Designed by Freepik

With more than 400 attendees, more than 100 scheduled speakers, and more than 20 fintech innovators demonstrating their technologies live on stage, Finovate’s first foray into the Middle East next month is an event not to be missed.

Dubai, the largest and most populous city in the United Arab Emirates, will host FinovateMiddleEast on the 26 and 27th of February. And in addition to our trademark live, seven-minute technology demonstrations, FinovateMiddleEast will also feature a strong slate of keynote addresses, roundtable conversations, and panel discussions on some of the most contemporary themes, trends, and topics in fintech. Here’s an advance look at some of what we’ll talk about at the conference.

Day One – What do fintechs want? What do banks want? What do investors think?

How do we successfully leverage technology to help solve 21st century financial challenges for the Middle East and North Africa? Finding harmony in the different interests and agendas of technologists, banks, and investors is key to creating the kind of environment that will lead to dynamic fintech innovation. During our FinovateMiddleEast Summit Days, we’ll learn what fintechs and banks want and need in order to effectively and profitably collaborate with each other. We’ll also explore the role of investors in providing the critical capital and guidance that will help turn today’s innovators into tomorrow’s market leaders.

For all the talk of disruption, leaders in MENA countries are looking for a more constructive relationship between fintech innovation and the societies they are innovating in. This means a fintech industry that is flexible enough to serve both the sizable number of ultra high net worth and high net worth consumers in the MENA, as well as the fast-growing, mobile-inclined, social media-connected youth population. Innovations that are able to respond to needs resulting from these “second wave sectors” like wealth management and international money transfers, are as important as those catering to traditional areas like banking and payments and “hot” technologies like the blockchain.

From banking and payments to AI and blockchain

Fintech in the MENA is dominated by innovations in the banking and payments space. As much of 84% of fintech in the MENA is payments-related, per Wamda/Payfort. Digital wallets are one area where banks and fintechs are working together and providing solutions. Earlier this month, Batelco and Arab Financial Services launched a new digital wallet and payment solution. Also this month, UAE-based Noor Bank partnered with UB QFPay to offer new mobile payment solutions. We’ll take a look at just how far digital wallet adoption in the MENA region can go, and look at how the launch of Apple Pay in the UAE may provide some visibility into the future of contactless payments in the region.

At the same time, new technologies like AI, the blockchain and cryptocurrencies are being explored eagerly by fintechs, banks, and governments alike in the MENA region. Dubai-based ArabianChain announced last week that it was launching a cryptocurrency exchange. In June, a company called MAG Lifestyle Development will introduce a Sharia-compliant cryptocurrency for buying property in June. Finovate alum NCR plans to introduce bitcoin-enabled ATMs in the UAE in the spring.

We’ll examine the results of an interbank blockchain pilot involving Emirates NBD and ICICI Bank India launched last fall, as well as a look at how blockchain technology can increase efficiency and accountability for financial transactions in the GCC more broadly. We’ll also take a tour of 3D printing facilities and visit local accelerator, Future Foundation, as a prelude of sorts to our accelerator showcase on Day Two.

Day Two – Regulations and regtech as catalyst for innovation

What are the biggest challenges to the vision that fintech entrepreneurs, banks, investors, and technologists have for the MENA region? Ensuring that regulation is used as a tool to steer fintech toward its most productive possible role in society – one in which its solutions are effective, trusted, cost-effective, and widely available – is important.

So in addition to discussing future opportunities for fintech in the MENA region, we’ll take the time to understand both the current and emerging regulatory infrastructure that will define the kind of fintech that will develop in the Middle East. These topics range from helping fintechs in the region offer new, innovative Sharia-compliant products and services to anticipating the effects of the introduction of VAT in the UAE.

Part of our journey into this topic will hosted by a panel of leading fintech research analysts from firms like Gartner and Forrester who have specific expertise in the MENA region. We’ll also look at fintech regulation in the Middle East and compare it to how regulations are being developed in other areas like Asia and Europe. Do the differences between these regions – and their different regulatory needs and concerns – help us better understand how regulation and innovation should go and in hand for fintech in the MENA? Our conversation on Day Two is designed to help us explore these issues deeply.

Uniting fintechs, banks, and investors to better serve the underbanked

There can be no discussion of financial technology without a discussion of serving the underbanked. And while this is an important conversation in all areas, it may be especially acute in the Middle East and North Africa. According to a recent report from Wamda/Payfort, more than 85% of adults in the MENA do not have access to a bank account. Moreover, as Daniel Navarro wrote last spring in the Khaleej Times, financial inclusion is a major requirement for broader economic development.

“The solutions to increase financial inclusion need to be implemented properly, customized for each market segment, include microfinance services, low cost transfers, international remittances and other digital services to leverage the economic and social development. Also, the financial inclusion initiatives shall always be accompanied by proper security measures for KYC, AML, and CFT controls.”

Our conversation looks at opportunities, challenges, and successes alike. We’ll discuss Turkey’s plan to go cashless by 2023, as well as look at what is necessary from banks, fintechs, and the rest of the players in a modern economy in order to serve “the digital person.”

Another big feature on Day Two is the accelerator showcase which spotlights fintech startups that are based in the MENA region or doing significant business in the area. Added to the Finovate format last fall, the Accelerator Showcase provides a no-middleman opportunity for attendees to see and hear first hand what some of the MENA region’s most innovative young fintech startups are developing. And by viewing MENA startups through the lens of the accelerator programs that sponsored them, we get another opportunity to see and discuss the importance of startup culture and a dynamic, supportive ecosystem when it comes to preparing the next generation of fintech innovators.

What can banks gain from fintech innovation? What can fintechs gain from bank partnership and collaboration? And what incentivizes investors to come in from the sidelines with their critical support? Join us next month in Dubai as we tackle these and other issues driving the future of fintech in the Middle East.

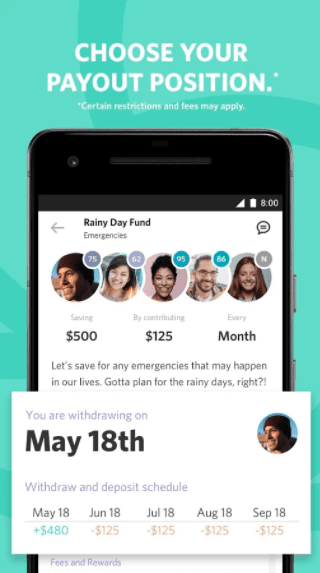

Launched last week, the Tanda app divides users into groups of five or nine to pool money and save for short-term savings goals. Users group their money together over the course of a set period of time and every month, one user gets to take home the entire pot of money. The first two users to receive the funds pay a small fee, while the last recipient earns a 2% bonus.

Launched last week, the Tanda app divides users into groups of five or nine to pool money and save for short-term savings goals. Users group their money together over the course of a set period of time and every month, one user gets to take home the entire pot of money. The first two users to receive the funds pay a small fee, while the last recipient earns a 2% bonus.

Last month we reported that digital currency wallet

Last month we reported that digital currency wallet