by Husayn Kassai, CEO and Co-Founder of Onfido Background Checks. First published on FinTech Futures.

Robo advisers are democratizing access to financial services by offering expert financial advice, and with it RegTech is growing. We have seen this trend start in the US, and spread to the rest of the world. With Wealthfront and Betterment already household names and companies like Scalable Capital launching in both the UK and Germany, the market for robo advice is growing, and growing fast.

In its simplest form, the technology essentially involves replacing traditional, face-to-face savings and investment advice with automated, online guidance. Its capabilities extend much further than simply offering advice however; based on complex sets of algorithms, robo advisers can also execute on instruction and even invest money on your behalf.

The advantages of the technology are many, not least its democratization of access to investment and subsequent opening up of wealth management to the masses.

In particular, the need for remote, robust identity verification – ensuring a person is who they claim to be – will be paramount. As access to investment advice becomes more widely available, with many more users looking to sign up in a frictionless way in the comfort of their own home, the challenge of identity verification and the risks that come with it increase, as there may be more bad actors entering the system. It’s reduction of this risk that Regtech like Onfido offers.

Unfortunately, there’s often a tension between necessary compliance and fraud measures and a seamless, easy on-boarding process. It’s a difficult issue to resolve – while rigorous KYC & AML processes might put off honest applicants, making the user experience easier could make it easier for fraudsters to cheat the system. At Onfido, we’re evolving with the needs of the FinTech community to increase conversion and reduce fraud at the same time. With our SDK, it’s as easy as holding your ID document up to your smartphone or computer and taking a selfie. You can do it in seconds, and from the comfort of your own home, avoiding the long, complicated and fallible process of going in branch or even sending documents by mail.

Robo advice is growing to rapid prominence, and recent acquisitions of robo advice platforms FutureAdvisor and AnlageFinger by global banking giants BlackRock and Deutsche Bank respectively shows how seriously the new tech is being taken.

There’s still a long way to go, however. Regtech like Onfido’s has gone from improving financial services to opening FinTech to thin-files. The next phase will be to push financial inclusion even further and tackle the world’s 2 billion currently unbanked individuals. The technology already exists to enable this companies like Payjoy, for instance, can safely and seamlessly on-board users within seconds and at just a fraction of the considerable time and cost it would previously have taken.

Beyond that, penetration into other verticals is inevitable. A handful of companies in the UK and the US are already taking aim at the mortgage market, and many more look set to follow suit. The Robo market is undoubtedly on the rise, and Regtech is coming with it.

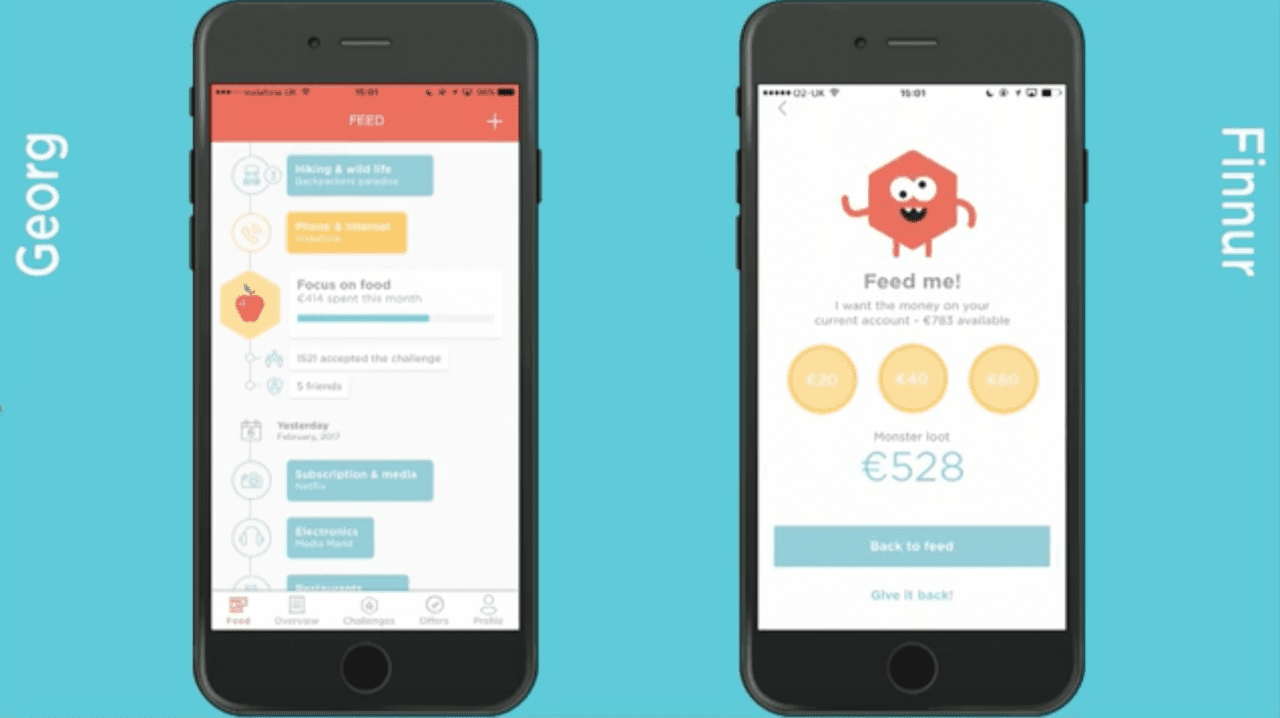

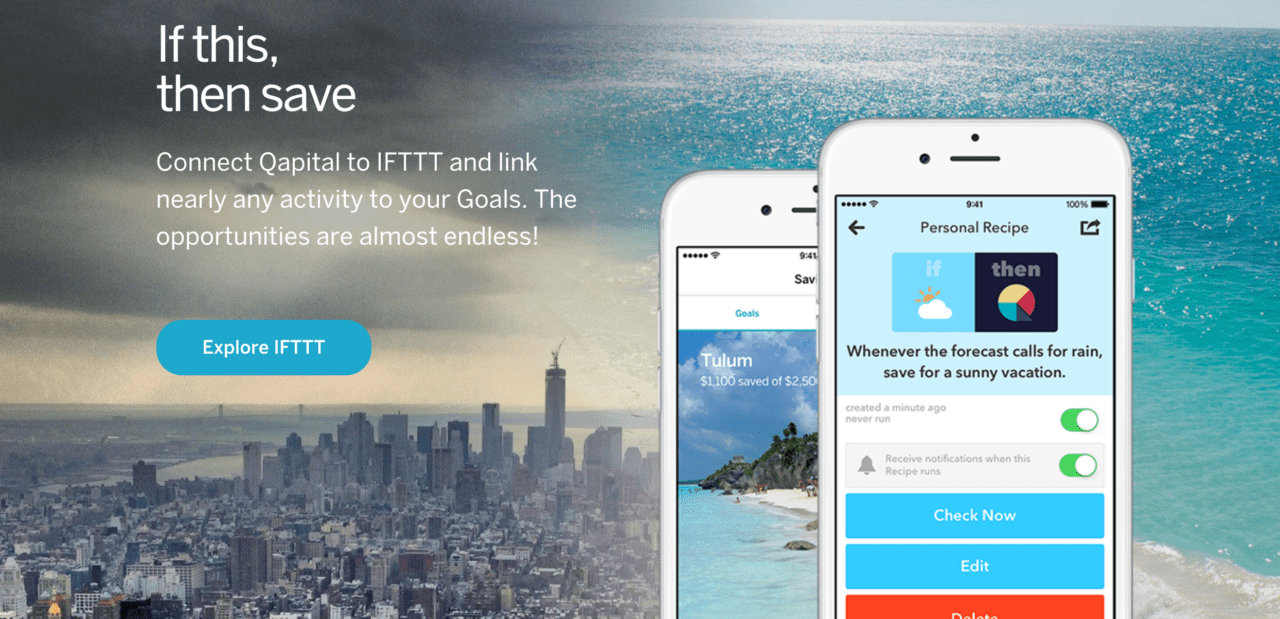

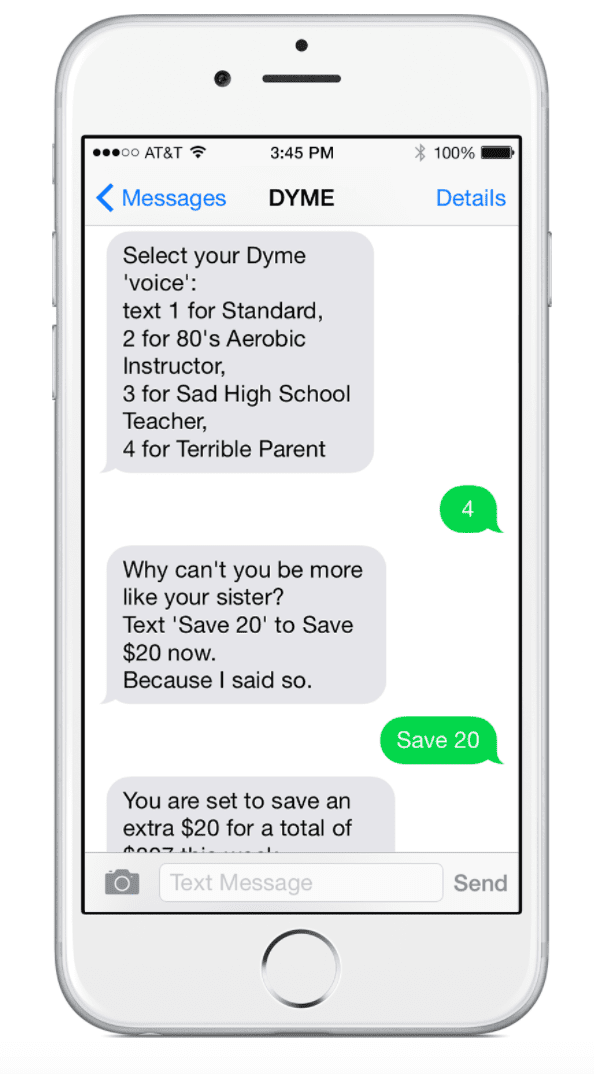

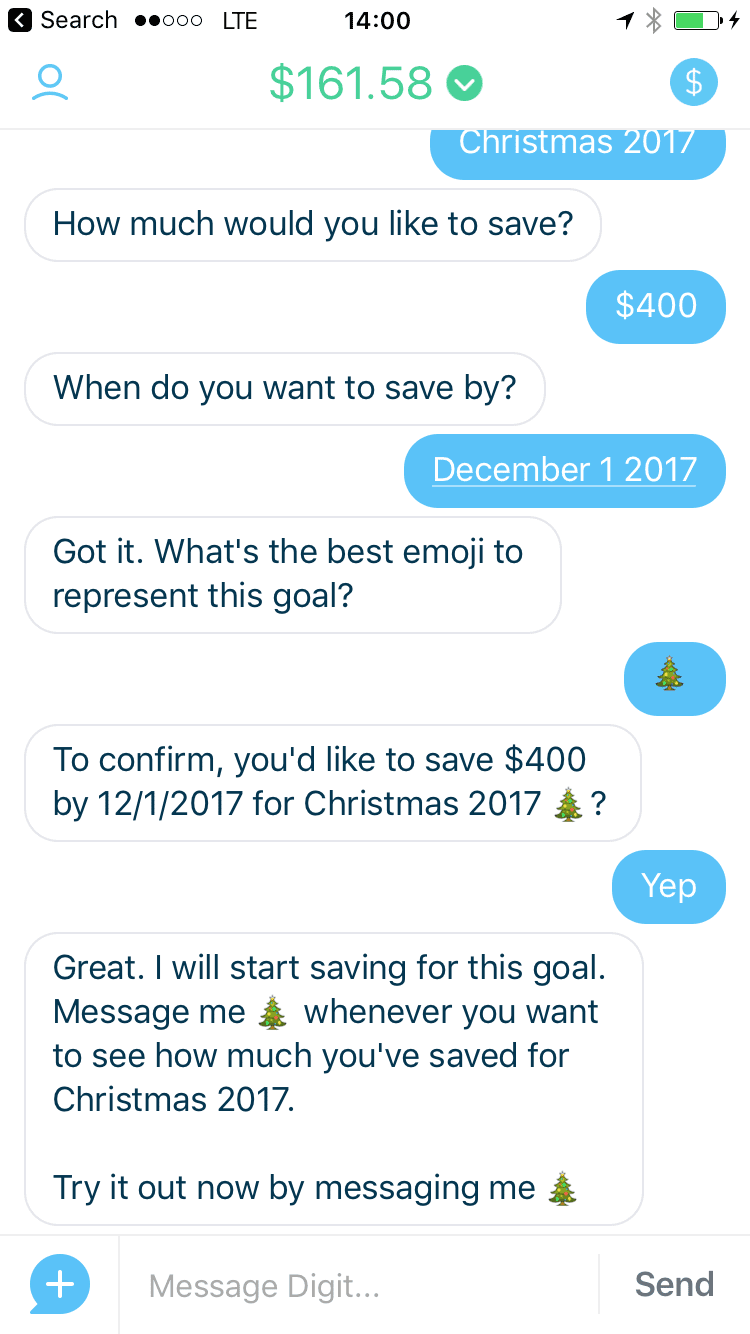

approach to determine the best dollar amount and frequency to save on behalf of the user, based on their historical spend. They use a chat-based interface for client communication and account management. Two examples in this space are Dyme, which takes a strict B2B approach, and Digit, which offers a B2C app.

approach to determine the best dollar amount and frequency to save on behalf of the user, based on their historical spend. They use a chat-based interface for client communication and account management. Two examples in this space are Dyme, which takes a strict B2B approach, and Digit, which offers a B2C app. a smartphone to take advantage of it. All they need to do it set up an account with their primary debit card and text the commands. Want to set aside an extra $10? Text, “save $10.” Want to withdraw your entire balance to pay your taxes? Text, “withdraw $1,700 for taxes.” To encourage interaction, Digit texts users their savings balance and checking account balance on a regular basis.Last month, the company expanded its platform

a smartphone to take advantage of it. All they need to do it set up an account with their primary debit card and text the commands. Want to set aside an extra $10? Text, “save $10.” Want to withdraw your entire balance to pay your taxes? Text, “withdraw $1,700 for taxes.” To encourage interaction, Digit texts users their savings balance and checking account balance on a regular basis.Last month, the company expanded its platform