For the second week in a row, the number of deals reported, 38, was just one below the weekly record. In all, fintech companies worldwide raised $222 million the second week of June. Nine deals were for undisclosed sums and $500,000 was reported as debt, although two were convertible notes. There was an odd cluster of fundings around the $2 million mark with 10 of the 29 deals (with known amounts) landing between $1.8 and $2.5 million.

For the second week in a row, the number of deals reported, 38, was just one below the weekly record. In all, fintech companies worldwide raised $222 million the second week of June. Nine deals were for undisclosed sums and $500,000 was reported as debt, although two were convertible notes. There was an odd cluster of fundings around the $2 million mark with 10 of the 29 deals (with known amounts) landing between $1.8 and $2.5 million.

Five Finovate alums combined to raise nearly $100 million, 42% of the week’s total:

The total number of deals YTD stands at 627, nearly double last year’s 321. Total dollars raised YTD is now $16.4 billion, more than twice the $7.5 billion raised during the same period a year ago.

——-

Fintech deals by size from 4 June to 10 June 2016:

Tradeshift

Trading platform

Latest round: $75 million Series D

Total raised: $174 million

HQ: San Francisco, California

Tags: SMB, enterprise, trade finance, invoicing, billing, expense management, accounting, payables, Finovate alum

Source: Finovate

zipMoney Payments

Alt-lender and payments

Latest round: $20.6 million Post-IPO Equity

Total raised: $121.6 million Post-IPO, including $100 million Debt

HQ: Perth, Australia

Tags: Consumer, lending, credit, underwriting, payments, point-of-sale financing, POS

Source: Crunchbase

Jiff

Enerprise health benefits platform

Latest round: $17.7 million Series C

Total raised: $65.7 million

HQ: Palo Alto, California

Tags: Healthcare, insurance, employee benefits, HR

Source: FT Partners

nCino

Bank operating system

Latest round: $15.67 million

Total raised: $64.67 million

HQ: Wilmington, North Carolina

Tags: Institutions, CRM, loan origination, workflow, content management, analytics, BI

Source: Crunchbase

NexusCrowd

Real estate crowdfunding platform

Latest round: $15.5 million

Total raised: $15.5 million

HQ: Toronto, Ontario, Canada

Tags: Consumer, SMB, lending, peer-to-peer, P2P, credit, underwriting, investing

Source: Crunchbase

Ascend Consumer Finance

Alt-lender

Latest round: $11 million Series A

Total raised: $12.5 million

HQ: San Francisco, California

Tags: Consumer, lending, credit, underwriting, investing

Source: Crunchbase

CrowdFlower

Data analytics platform

Latest round: $10 million Series D

Total raised: $38 million

HQ: San Francisco, California

Tags: Insitutions, advisers, big data, machine learning, analytics, BI, Finovate alums

Source: Finovate

trueEX

Executation platform for interest rate swaps (IRS)

Latest round: $9.21 million

Total raised: $33.7 million

HQ: New York City

Tags: Institutions, trading, investing

Source: Crunchbase

Notarize

Electronic notary service

Latest round: $8 million Series A

Total raised: $10.4 million

HQ: Boston, Massachusetts

Tags: SMB, lending, legal, compliance

Source: Crunchbase

Bento for Business

Digital business banking platform

Latest round: $7 million Series A

Total raised: $9.5 million

HQ: San Francisco, California

Tags: SMB, small business, online banking, payments, debit cards, prepaid, expense control, Finovate alum

Source: Finovate

InvoiceFinance

Invoice financing

Latest round: $3.9 million Seed

Total raised: $3.9 million

HQ: ‘s-hertogenbosch, Netherlands

Tags: SMB, lending, alt-lender, commerical loans, trade finance, billing, invoicing, cash flow, working capital

Source: Crunchbase

FlexReceipts

Digital receipts

Latest round: $2.5 million

Total raised: $5 million

HQ: California

Tags: SMB, B2B2C, payments, personal financial management (PFM), spending, marketing

Source: Crunchbase

PaymentWorks

B2B payments platform

Latest round: $2.5 million Convertible Note

Total raised: $4.03 million

HQ: Cambridge, Massachusetts

Tags: SMB, payments, invoicing, billing, bill payment

Source: Crunchbase

Satago

Invoice financing

Latest round: $2.3 million

Total raised: $3.4 million

HQ: London, England, United Kingdom

Tags: SMB, lending, alt-lender, commerical loans, trade finance, billing, invoicing, cash flow

Source: Crunchbase

Muume

Mobile point-of-sale platform

Latest round: $2.3 million Series A

Total raised: $2.3 million

HQ: Cham, Switzerland

Tags: SMB, payments, mobile, mPOS, merchants, acquiring, credit/debit cards

Source: Crunchbase

Bunker Protect

Insurance marketplace for contract labor

Latest round: $2 million Seed

Total raised: $2 million

HQ: San Francisco, California

Tags: SMB, insurance, contract-related, 1099 workers

Investors: Hiscox, Route 66, American Family, Comcast

Source: Crunchbase

CreditVidya

Alt-credit score

Latest round: $2 million Series A

Total raised: $2 million

HQ: Mumbai, India

Tags: Institutions, lenders, credit reports, underwriting, credit

Source: Crunchbase

ePaylater

Consumer point-of-sale financing

Latest round: $2 million Seed

Total raised: $2 million

HQ: Mumbai, India

Tags: Consumer, lending, alt-lending, underwriting, credit

Source: Crunchbase

FollowIt

Real estate listings

Latest round: $2 million Seed

Total raised: $2 million

HQ: Woolloomooloo, Australia

Tags: Consumer, mortgage, home buying, discovery, lead generation

Source: Crunchbase

KrazyBee (Finovation Tech Solutions)

Alt-lender

Latest round: $2 million Seed

Total raised: $2 million

HQ: Bangalore, India

Tags: Consumer, lending, credit, underwriting, point-of-sale financing

Source: Crunchbase

Buzz Points (owned by Fisoc)

Debit and credit card rewards

Latest round: $1.86 million

Total raised: $1.86 million

HQ: Austin, Texas

Tags: B2B2C, institutions, payments, marketing, loyalty, marketing, Finovate alum

Source: Crunchbase

AppFront

Mobile point-of-sale apps

Latest round: $1.5 million Seed

Total raised: $1.5 million

HQ: Tel Aviv, Israel

Tags: B2B2C, SMB, payments, mobile, mPOS, merchants

Source: Crunchbase

GrowthDeck

Equity crowdfunding platform

Latest round: $1.45 million

Total raised: $1.45 million

HQ: London, England, United Kingdom

Tags: Consumer, SMB, equity, stock, peer-to-peer, P2P, investing

Source: Crunchbase

NettCash (owned by Mozido)

Mobile wallet & payments

Latest round: $1.3 million

Total raised: $1.3 million

HQ: Harare, Zimbabwe

Tags: Consumer, payments, mobile, merchants, acquiring, mPOS

Source: Crunchbase

Insly

Insurance management software

Latest round: $1.13 million Seed

Total raised: $1.16 million

HQ: London, England, United Kingdom

Tags: SMB, insurance agents, brokers, process management

Source: Crunchbase

Risk Focus

Risk management for capital markets

Latest round: $500,0000 Debt

Total raised: $500,000

HQ: New York City, New York

Tags: Institutions, compliance, risk mananagement, trading, investing

Source: Crunchbase

Besepa

Direct debit platform

Latest round: $340,000 Seed

Total raised: $630,000

HQ: Madrid, Spain

Tags: Consumer, SMB, funds transfer, payments, debit, billpay

Source: Crunchbase

Payfully

Receivables financing for AirBnB hosts

Latest round: $300,000 Convertible Note

Total raised: $300,000

HQ: Brooklyn, New York

Tags: Consumer, SMB, lending, alt-lending, invoice financing

Source: Crunchbase

PocketSuite

Payment and management tools for small businesses

Latest round: $120,000 Seed

Total raised: $395,000

HQ: San Francisco, California

Accelerator: Y Combinator

Tags: SMB, payments, billing, invoicing, accounting bookkeeping

Source: Crunchbase

Alpha Payments Cloud

Payments platform

Latest round: Undisclosed

Total raised: $12+ million

HQ: Singapore

Accelerator: Wells Fargo

Tags: Institutions, SMB, payments, hub, merchants, credit/debit cards, Finovate alum

Source: Finovate

BLender

P2P lending platform

Latest round: Undisclosed

Total raised: $5 million

HQ: Tel Aviv, Israel

Tags: Consumer, lending, peer-to-peer, P2P, credit, underwriting, investing

Source: Crunchbase

Capsilon

Document and data management for mortgage companies

Latest round: Undisclosed

Total raised: $21.4+ million

HQ: California

Tags: Institution, mortgage banking, brokers, process management

Source: FT Partners

Chamasoft

Bookkeeping tool for investment groups

Latest round: Undisclosed

Total raised: Unknown

HQ: Nairobi, Kenya

Tags: Consumer, lending, peer-to-peer, P2P, credit, underwriting, investing

Source: Crunchbase

Kwanji

FX comparison site

Latest round: Not disclosed

Total raised: $1.93 million

HQ: London, England, United Kingdom

Tags: SMB, foreign exchange, shopping, lead generation, price comparison, remittances

Source: Crunchbase

mergims

Mobile prepaid account

Latest round: Undisclosed

Total raised: $160,000

HQ: Kigali, Rwanda

Tags: Consumer, payments, underbanked, prepaid, mobile

Source: Crunchbase

Tokhelp

Fundraising software for charitable institutions

Latest round: Undisclosed Series C

Total raised: Unknown

HQ: Goiania, Brazil

Tags: Nonprofits, payments, merchants, acquiring, mobile

Source: FT Partners

VugaPay

Mobile payments

Latest round: Undisclosed

Total raised: $25,000+

HQ: Kigali, Rwanda

Tags: Consumer, payments, mobile, prepaid

Source: Crunchbase

Zuora

Billing solutions

Latest round: Undisclosed

Total raised: $242.5 million

HQ: Foster City, California

Tags: SMB, billing, invoicing, payments, accounts-receivables management, bookkeeping

Source: Crunchbase

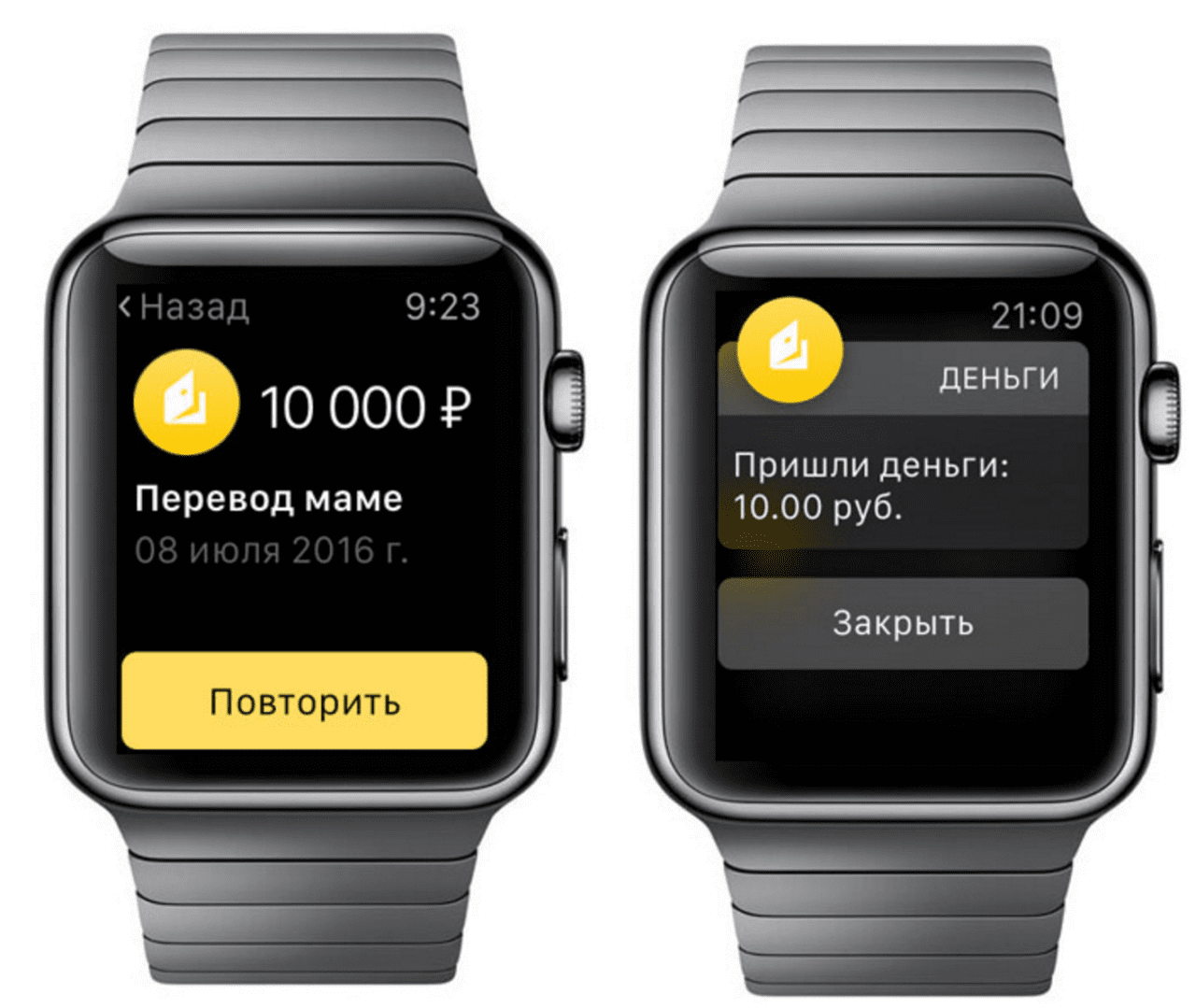

In a move that expands payment methods for its users, digital payments company Yandex.Money launched an app for the Apple Watch this week. The app allows users to top up their mobile money accounts, make transfers, receive payment alerts via push notifications, and view their Yandex account balance.

In a move that expands payment methods for its users, digital payments company Yandex.Money launched an app for the Apple Watch this week. The app allows users to top up their mobile money accounts, make transfers, receive payment alerts via push notifications, and view their Yandex account balance.

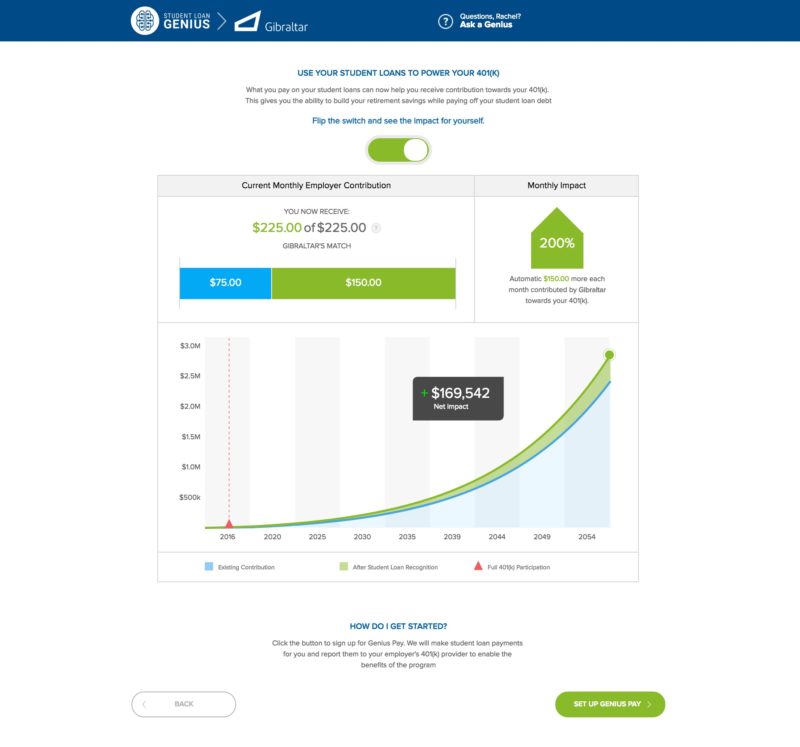

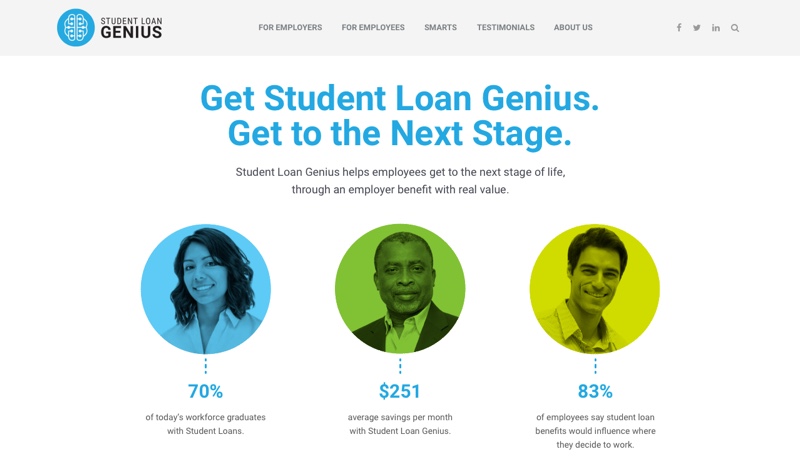

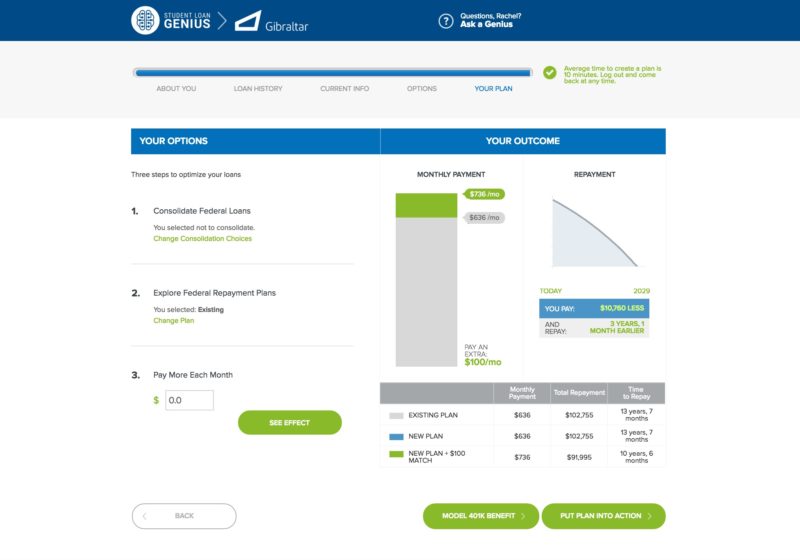

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.