Less than a week after EyeVerify’s successful return to the Finovate stage, the company announced that it has been acquired by Ant Financial. Terms of the deal were not disclosed, but EyeVerify will remain in operation as a wholly owned subsidiary of Ant Financial Services and will remain headquartered in Kansas City, Missouri.

EyeVerify founder and CEO Toby Rush said Ant Financial’s vision to support small and micro enterprises and their consumers “resonate(d) deeply” with the core mission of EyeVerify. Rush notes that EyeVerify’s payment-grade biometric platform is already trusted by more than three dozen banks and technology leaders, and says, “We look forward to helping even more people across the financial spectrum access digital services with security and convenience.”

EyeVerify’s Director of Marketing Tinna Hung demonstrated EyePrint ID at FinovateEurope 2016.

EyeVerify’s innovation is to use the pattern of veins and white space in the human eye as a biometric marker, an identifier more unique than fingerprints according to the company. Using the camera embedded in most smartphones, EyeVerify users can take an “eyeprint” as easily as they would take a selfie and use that spoof-proof eyeprint for authentication purposes. The software-based technology, deployed by Wells Fargo for its corporate clients with commercial banks this spring, doesn’t require expensive hardware and has an accuracy rate of 99.99%.

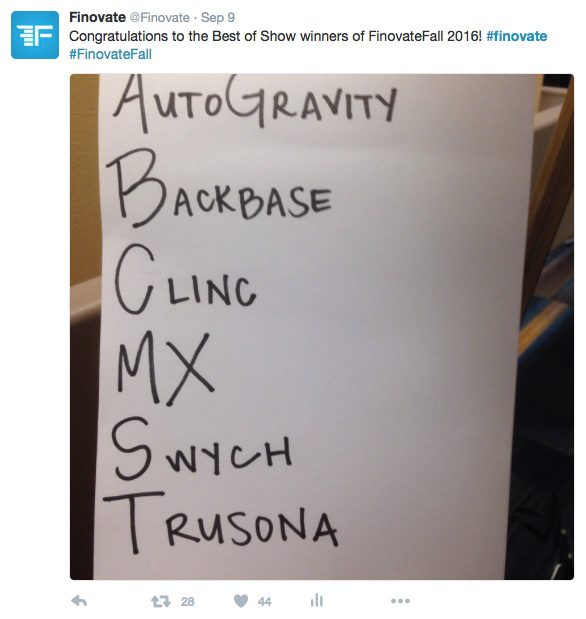

Founded in 2012 and headquartered in Kansas City, Missouri, EyeVerify demonstrated its Eyeprint ID at FinovateEurope in spring 2016, where the company won Best of Show. More recently, EyeVerify demoed its technology here in the U.S. at FinovateFall 2016 (demo video available soon). Last month, EyeVerify integrated its Eyeprint ID technology into the Identity Platform of fellow Finovate alum, BioConnect.

Our Twitter followers are not above issuing a challenge or two, either. How does this technology help banks and credit unions serve their customers better? Why does this solution secure my personal information or my business data better than another? What does this innovation truly do to foster financial inclusion and support the underbanked?

Our Twitter followers are not above issuing a challenge or two, either. How does this technology help banks and credit unions serve their customers better? Why does this solution secure my personal information or my business data better than another? What does this innovation truly do to foster financial inclusion and support the underbanked?

years as a portfolio manager. Before that, Berglund was a financial analyst and later an associate at Goldman Sachs in the firm’s investment banking division. A veteran of the Swedish Army, where he earned the rank of 2nd lieutenant, Berglund holds an MS in economics and business administration from the Stockholm School of Economics.

years as a portfolio manager. Before that, Berglund was a financial analyst and later an associate at Goldman Sachs in the firm’s investment banking division. A veteran of the Swedish Army, where he earned the rank of 2nd lieutenant, Berglund holds an MS in economics and business administration from the Stockholm School of Economics.