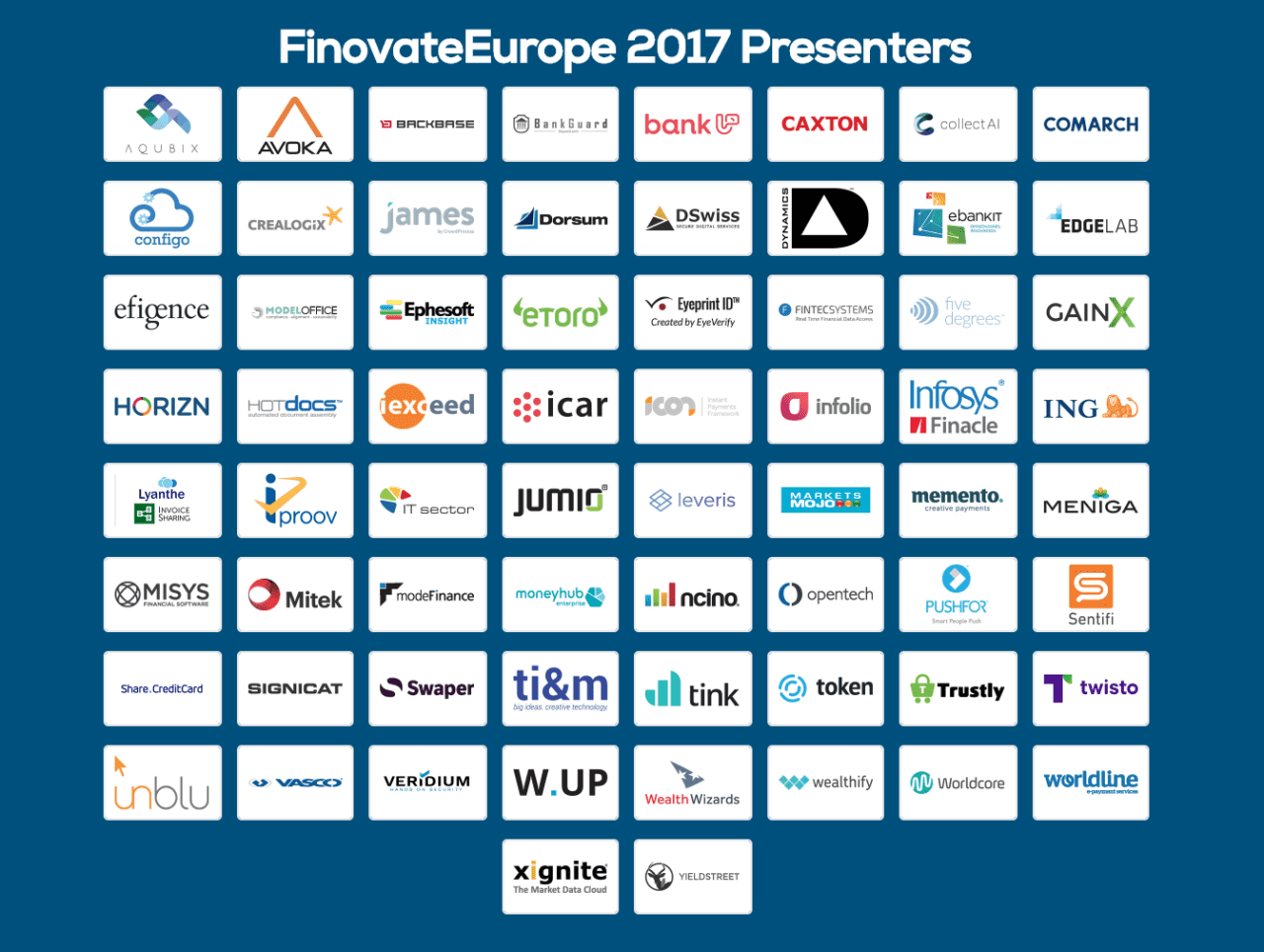

![]() A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

unblu’s live collaboration suite helps the world’s leading banks deliver an in-person experience online. Over 80 banks worldwide trust unblu.

Features

- Facilitates customer acquisition and end-to-end onboarding

- Lifts conversion rates and increases sales through live engagements

- Offers customers consulting from the comfort of their home

Why it’s great

Allows you to create a virtual branch rivaling any high-street presence. unblu is changing how banks do business and deliver services through their digital channels.

Presenters

Presenters

Jens Rabe, CMO

Rabe loves to understand technology and its potential impact on real life problems to help design new ways in which business can be done.

LinkedIn

Luc Haldimann, CEO, unblu

Luc Haldimann, CEO, unblu

Haldimann combines vision, persistence and entrepreneurship. A true inventor, he strives to make lasting contributions to the technology and business worlds.

LinkedIn

Presenters

Presenters Peet Denny, Chief Technology Officer

Peet Denny, Chief Technology Officer

Korst (pictured) arrives at Avalara after several years at Microsoft where he led planning and execution of the global launch of Windows 10. Previous to Microsoft, Korst served as vice president and general manager at T-Mobile, and senior product marketing manager at AT&T Wireless/Cingular. A member of the board of a number of companies including Shoelace Wireless and 9104 Studios, Korst is a mentor for Seattle-area technology accelerator, 9Mile Labs. He has a BA in Economics, Politics, and Government from the University of Puget Sound, and a MBA from the Wharton School, University of Pennsylvania.

Korst (pictured) arrives at Avalara after several years at Microsoft where he led planning and execution of the global launch of Windows 10. Previous to Microsoft, Korst served as vice president and general manager at T-Mobile, and senior product marketing manager at AT&T Wireless/Cingular. A member of the board of a number of companies including Shoelace Wireless and 9104 Studios, Korst is a mentor for Seattle-area technology accelerator, 9Mile Labs. He has a BA in Economics, Politics, and Government from the University of Puget Sound, and a MBA from the Wharton School, University of Pennsylvania.

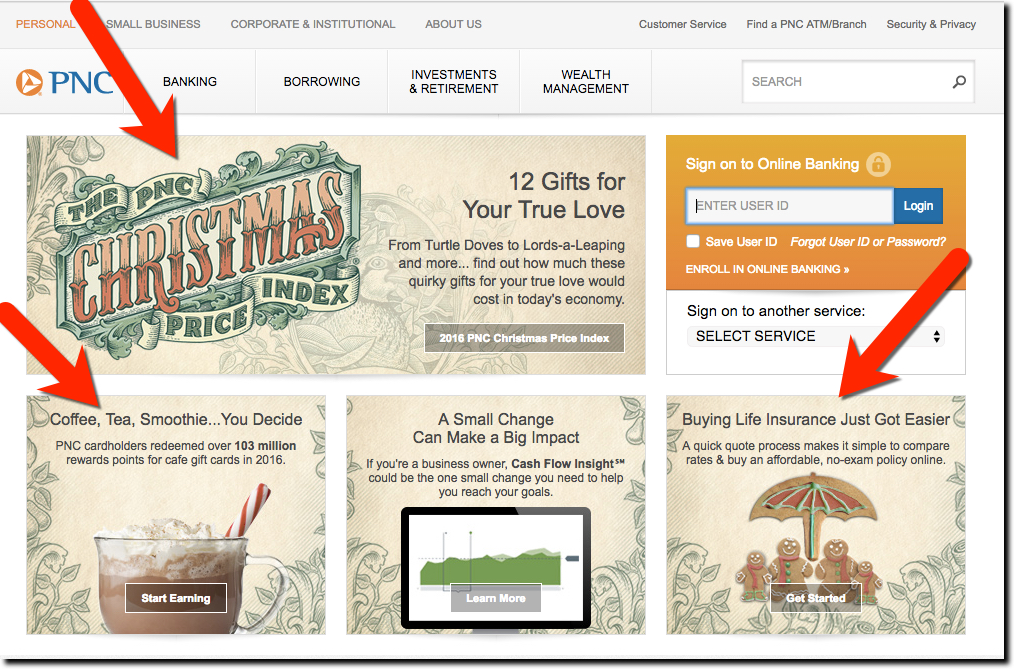

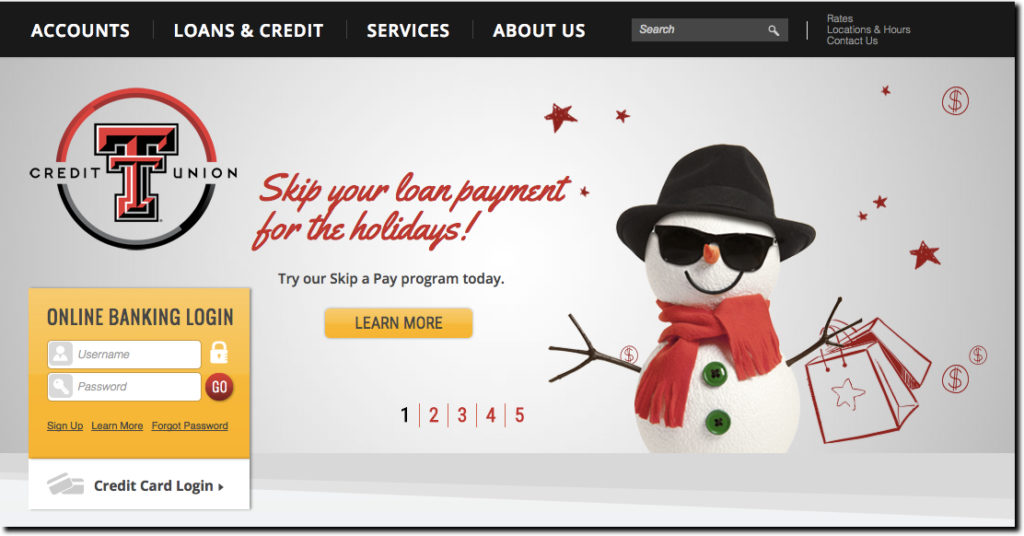

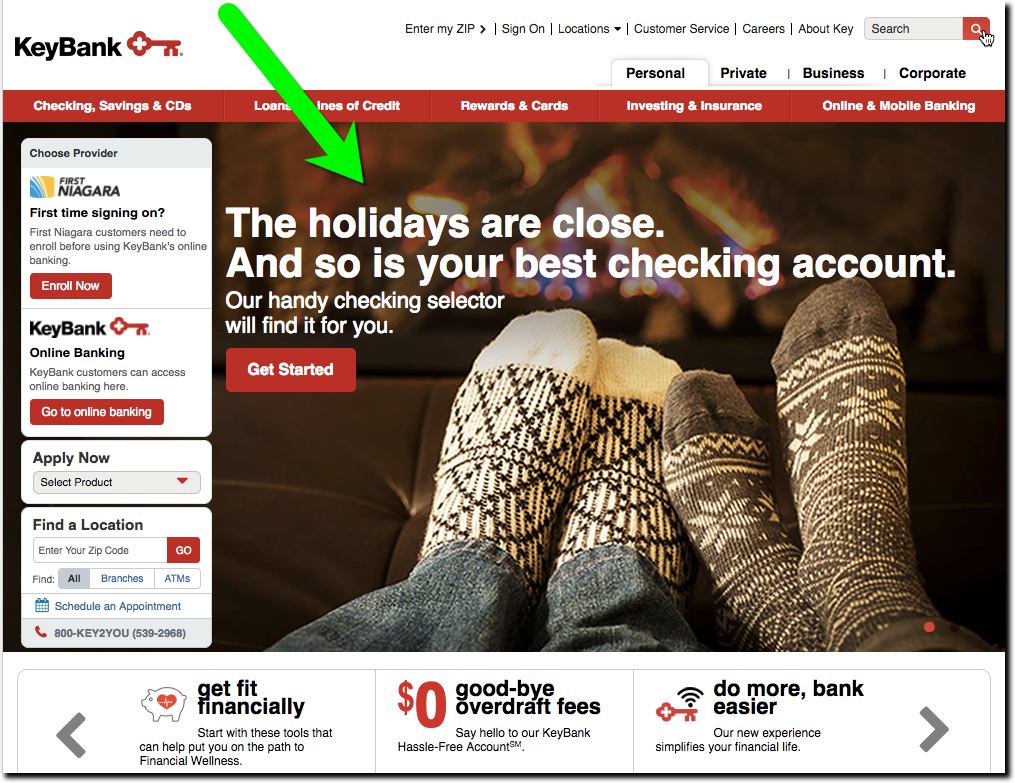

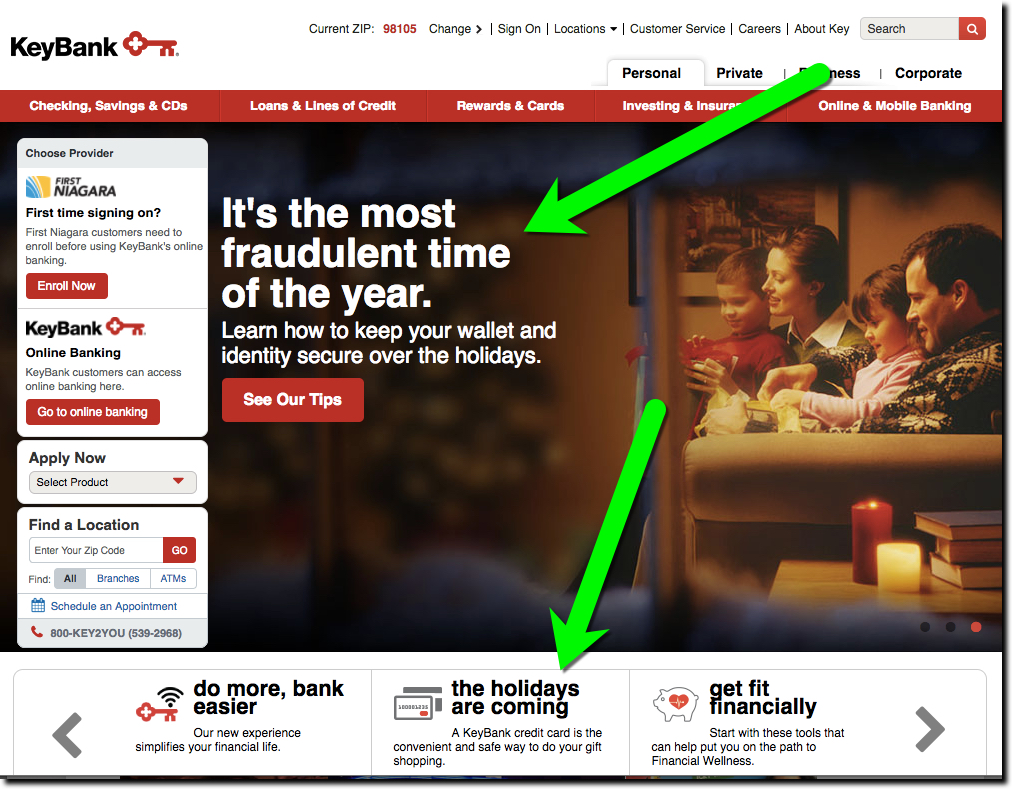

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

can’t wait to join the team and to work with Manolo to extend the success story of BBVA Compass.” Genç will replace Manolo Sanchez, who became CEO of BBVA Compass in 2008 and will transition into a new role of non-executive chairman.

can’t wait to join the team and to work with Manolo to extend the success story of BBVA Compass.” Genç will replace Manolo Sanchez, who became CEO of BBVA Compass in 2008 and will transition into a new role of non-executive chairman.

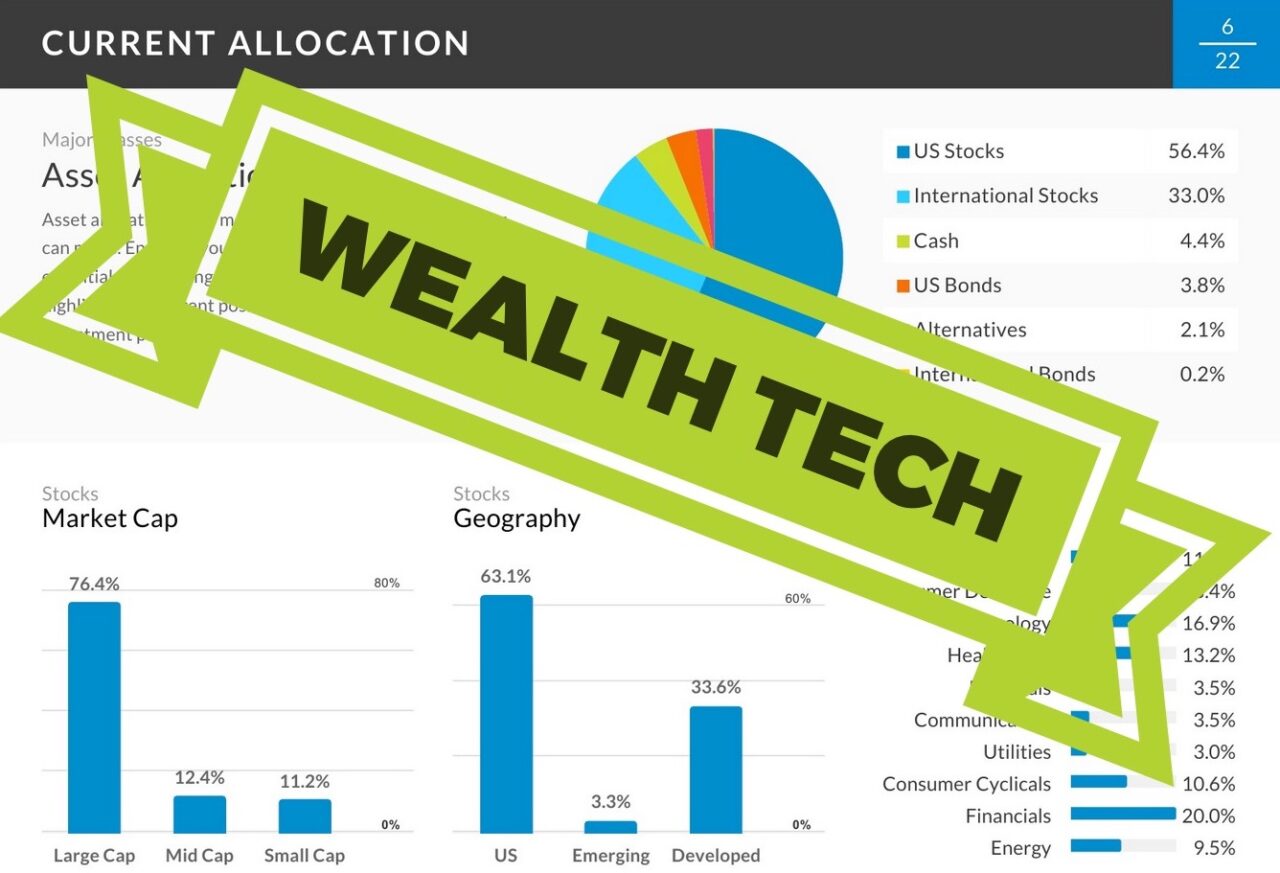

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank

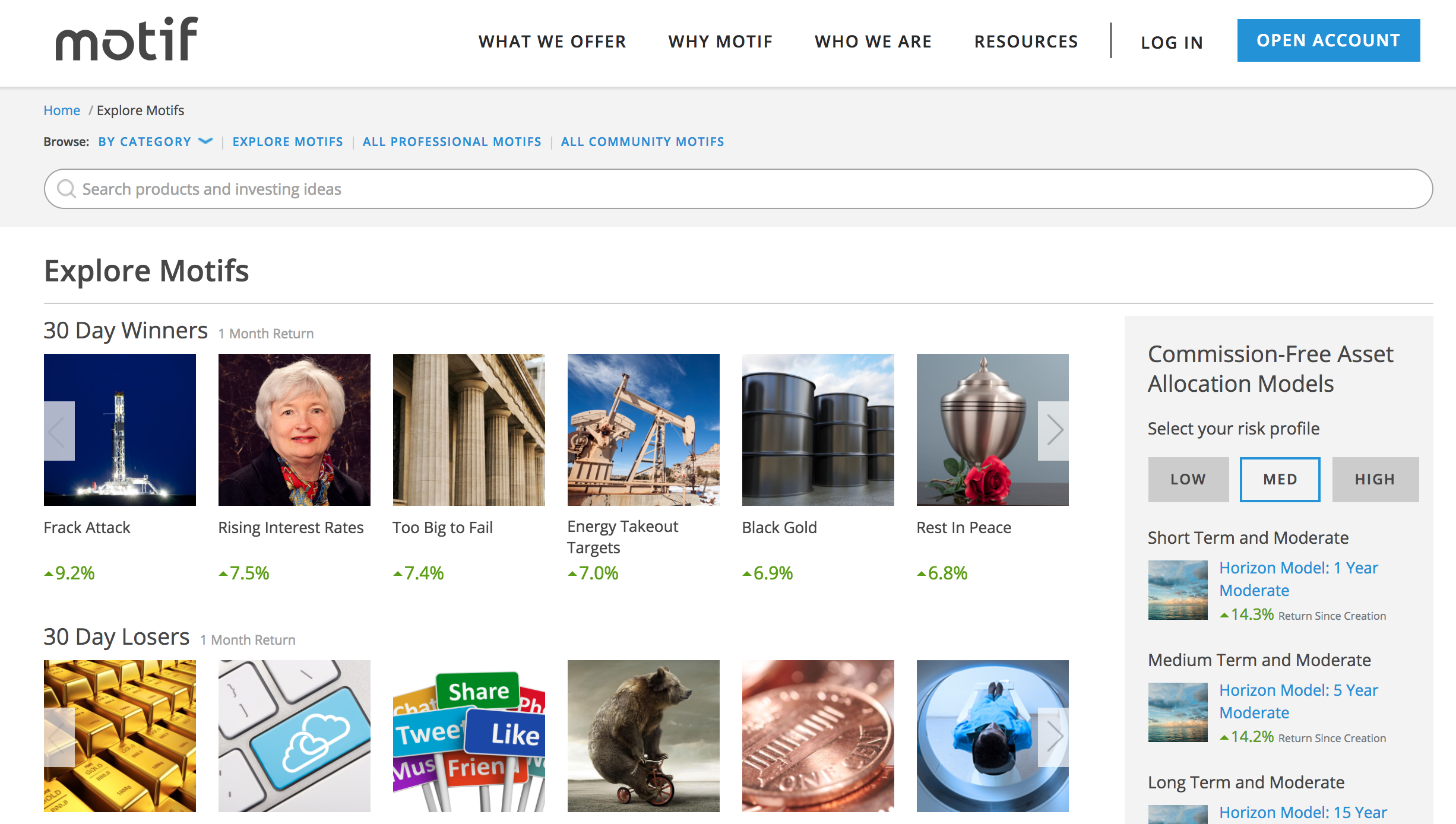

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme

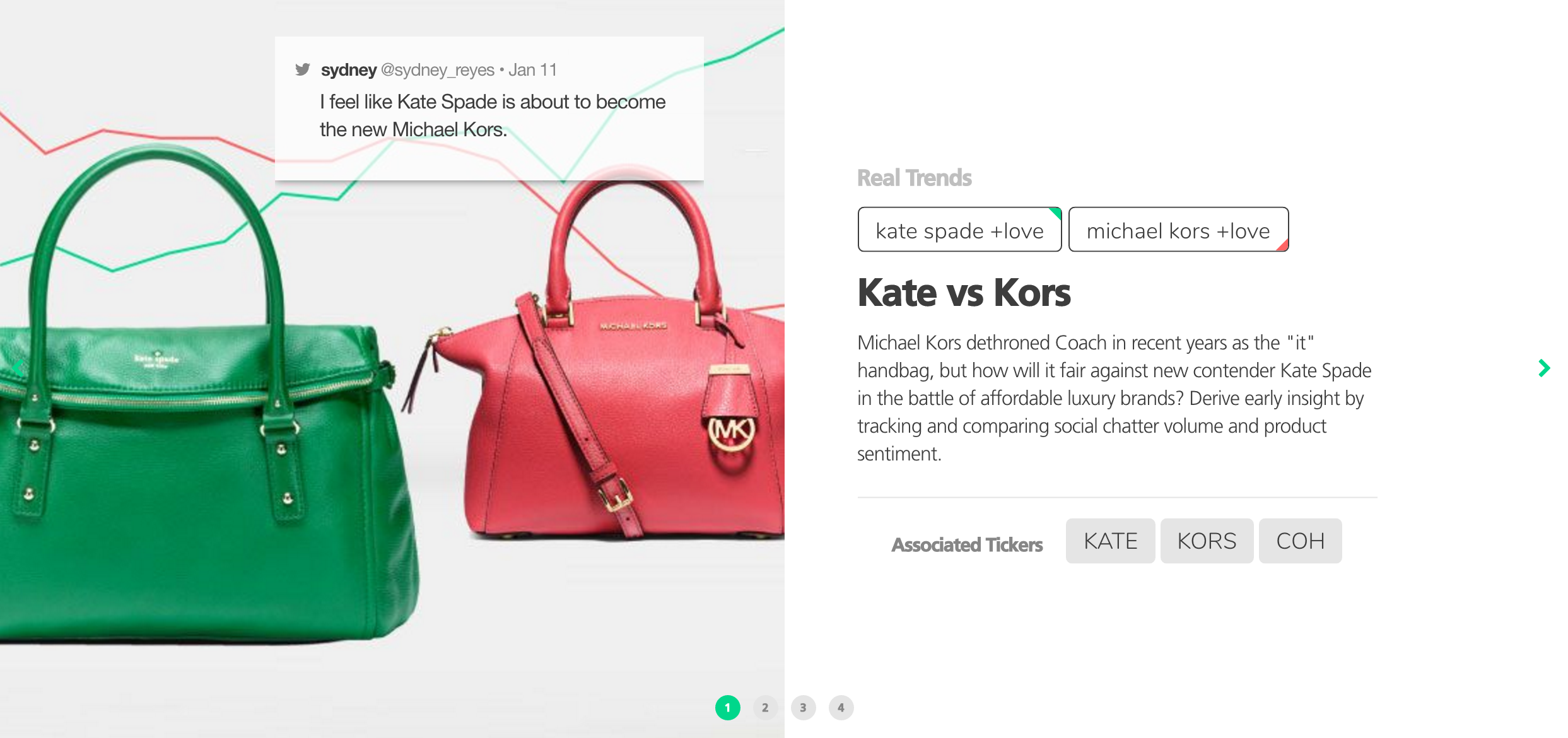

With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme TickerTags helps users discover trends even before they become news

TickerTags helps users discover trends even before they become news