Max, the intelligent cash-management solution for high-net-worth individuals, announced its third anniversary last week with news that the platform now supports TD Bank accounts. This brings the total number of checking and brokerage accounts supported by Max to ten, with more on the way.

In an email, the company reflected on 2015, highlighting some of the year’s biggest highlights: Max built its Common Application, which makes managing multiple accounts easier, and its Advisor Dashboard gives advisers the ability to better work with clients on the platform. 2015 was also the year that Max added support for accounts from FIs including Fidelity, Goldman Sachs, and US Bank. “We see an exciting year ahead and look forward to helping our members continue to more effectively manage their cash,” the email read.

(Left to right): CEO Gary Zimmerman (founder) and Richard Wu, director of engineering, demonstrated MaxMyInterest at FinovateFall 2014 in New York.

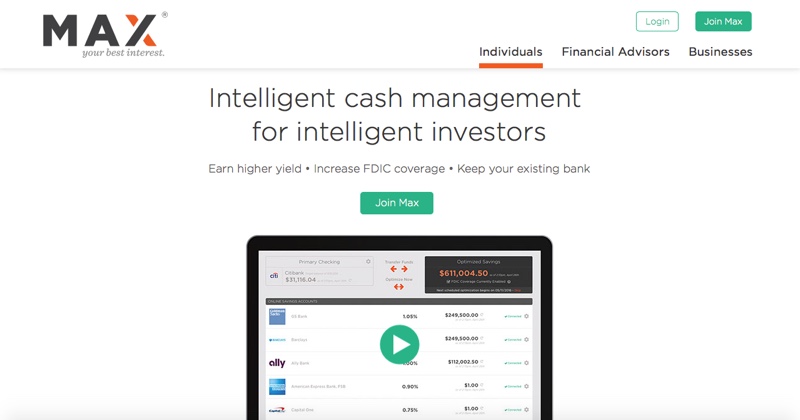

MaxMyInterest helps to mass affluent and high net worth investors and to make the most of their cash in this low-interest rate environment. The technology dynamically allocates the client-cash to make sure it is earning the highest possible interest rate as well as ensuring that cash levels per account remain below FDIC limits. The platform also provides investors with other cash-management tools such as a monthly cash sweep and an intelligent funds transfer solution that makes it easier for investors to allocate funds between different accounts. The company says that those using its platform typically earn 0.7 to 0.9% more than they currently earn at traditional banks. Read our Finovate Debuts feature on MaxMyInterest for more.

Founded in 2013 and headquartered in New York City, MaxMyInterest demonstrated its intelligent cash-management solution at FinovateFall 2014. The company launched its client-invitation feature in May, making it easier for advisers to onboard clients, and last fall, MaxMyInterest was honored by UBS, earning a finalist spot in its Future of Finance Challenge.