In a round led by Nyca, CommerzVentures, and CEFIF, augmented digital commerce platform Omnyway has raised $12.75 million in new funding. The Series A will give Omnyway (formerly Omnypay) the ability to launch new services, expand operations, and add to its customer base both in the U.S. and around the globe.

“To keep up in this fast-moving, mobile-first (and soon, mobile-only) world, retailers need tools that speak to how people want to shop and engage today,” Omnyway CEO Ashok Narasimhan said. He added that the funding would enable the company to “continue innovating on today’s fundamentally different retail experience.”

This retail experience involves putting mobile at the center of the shopping experience. The company’s platform helps retailers leverage in-store, online, and in-app interaction channels, as well as virtual aisles and dynamic media to engage customers in a dynamic, digital, and thoroughly omni-channel way. Available as a white-label solution, the technology integrates readily with both legacy back-end systems and existing mobile apps, and has been used by retailers like Kohls to add payment functionality to their apps.

Amitaabh Malhotra, Chief Marketing Officer for Omnyway, demonstrating the Zapbuy plugin for banking apps at FinovateFall 2017.

More recently the company has earned recognition for its Zapbuy service, which the company demonstrated during its debut at FinovateFall last month. Zapbuy enables shoppers to purchase items directly from an advertisement simply by clicking on the ad itself. “Zapbuy utilizes the latest in contextualization, personalization, and frictionless checkout techniques to offer an uplift in ROI from advertising budgets while also maximizing revenue,” Omnyway CMO Amitaabh Malhotra explained from the Finovate stage.

Malhotra showed how the platform guided the shopper from a digital ad they had clicked on to a pop-up window that featured credentialed payment options featured such as a bank as well as a QR code. After making their payment selection, the shopper simply locates and chooses the “Zapbuy” option, which opens up the camera on the shopper’s mobile phone so they can photograph the item’s QR code. A confirmation page provides the shopper with all the information about the transaction – including applied rewards or discounts, points earned, shipping address, etc. – before they make the final purchase.

“We are allowing financial institutions to participate in a new revenue stream which is associated with affiliate revenue and advertising revenue that otherwise would not have been available,” Malhotra said. “Secondly we are also making their credentials top of wallet for that particular user. So every time they come back to that particular type of ad or interface, they are able to make the purchase again using the same credential and any other financial benefits you want to offer them.”

Founded in 2014, Omnyway is headquartered in San Francisco, California.

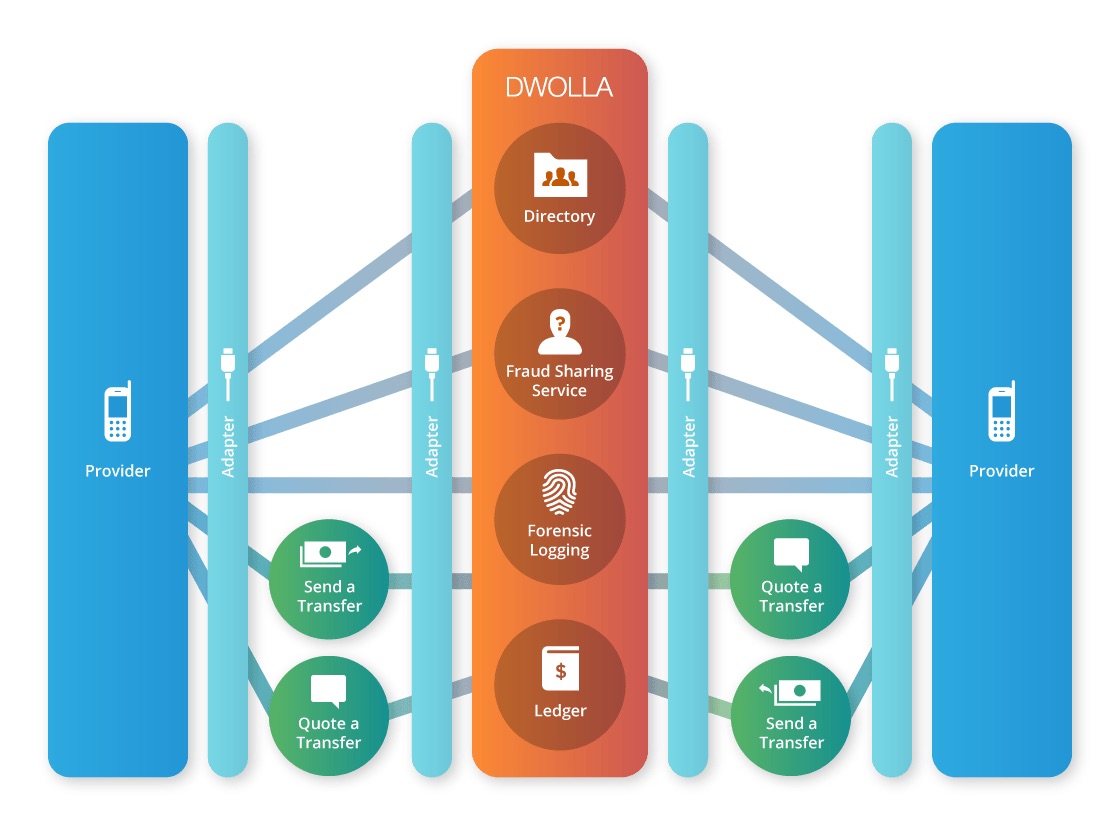

The Bill & Melinda Gates Foundation

The Bill & Melinda Gates Foundation