Take the “money transfer without money movement” sensibility of the hawala system on one hand. Take improvements on the Diffie-Helman key exchange on the other. Combine the two and the result is the “mutual and simultaneous” authentication system developed by Uniken and demonstrated at FinovateFall this September.

“Uniken is a cybersecurity company that does one thing and only one thing, but we do it incredibly well—we make connecting safe,” says company CEO Bimal Gandhi. “In two years, 28 implementations, four million users, and nine million end-points protected, we have zero penetrations, zero hacks, zero identity loss, and—most importantly—zero financial dollar and zero data loss.”

“Uniken is a cybersecurity company that does one thing and only one thing, but we do it incredibly well—we make connecting safe,” says company CEO Bimal Gandhi. “In two years, 28 implementations, four million users, and nine million end-points protected, we have zero penetrations, zero hacks, zero identity loss, and—most importantly—zero financial dollar and zero data loss.”

Uniken recognizes that secure connections are based on secure relationships. Likening current authentication methods to asking for identification after a stranger has entered your home, Uniken instead focuses on preconnection authentication. This ensures that requests for connection come from approved users, approved apps, and approved devices before they reach the network. Gandhi says their REL-ID product is what users ask for; namely, a security solution for mobile applications that “tightly integrates identity and authentication with a secure, omnichannel solution.” It authenticates with perfect forward secrecy and fidelity and “dramatically reduces the attack surface—all while ensuring security doesn’t get in the way of an app’s phenomenal client experience.”

At FinovateFall, Gandhi demonstrated REL-ID Verify, Uniken’s authentication and verification solution designed especially for logins from work and even publicly accessible PCs, such as those at a hotel business center. Gandhi explained:

With REL-IDverify and a trusted device like a mobile phone, what you get is simply the ability to log in, get a message through a trusted channel that you verify, and coming back to you through that secure channel. There was never a third party involved. That communication was between that app and your authentication server directly—all on a tightly integrated secure channel.

Company facts:

- Founded in August 2013

- Headquartered in Chatham, New Jersey

- Serves four million users and protects more than nine million endpoints around the world

- Raised more than $8 million in equity funding

- Generated close to $2 million in revenue

From left: Uniken’s Robert Levine, VP business development, and CEO Bimal Gandhi demonstrated REL-IDverify at FinovateFall 2016.

I talked with Uniken CEO Bimal Gandhi during rehearsals at FinovateFall 2016, and followed up a few weeks later with some questions via email. Here’s our exchange:

I talked with Uniken CEO Bimal Gandhi during rehearsals at FinovateFall 2016, and followed up a few weeks later with some questions via email. Here’s our exchange:

Finovate: What problem does your technology solve?

Bimal Gandhi: We make connecting safe. Uniken looks at the world differently by revolutionizing the way that people think about identity authentication and why it must be done over a secure channel that addresses the threats we now experience. Our core solution allows companies to safely connect their clients to its digital products. To do this, our solution integrates three separate technologies: a new secure channel with key distribution, multifactor authentication, and software-defined perimeters that reduce the attack surface of your applications, all while enabling an amazing user experience.

Finovate: Who are your primary customers?

Gandhi: We are targeting our solution to enterprises that have large-scale digital customers. Our solution is geared toward mid-market and large-scale enterprises with a need for exceptionally strong security while concurrently enabling an amazing customer experience. Today we have customers in government, military, financial services, manufacturing, and e-commerce spaces. We are rapidly expanding into health care, secure infrastructure, and IoT.

Finovate: How does Uniken solve the problem better?

Gandhi: By combining three separate technologies, we are able to mitigate risks that other technologies can’t. These risks include credential compromise, MITM attacks and phishing attacks, all while also reducing the overall attack surface for the enterprise. Our next couple of releases will further enhance our DDOS resistance by segmenting connectivity at the protocol layer in a way that no other product can do.

Finovate: Tell us about your favorite implementation.

Gandhi: One of our most remarkable implementations was for one of the major depository clearinghouses of a major country. We were able to get this institution up and running with 1,500 financial institutions and fully functional within 60 days. In short, 1,500 member banks were able to get into the depository clearinghouse on the 60th day and clear billions of dollars of transactions safely, simply, and securely. This is a great testament that speaks to the ease that our technology integrates with existing systems.

Finovate: What in your background gave you the confidence to tackle this challenge?

Gandhi: Our management team has broad backgrounds encompassing financial services, technology, and cyber security. We have built teams, scaled businesses, and consistently bring value to clients every day. We are proud to have as our Chief Security Officer Dr. Whitfield Diffie. He helped create the preeminent key-exchange technology used on the internet today, i.e., the Diffie-Helman key exchange mentioned above. Our whole team reassures clients that we will be a major factor in the future and gives them the confidence that we can deliver today.

Finovate: What are some upcoming initiatives from Uniken that we can look forward to over the next few months?

Gandhi: Our road map includes some great extensions of both platform and capability. We are upgrading our desktop clients to match the robustness of our recent REL-IDmobile and REL-IDverify offerings. The desktop agent will be the final piece in our client-facing product set. We are also extending our connectivity solution to servers and Linux-based environments, enabling the use of our protocol in server-to-server connections and cloud-only application environments. And finally, we are making our back-end and front-end offerings FIDO compliant, giving our customers the ability to quickly integrate any other FIDO credential system. With these features in place, we believe the REL-ID family of offerings will be unique in the security marketplace for safety, simplicity, and scale.

Finovate: Where do you see Uniken a year or two from now?

Gandhi: We expect to see Uniken as the leader in customer identity management and expect broad-based adoption of our REL-ID protocol as a part of a larger ecosystem, whereby multiple vendors cooperate with solutions to keep the internet safe.

Levine and Gandhi demonstrating REL-IDverify at FinovateFall 2016 in New York.

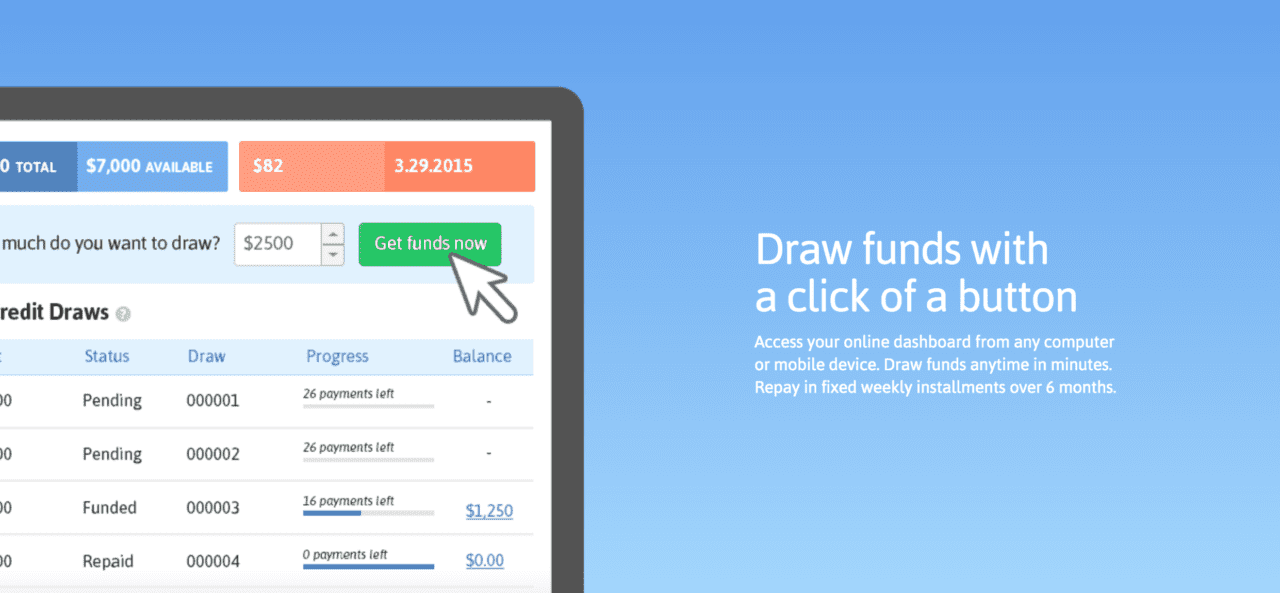

BlueVine offers a straightforward line of credit to help small businesses get the working capital they need. The company is best known for Invoice Factoring, in which it issues cash to small businesses who sell their unpaid invoices at a discount, then receive working capital in a matter of days to help manage operations. Unlike BlueVine’s traditional line-of-credit offering, the term of the financing is short, usually 60 to 90 days.

BlueVine offers a straightforward line of credit to help small businesses get the working capital they need. The company is best known for Invoice Factoring, in which it issues cash to small businesses who sell their unpaid invoices at a discount, then receive working capital in a matter of days to help manage operations. Unlike BlueVine’s traditional line-of-credit offering, the term of the financing is short, usually 60 to 90 days.

“Uniken is a cybersecurity company that does one thing and only one thing, but we do it incredibly well—we make connecting safe,” says company CEO Bimal Gandhi. “In two years, 28 implementations, four million users, and nine million end-points protected, we have zero penetrations, zero hacks, zero identity loss, and—most importantly—zero financial dollar and zero data loss.”

“Uniken is a cybersecurity company that does one thing and only one thing, but we do it incredibly well—we make connecting safe,” says company CEO Bimal Gandhi. “In two years, 28 implementations, four million users, and nine million end-points protected, we have zero penetrations, zero hacks, zero identity loss, and—most importantly—zero financial dollar and zero data loss.”

I talked with Uniken CEO Bimal Gandhi during rehearsals at FinovateFall 2016, and followed up a few weeks later with some questions via email. Here’s our exchange:

I talked with Uniken CEO Bimal Gandhi during rehearsals at FinovateFall 2016, and followed up a few weeks later with some questions via email. Here’s our exchange:

The second deadline to apply to speak at

The second deadline to apply to speak at