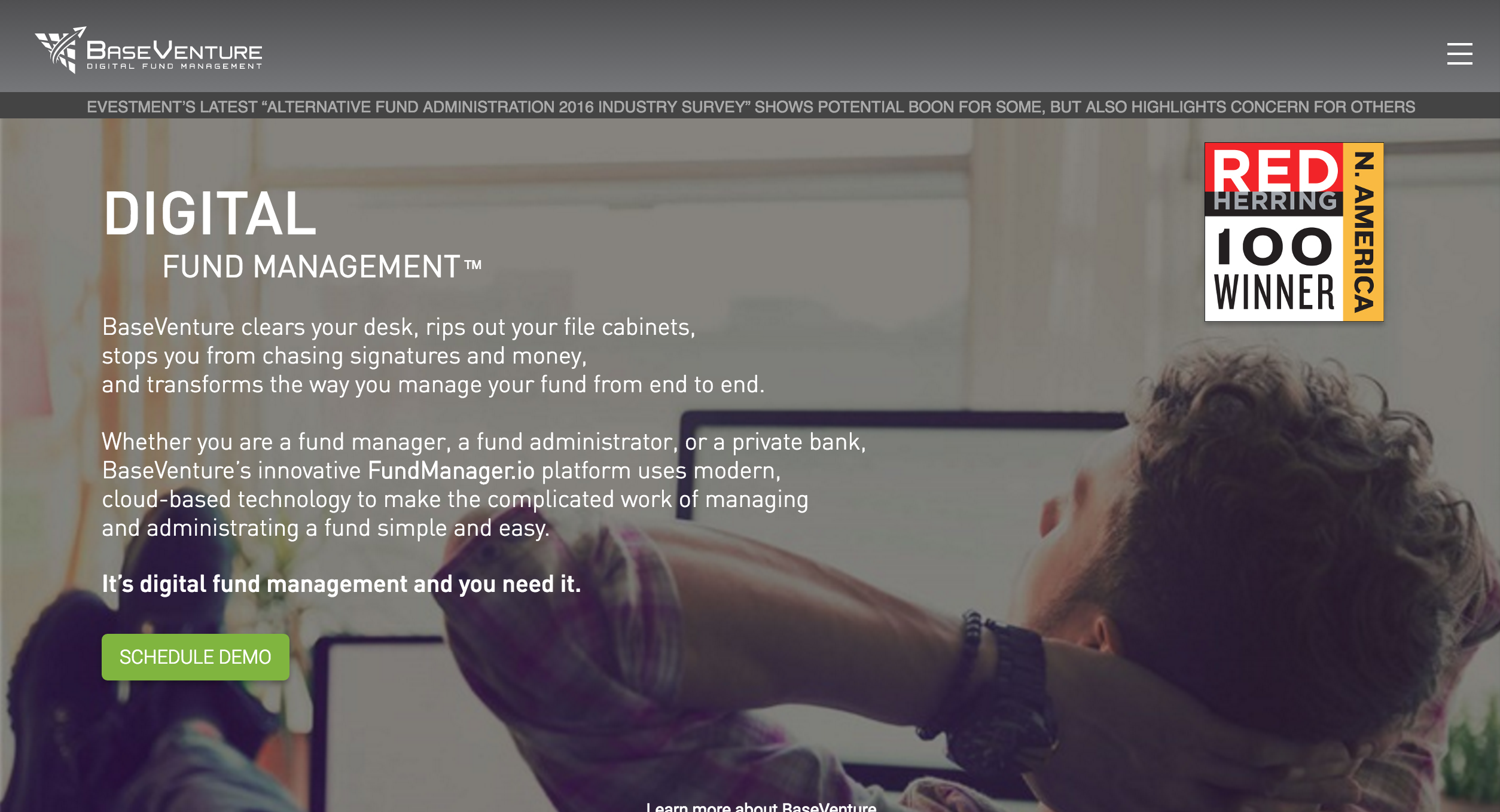

BaseVenture helps fund-managers and -administrators digitize and manage funds holistically. The company was launched by two of the former C-level executives of mFoundry (FinovateFall 2010 demo) after selling the mobile banking and payments company to FIS in 2013.

“Until now, the industries had to rely upon spreadsheets, PDFs, emails, and other antiquated technology to manage their funds and report returns to their investors,” said CEO John Pizzi during the FinovateSpring 2016 demo of FundManager.io, BaseVenture’s flagship product. “Those days are over.”

FundManager.io is a SaaS platform designed to give fund managers a central place to manage investors, execute trades, and raise capital. The platform offers filtering, finding, sharing, and tagging capabilities to facilitate easy document sorting and compliance.

Company facts:

- Headquartered San Rafael, California

- Founded in 2015

- 25 customers

- 15 employees

- $2.5 million raised

CEO John Pizzi, co-founder, and Steve Lemmer, director of product, at their FinovateSpring 2016 demo of BaseVenture’s FundManager.io

CEO John Pizzi, co-founder, and Steve Lemmer, director of product, at their FinovateSpring 2016 demo of BaseVenture’s FundManager.io

BaseVenture CEO John Pizzi offered to give us some additional insight into the company after his demo at FinovateSpring earlier this year. Pizzi was formerly president and COO of mFoundry before selling to FIS in 2013. Prior to that, he was VP of Arc Worldwide, a marketing services company.

BaseVenture CEO John Pizzi offered to give us some additional insight into the company after his demo at FinovateSpring earlier this year. Pizzi was formerly president and COO of mFoundry before selling to FIS in 2013. Prior to that, he was VP of Arc Worldwide, a marketing services company.

Finovate: What problem does BaseVenture solve?

Pizzi: We solve a very simple, yet complicated, problem—private fund management and administration is inefficient, antiquated, and overpriced. Technology innovation for this industry has been overlooked for decades—despite it being the fastest growing category of investment activity—and the industry spend on third-party services is enormous.

Private funds—think: hedge, real estate, private equity—spend 60% of their expenses on manual solutions to operations and business-management needs. They spend less than 40% on things that matter: raising capital and creating higher returns. To further complicate things, the industry is at the beginning of massive changes that will trigger greater regulatory and compliance scrutiny and requirements that these funds aren’t prepared to address.

Our SaaS platform—FundManager.io—changes all that. It uses modern technology to automate private fund management and administration from end to end. The result for our clients is more time and money to focus on growth and more satisfied investors.

Finovate: Who are your primary customers?

Pizzi: We help anyone managing investors to automate their operations. Our typical clients include private banks and trusts, fund administrators, fund managers, family offices, wealth advisers and more.

We also help RIA platforms and custodians standardize their approval processes and better manage investments on their platforms. You can learn more about BaseVenture and our award-winning platform, FundManager.io, on our website (www.baseventure.com).

Finovate: How does BaseVenture solve the problem better?

Pizzi: BaseVenture is the only SaaS solution that was created to specifically focus on solving the inefficiency of operations and compliance requirements for alternative investments.

We have tackled head-on the toughest and costliest operational and compliance-related problems that our customers face, using modern, easy-to-use software in the cloud. We’ve been successful, in part, because our team is the perfect blend of FinTech and Alternative Investment veterans, resulting in state-of-the-art technology designed precisely to solve the most pressing industry challenges.

Finovate: Tell us about your favorite implementation of your solution.

Pizzi: My favorite implementation of our software was with our first fund administrator client. They had a large offshore staff that struggled to keep up with the growing business—manually processing investments, financial accounting, reporting and compliance activities.

We introduced our FundManager.io platform and transformed their operations. The manual tasks were automated by software: the data no longer had to be input manually; the reports were automatically generated and shared; and compliance procedures became electronic and fully auditable.

It was a tremendous success, not only for staff who could now focus on higher-value activities, but also for the business, [now] able to grow at a faster rate and with higher levels of profitability.

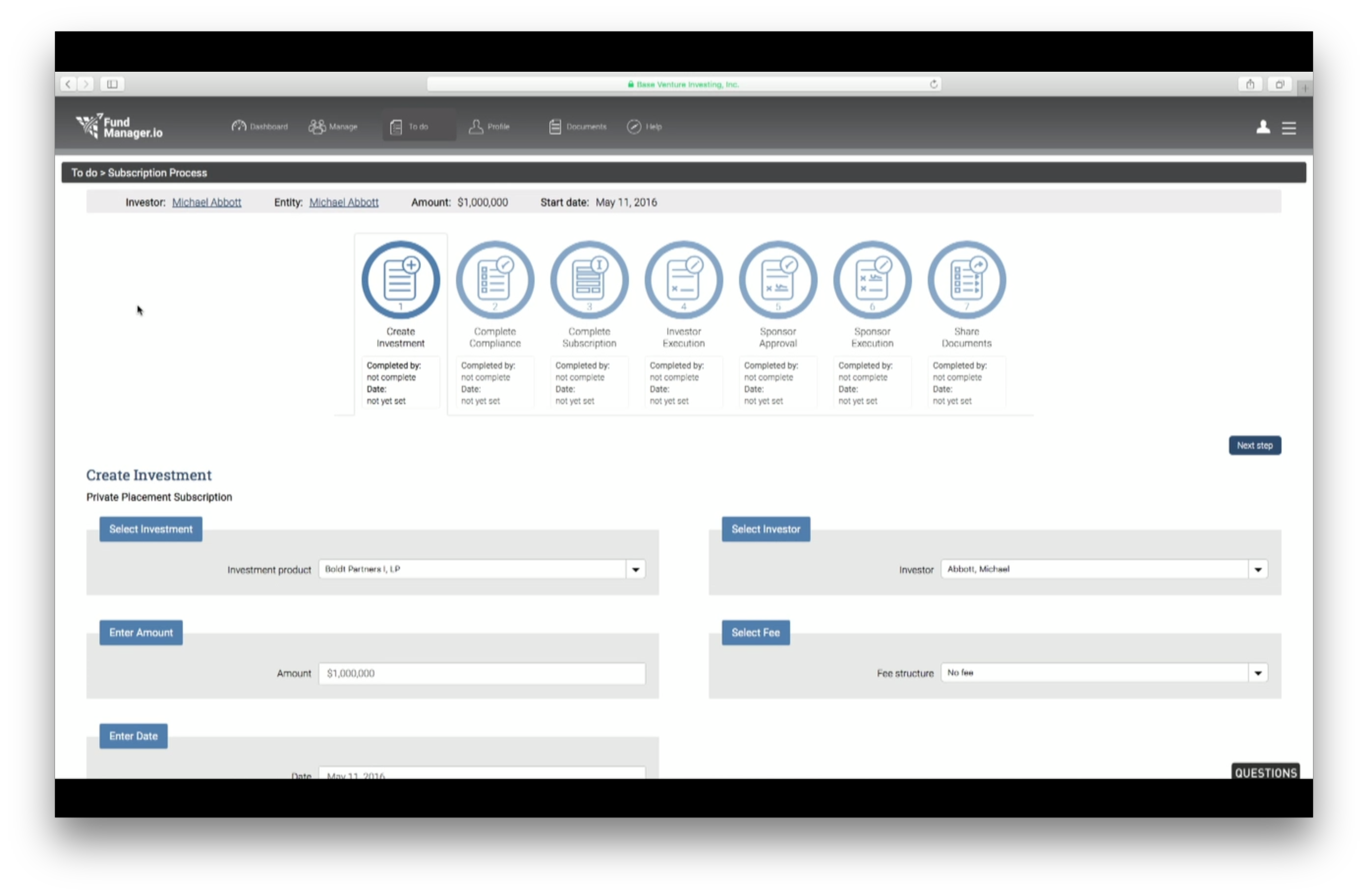

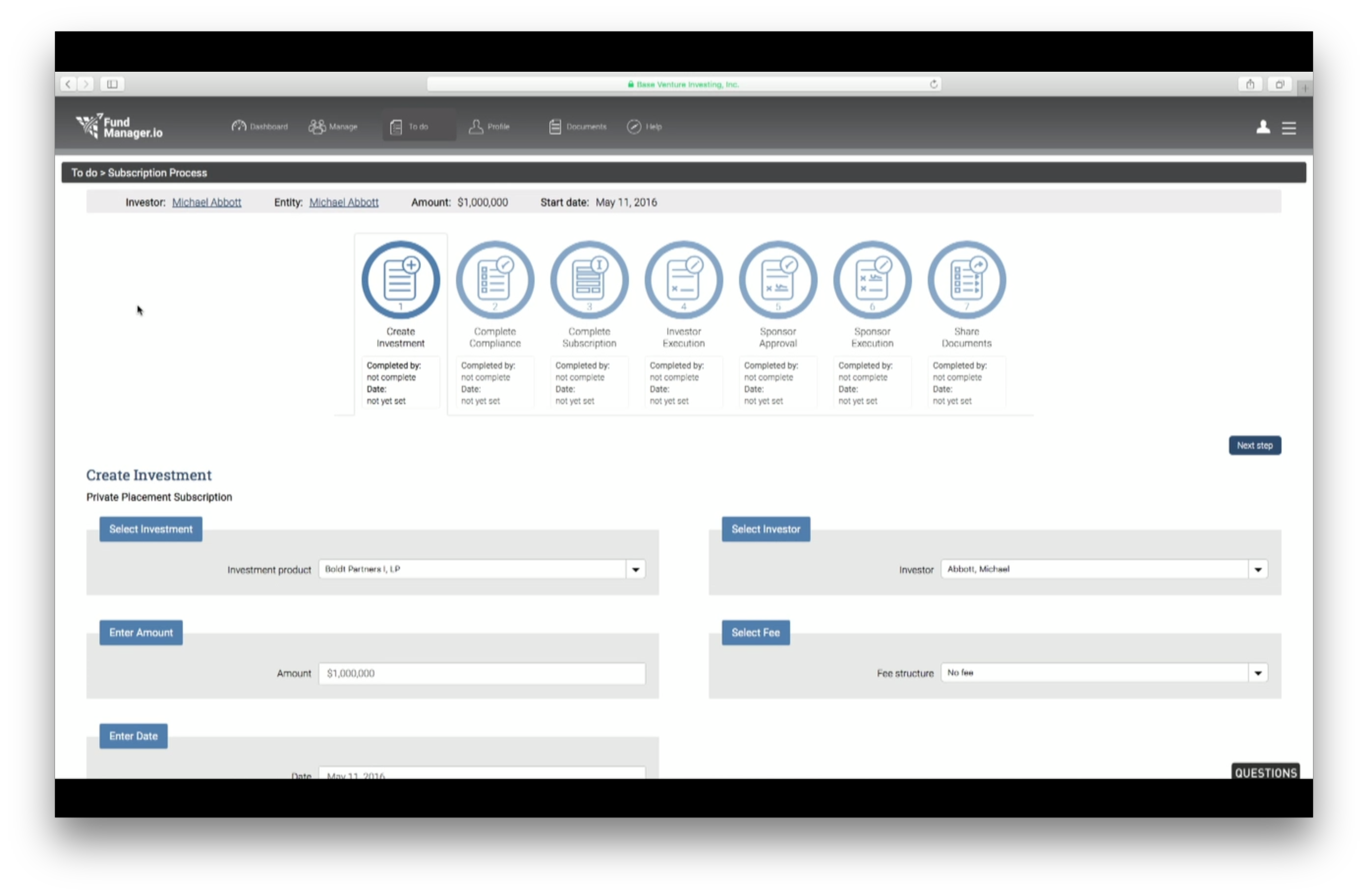

BaseVenture workflow

BaseVenture workflow

Finovate: What in your background gave you the confidence to tackle this challenge?

Pizzi: This is my second FinTech startup. I was previously the COO of mFoundry, the leading mobile banking and payments company in North America, which was sold to FIS in 2013. So I am very comfortable tackling the unique challenges of building a successful FinTech company and delivering a technology solution that is financial-grade.

But my real confidence comes from our team. My co-founder Kim Vogel and I have brought together an all-star team of technology, product and business leaders and together we’ve created a world-class product. And the reception we are getting in the market from our customers and partners is just tremendous.

Finovate: What are some upcoming initiatives from BaseVenture that we can look forward to over the next few months?

Pizzi: The next few months are exciting. We’re growing fast, adding new customers, expanding our product and hiring new people. While I don’t want to spoil any surprises, I can share a few highlights:

- We are launching new functionality that private banks and trusts are going to love. It allows them to more efficiently manage private funds, giving them the ability to grow their business by supporting incrementally more funds on their platform.

- We are introducing a full suite of automated workflow features that we’ve been working on with a select group of customers. They change the game by eliminating an immense amount of repetitive manual labor.

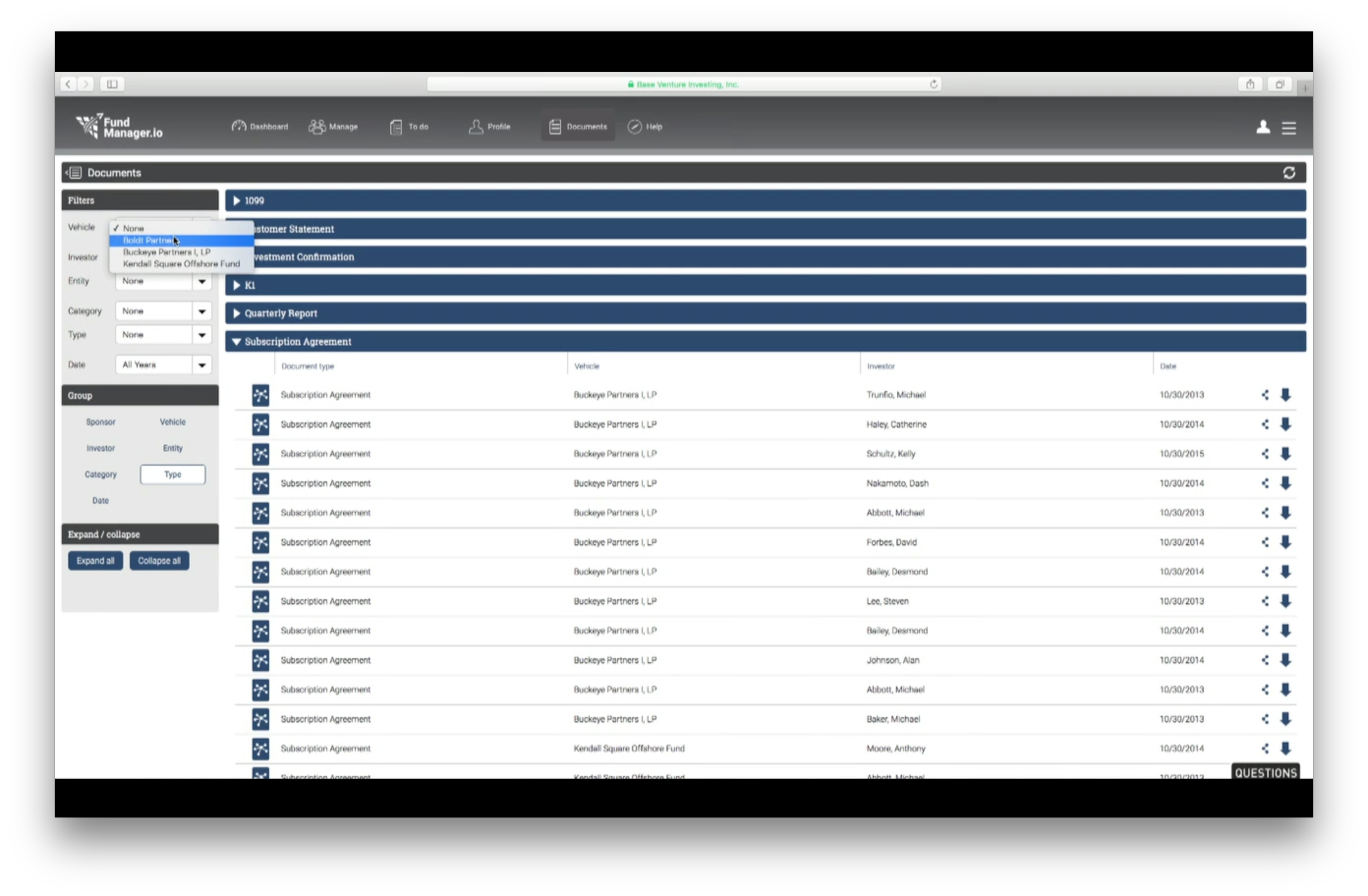

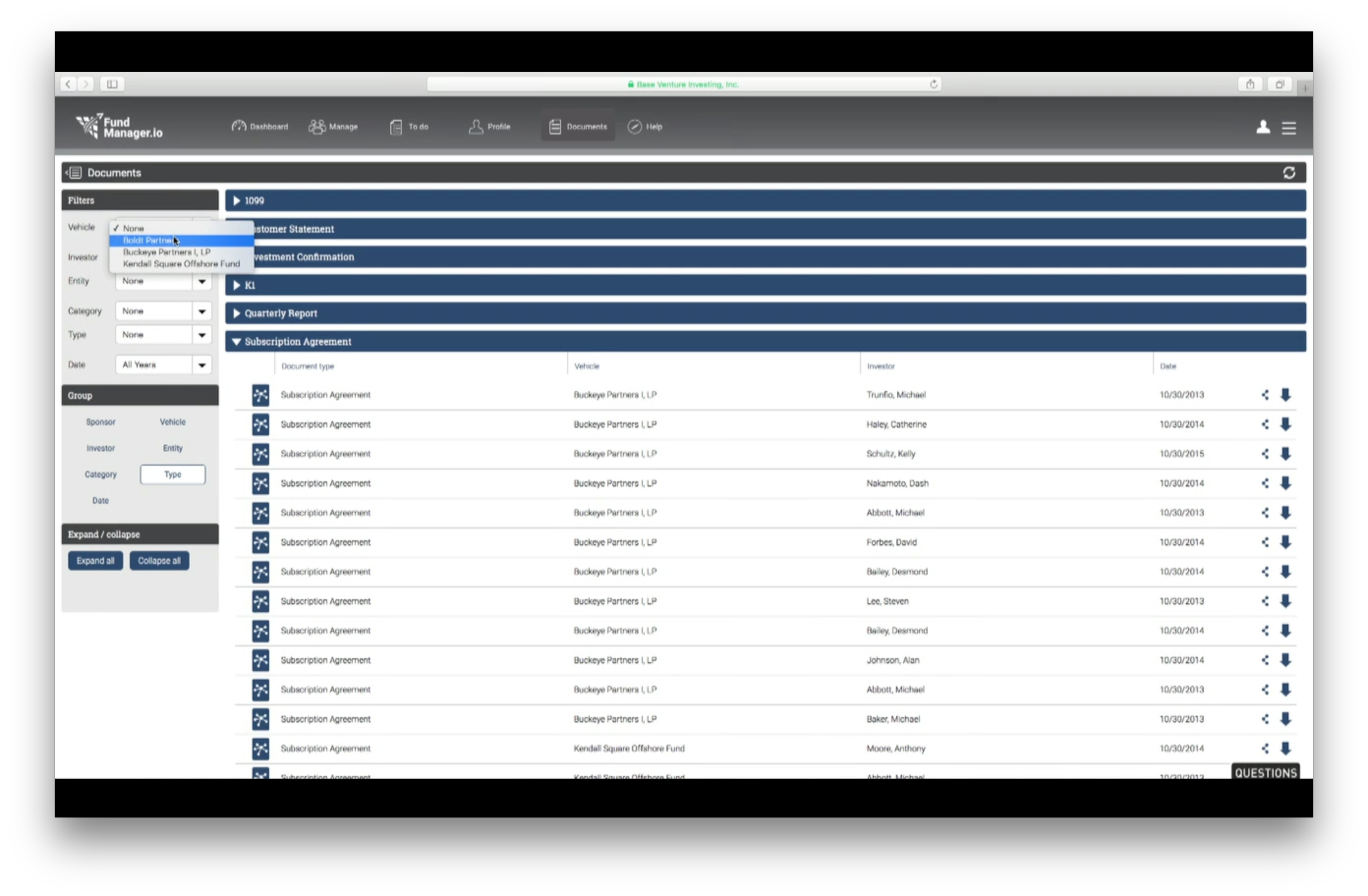

BaseVenture filtering capability

BaseVenture filtering capability

Finovate: Where do you see BaseVenture a year or two from now?

Pizzi: In a year or two, BaseVenture will be at the center of how private funds are administered and managed.

We’re already becoming the “go to” partner for any fund administrator, private bank, or fund manager that is looking to simplify and modernize their operations. But the effect that we’re having on improving compliance, creating efficiency, and enabling growth will reach far and wide into the wealth services industry.

The compliance area in particular is one of great importance, and BaseVenture will be a respected voice in helping the industry meet the growing and needed demands of increasing compliance, without hamstringing a fund managers’ ability to sustain and grow their businesses.

Our FinDEVr New York developer showcase was a success! FinDEVr Silicon Valley will be held October 18 & 19 in Santa Clara. Register today and save.

Our FinDEVr New York developer showcase was a success! FinDEVr Silicon Valley will be held October 18 & 19 in Santa Clara. Register today and save.

CEO John Pizzi, co-founder, and Steve Lemmer, director of product, at their FinovateSpring 2016 demo of BaseVenture’s FundManager.io

CEO John Pizzi, co-founder, and Steve Lemmer, director of product, at their FinovateSpring 2016 demo of BaseVenture’s FundManager.io BaseVenture CEO John Pizzi offered to give us some additional insight into the company after his demo at FinovateSpring earlier this year. Pizzi was formerly president and COO of mFoundry before selling to FIS in 2013. Prior to that, he was VP of Arc Worldwide, a marketing services company.

BaseVenture CEO John Pizzi offered to give us some additional insight into the company after his demo at FinovateSpring earlier this year. Pizzi was formerly president and COO of mFoundry before selling to FIS in 2013. Prior to that, he was VP of Arc Worldwide, a marketing services company. BaseVenture workflow

BaseVenture workflow BaseVenture filtering capability

BaseVenture filtering capability