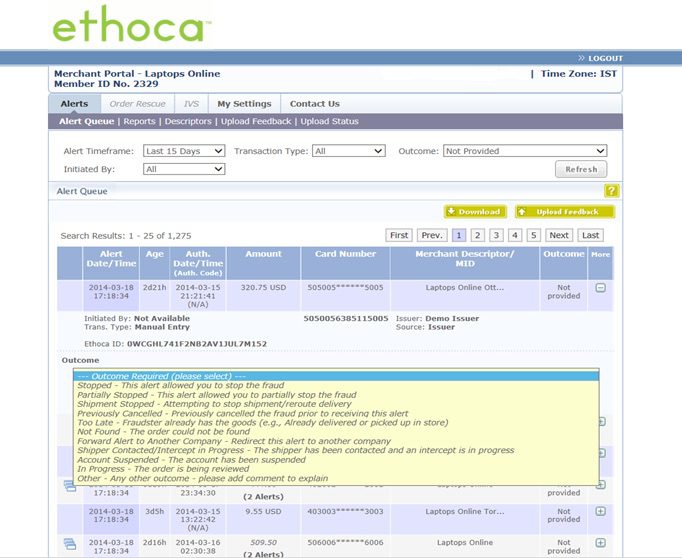

Presenters

Presenters Tom Martin, Head of PMO

Tom Martin, Head of PMO

Presenters

Presenters Chris Edgington, Global Industry Solutions, Financial Services

Chris Edgington, Global Industry Solutions, Financial Services