Singapore-based B2B roboadvisor Bambu has completed a funding round that featured a strategic investment from Franklin Templeton Investments and venture capital funding from Wavemaker Partners, part of the Draper Venture Network. Also participating in the round was fintech and global robo advisor investor and advocate, Robby Hilkowitz.

“Bambu is now a growth stage company in the rapidly changing world of digital wealth,” Bambu CEO and co-founder Ned Phillips said. “To gain support from leading industry players brings great momentum towards our goal of becoming the market leader in the space.” He added that the company would use the new capital to speed business development and sales efforts, as well as bolster research and development.

Although the amount of this week’s investment was not made public, TechinAsia reports that the company’s total funding is more than $1 million, including a $400,000 seed round in the spring of 2016.

Pictured (left to right): Bambu CEO Ned Phillips and COO Aki Ranin demonstrating the Robo and Intelligent Digital Advisory platform at FinovateAsia 2016.

Bambu’s strategy as a robo advisory platform is to de-commoditize the industry by offering solutions that are tailored to specific markets. The company offers an Intelligent Advisor solution that is geared toward private banks and wealth managers working with high net worth clients. Bambu also has a white-label, robo advisory platform for affluent and retail investors that enables banks and asset managers to offer clients the ability to build personalized, goal-based portfolios.

Wavemaker Partners managing partner Paul Santos credited the experience of Bambu co-founders Ned Phillips and Aki Ranin in support of the firm’s investment. Praising the pair’s “deep domain expertise building scalable, sustainable businesses,” Santos added, “Ned and Aki have gone from strength to strength to find customers that love their product and have built up a promising pipeline.”

Bambu demonstrated its Robo and Intelligent Digital Advisory platform at its Finovate debut in Hong Kong in November 2016. In January, Bambu won Best Early Startup at the Next Money Fintech Finals in Hong Kong. Finovate research analyst Julie Muhn highlighted the company in her look at “Top Business-to-Business Wealth Tech Players” earlier this year. Bambu is a veteran of Hong Kong’s SuperCharger FinTech Accelerator 2.0, sponsored by Standard Chartered Bank and Fidelity International. The company was founded in 2016.

Interested in fintech in Asia? FinovateAsia returns to Hong Kong this November. Visit our FinovateAsia 2017 page for more information. Reserve your ticket by September 29th to take advantage of early-registration savings.

A look at the companies demoing live at FinovateFall on September 11 through 14 in New York. Pick up your tickets today and save your spot.

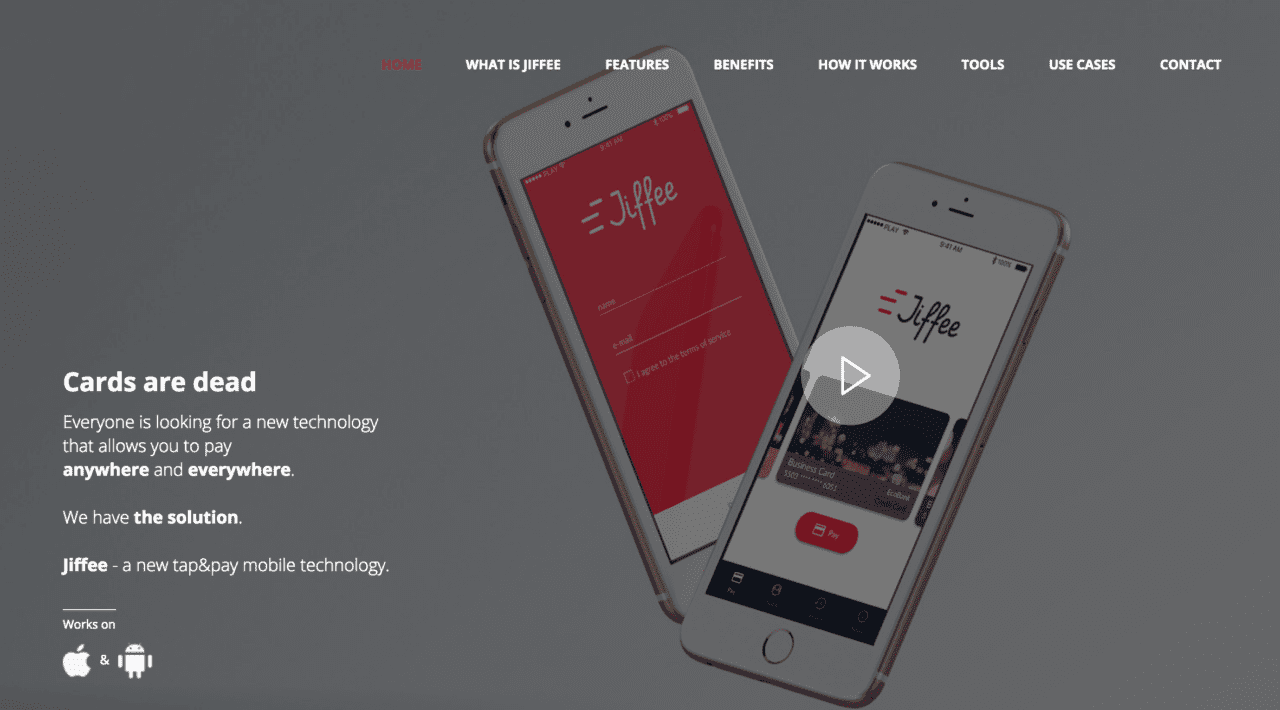

Wojciech Zatorski, CEO & Co-Founder

Wojciech Zatorski, CEO & Co-Founder

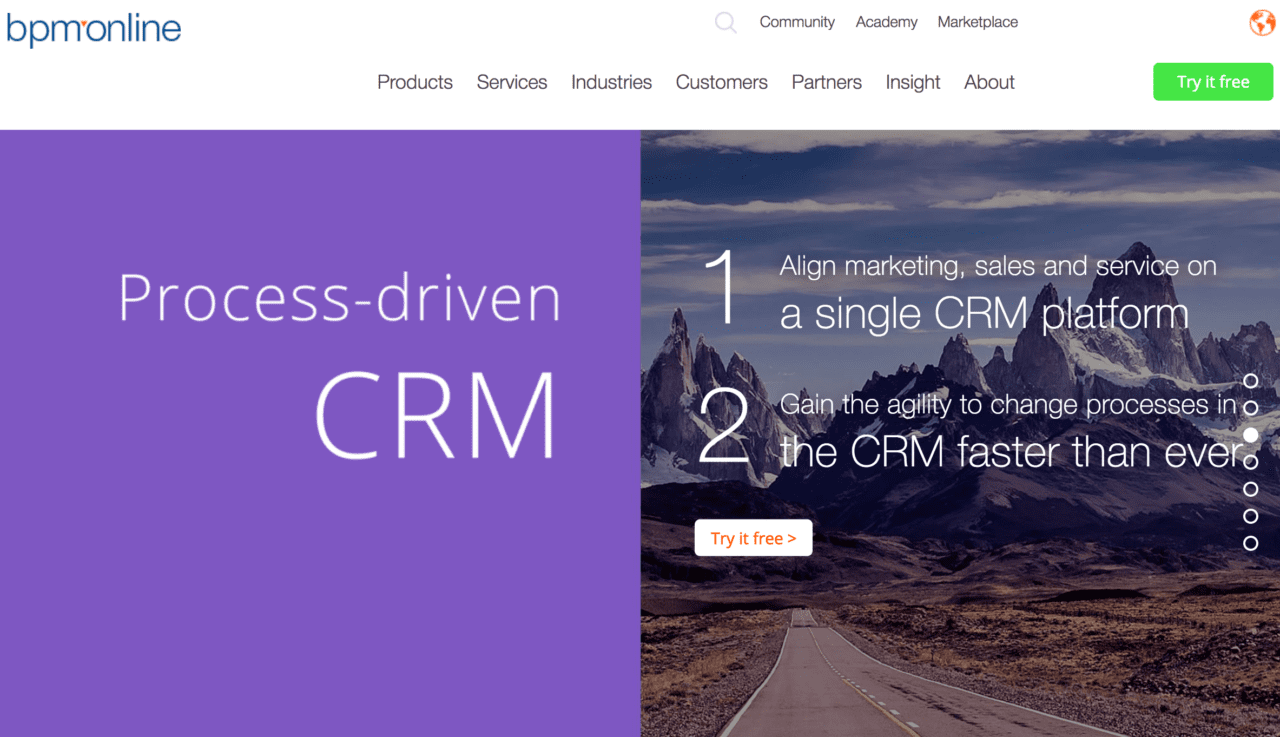

John Binda, Enterprise Account Executive

John Binda, Enterprise Account Executive

Jessie Morris, Director of Engineering

Jessie Morris, Director of Engineering