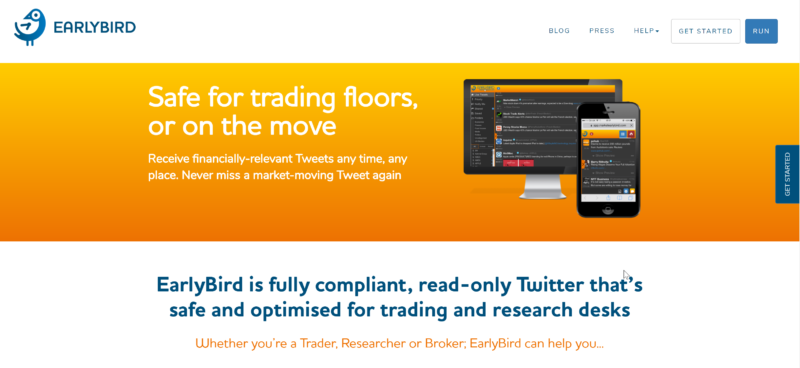

With a lighthearted observation about the current President of the United States, Market Earlybird founder and CEO Danny Watkins acknowledged the power of social media like Twitter to broadcast ideas and gauge the sentiment of the crowd. But for many financial professionals, taking full advantage of Twitter presents a wealth of challenges in terms of regulations and compliance.

And that’s where Market Earlybird comes in. Market Earlybird is a cloud-based, Twitter platform designed specifically to handle the compliance issues faced by financial professionals like traders, researchers, and brokers. While recreating the Twitter experience on the platform, Market Earlybird is read-only, has no direct messaging functionality, and is fully recorded to meet compliance requirements. The platform is easy to integrate, requiring neither installation or firewall changes.

Pictured: Market Earlybird CEO Danny Watkins demonstrating the company’s technology at FinovateEurope 2017.

This leaves financial professionals free to take advantage of the analytics on the Market Earlybird platform to get faster and deeper insight into potentially market-moving events. This includes SmartTracks, which enable users to scan a set of preferred stocks, currencies, or news for financial relevance. The platform focuses on the qualitative, considering the Tweeter’s reputation and degree of engagement across the platform (retweets, likes, etc.) to determine which tweets are most likely to “go viral” and potentially have the most impact. The result is a Twitter experience that is designed to provide the most relevant tweets to the financial professional.

“We stop everybody (from) shouting at once. We really make sure you are able to get to the value of Twitter,” Watkins said.” “We enable you to organize your follows, organize your priority feeds, get notifications. And we start to do that really clever stuff of not only seeing tweets as a flat structure,” he said, “but seeing tweets for the actual value they provide.”

Company facts

- Headquartered in London, England

- Founded in February 2012

- Raised £250,000 in funding

- Serves a dozen banks including two Top 10 global banks

We sat down with Market Earlybird CEO Danny Watkins during FinovateEurope and followed up with the company’s Chief Evangelist, Stuart Hunt (pictured) with a few questions by email. His responses are below.

Finovate: What problem does your EarlyBird solve?

Finovate: What problem does your EarlyBird solve?

Stuart Hunt: EarlyBird solves the problem of Twitter access in regulated financial environments. Twitter is now part of the very fabric of how political and financial news moves today, which makes it an essential tool for traders and analysts who need to see that news as it breaks. However, the challenges and risks of Twitter being used for market abuse, through its secret person-to-person channels, can be huge, and therefore it is often blocked from trading and research desks. EarlyBird solves this problem by providing a read-only Twitter service that is safe and optimized for financial professionals.

Finovate: How does your technology solve the problem better?

Hunt: EarlyBird blocks all outbound tweeting and messaging, and all tweets received by its users are recorded for compliance to review. All activity, such as who you follow and what you’re tracking, is also invisible to anyone outside your organization. But EarlyBird does much more than that. It’s a layered product, with increasingly rich capabilities to sift, filter, sort and analyze tweets. EarlyBird’s AI curated company searches, SmartTracks, cast a wider net than regular Twitter searches and return Tweets with real market relevance. It’s Twitter, but optimized for financial professionals.

Finovate: Tell us about your favorite implementation of EarlyBird.

Hunt: We’re always delighted when we hear from traders, analysts and compliance teams about how EarlyBird is solving the problems it was designed for. Most recently, we had a lot of positive feedback about our $TRUMP SmartTrack, which we created ahead of his inauguration to enable users to easily track financially relevant tweets and news on Twitter regarding Trump. Trump has thrown a curve ball into financial markets with his fired-from-the-hip tweets, so it was pleasing to know we were helping our customers manage the uncertainty.

Finovate: What is your background gave you the confidence to tackle this challenge?

Hunt: EarlyBird was created by our CEO, Danny Watkins, a chartered IT professional and former senior technologist at a multi-national investment bank. Danny’s extensive experience in the industry led to him recognizing the need for an FCA-compliant, read-only Twitter feed. The software was built independently of the bank, supplied under license and piloted on multiple trade floors for several years before its full commercial launch in 2015. Because EarlyBird was tested so rigorously before launch, we knew there was a strong need for the service.

Finovate: Who are your primary customers?

Hunt: Our primary customers are investment banks and hedge funds. They are highly protective of their use of the service and we aren’t able to give names or specific details of how they use it. What we can say is that they are getting information using a combination of direct follows and our artificial intelligence curated feeds, which are giving them market insights that others are missing.

Finovate: What are some upcoming initiatives from your company that we can look forward to over the next few months?

Hunt: At the moment we’re putting the finishing touches to a new tweet translation feature for the platform. We’ve been working on this for the upcoming Europe elections so readers not only see the most relevant tweets, but can instantly see the content in their own language. We’re also going to be launching a brand new EarlyBird mobile app very soon as well.

Finovate: Where do you see Market EarlyBird a year or two from now?

Hunt: FinovateEurope was our first major conference after receiving funding from an Angel Investor at the end of last year. Since the event we’ve had many people approach us interested in EarlyBird, and off the back of those discussions have issued a number of new pilots which is really encouraging. In the coming two years, we hope to grow our user base, find new ways to enhance the software, and make EarlyBird the go-to platform for those looking to manage the risks and opportunities of Twitter in regulated finance firms.

CEO Danny Watkins demonstrating EarlyBird at FinovateEurope 2017.

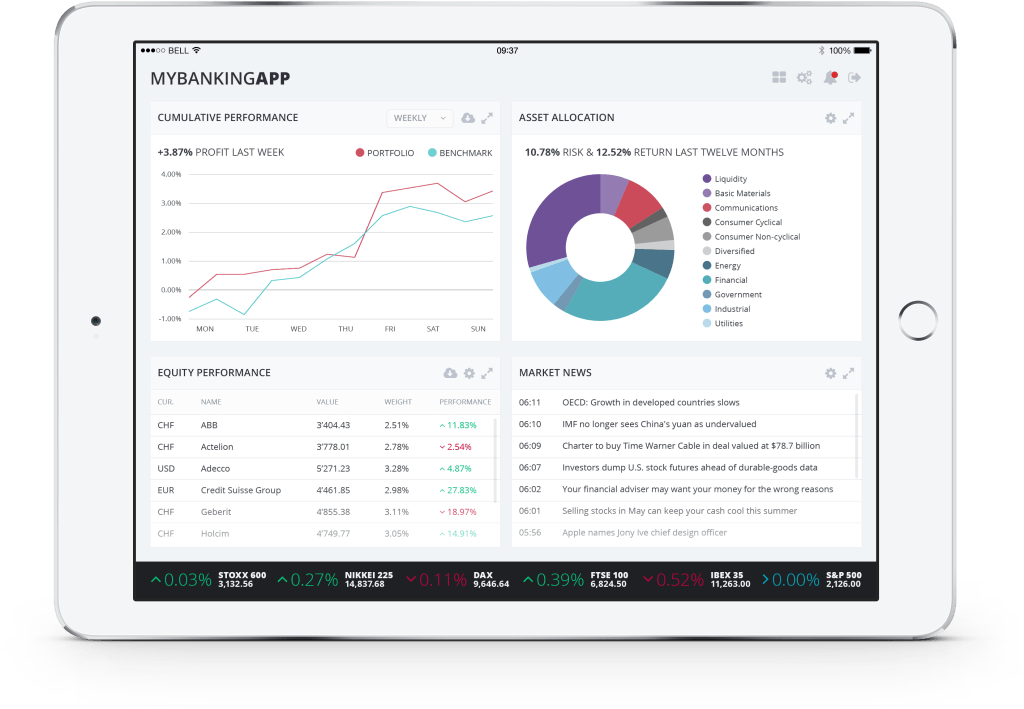

Founded in 1998, additiv offers a digital financial suite, robo advisor and advisor services, as well as digital mortgage tools. At FinovateEurope 2016, the company’s CEO and founder, Michael Stemmle, along with Adriano Lucatelli and Marc Sauter from Descartes Finance,

Founded in 1998, additiv offers a digital financial suite, robo advisor and advisor services, as well as digital mortgage tools. At FinovateEurope 2016, the company’s CEO and founder, Michael Stemmle, along with Adriano Lucatelli and Marc Sauter from Descartes Finance,

Finovate: What problem does your EarlyBird solve?

Finovate: What problem does your EarlyBird solve?

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology? Where did you start your career and how did you gain the experience needed to run the tech side of your company?

Where did you start your career and how did you gain the experience needed to run the tech side of your company?