This week Scalable Capital, a company that seeks to democratize investment management, closed on $7.9 million (£5.6 million) in funding. Subscribers to the round include Holtzbrink Ventures, Peng T. Ong’s Monk’s Hill Ventures, The German Startups Group and MPGI, all of whom contributed to the company’s first round of funding in 2015. New investors Tengelmann Ventures and Leonteq-founder Michael Hartweg also participated.

Combined with a previous round in 2015, today’s installment brings the Germany-based company’s total funding to $12.4 million (£8.8 million). In a press release, Adam French, co-founder and managing director of Scalable Capital, discussed plans for the funding:

This new capital will allow us to continue building our business in the U.K. as well as support our operations in Germany and expand selectively into new markets. Our goal is to become the leading digital investment manager in Europe.

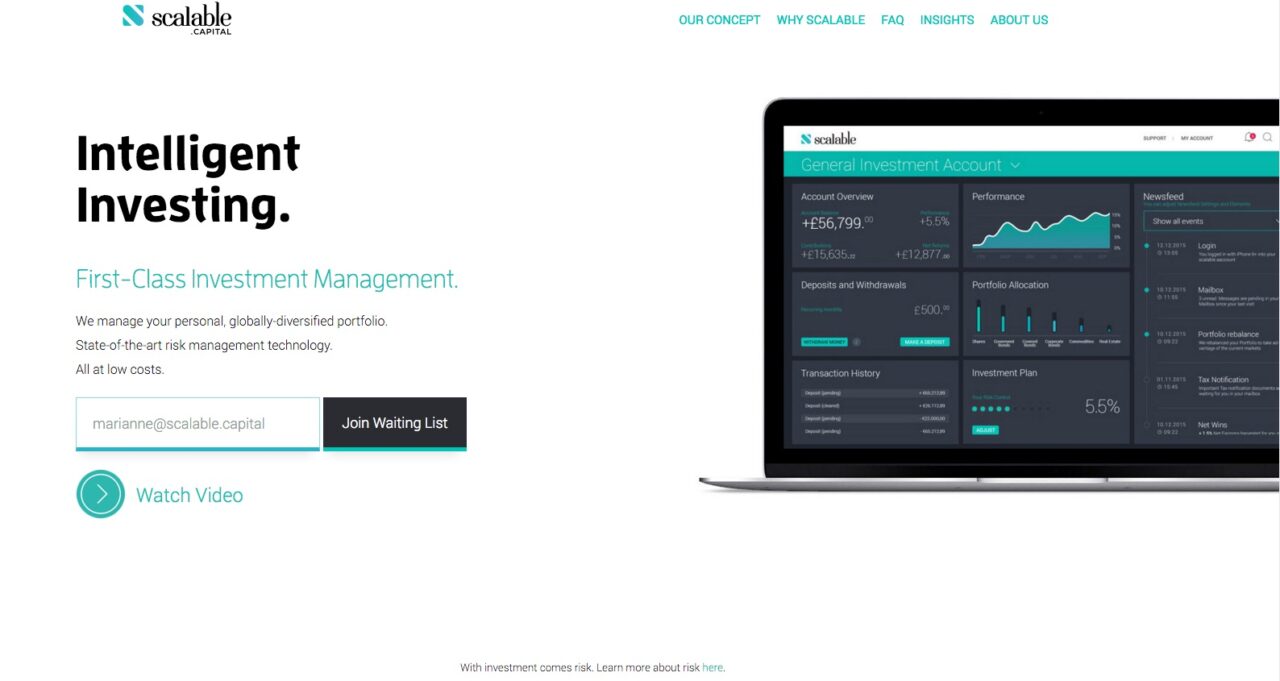

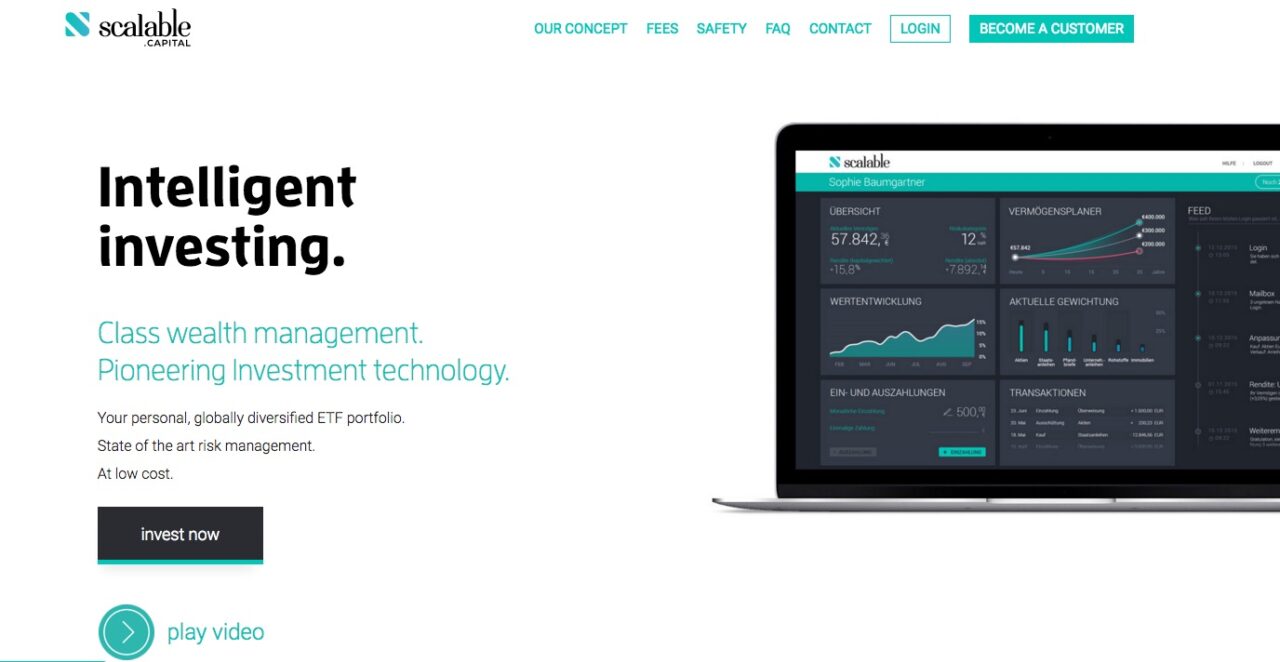

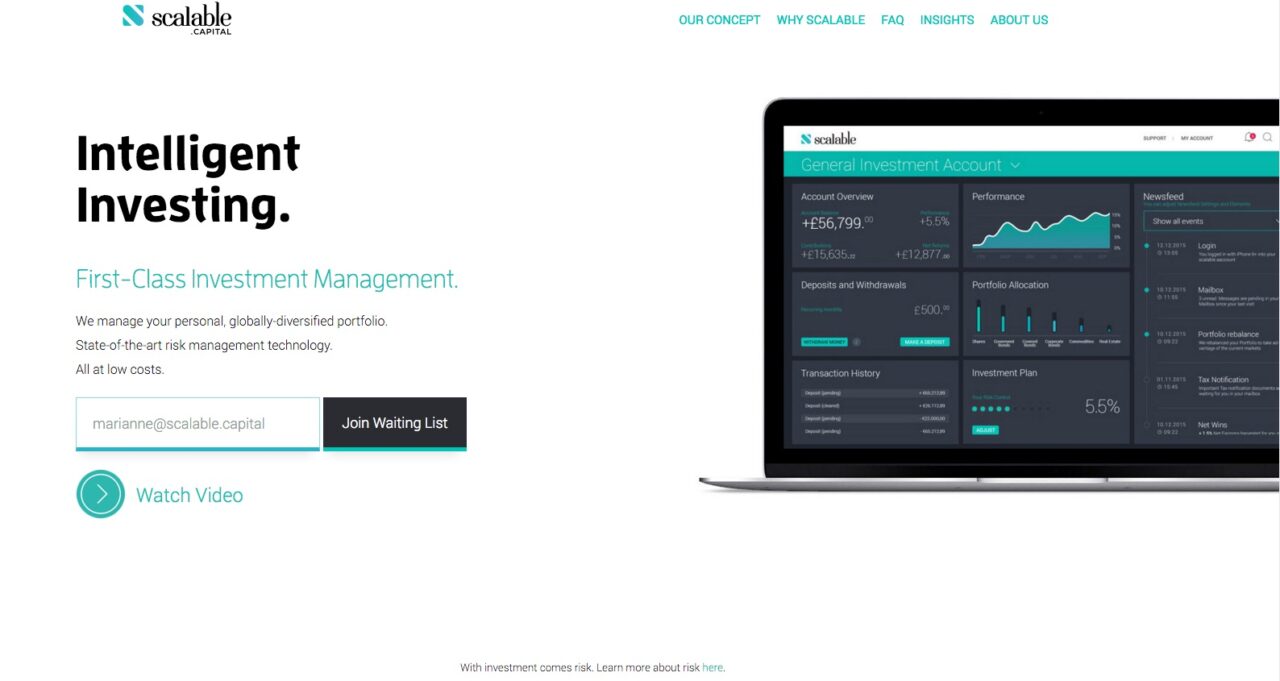

French (pictured above right) debuted Scalable Capital at FinovateEurope 2016. He began the demo by asking, “Does the world really need another robo-adviser?” and then answered his own question:

Where we fundamentally differ from the traditional wealth management world and the other players in this market is in the way that we manage your money. We’ve developed a risk management technology which was previously developed for institutional investors and … put it in the hands of retail investors.

Scalable Capital offers diversified and cost-efficient ETF portfolios. The company’s special sauce is in the way users select their risk preference. Instead of choosing from broad risk-categories (conservative, medium, and high) Scalable Capital quantifies the risk and attaches an institutional risk measure. The risk in every client portfolio is controlled by daily projections, and portfolios are readjusted if the risk limit has been breached.

Founded in 2014, Scalable Capital has received approval from the U.K.’s Financial Conduct Authority and will begin operating with its first U.K.-based investors this month.

Our

Our

Presenters

Presenters Steve Lemmer, Director of Product

Steve Lemmer, Director of Product

Darren Collins, Global Director, Banking and Insurance Industry Team

Darren Collins, Global Director, Banking and Insurance Industry Team Chris Edgington, Global Industry Solutions, Financial Services

Chris Edgington, Global Industry Solutions, Financial Services

Presenter: Safwan Shah, Founder and CEO

Presenter: Safwan Shah, Founder and CEO