Identity Assurance as a Service (IDAaaS) innovator Signicat has won phase two funding from Horizon 2020, the EU framework program for research and innovation. The $2 million grant (€1.6 million) will enable Signicat to continue development of its IDAaaS toolbox for use in Europe, and takes the company’s total funding to $3.9 million.

“A single digital ID market in Europe is vital so that financial service providers can easily offer their services across borders without the customer struggling to assert their identity,” Signicat CEO Gunnar Nordseth said. “Cross-border digital ID creates greater choice and convenience for the customer, and opens up new markets for financial institutions.”

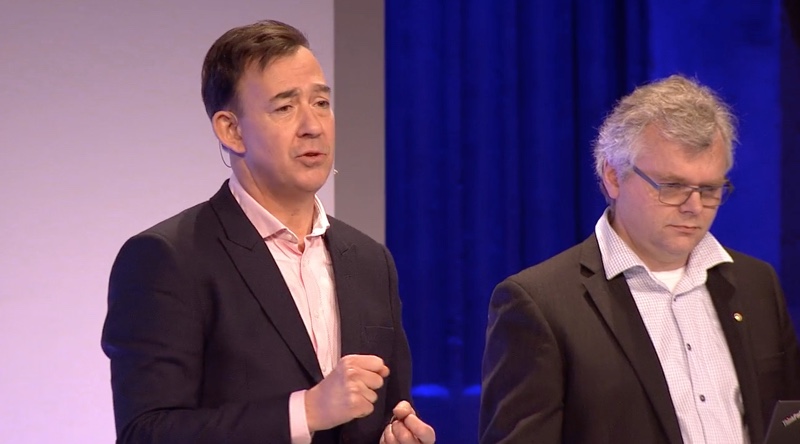

Left to right: Business Development Director Robert Kotlarz and Product Expert Kåre Indrøy demonstrating Signicat Assure and Signicat Sign at FinovateEurope 2017.

The development of a single digital identity market for Europe is a goal for the European Commission by the second half of the decade, Signicat noted in a statement. Signicat’s IDAaaS technology, the first of its kind, will give financial service providers and e-commerce businesses the ability to verify new customer identities using electronic identity (eID) and digital verification of paper ID. IDAaaS also enables them to take advantage of a range of other solutions such as facial recognition.

Signicat secured phase two funds following successful completion of phase one, which was begun and funded by Horizon 2020 at the end of 2016. During phase one, Signicat partnered with Innopay to analyze the demand and potential for digital onboarding solutions in a set of European countries. The study uncovered areas where current European eID protocols were lacking in terms of providing sufficient information for effective digital onboarding, and indicated how Signicat’s IDAaaS technology could fill those gaps.

“While eIDAS is a step in the right direction, it does not yet go far enough,” Nordseth said. “Our vision is to integrate eIDs across Europe, making on-boarding customers simple for financial institutions and their customers, while still meeting KYC regulations.”

Founded in 2007, Signicat demonstrated its Signicat Assure and Signicat Sign identity verification solutions at FinovateEurope 2017. The company, which is based in Trondheim, Norway, earned a spot in the European Fintech 100 last September, and launched its mobile authentication solution, MobileID, last year in May. Also that month, the company partnered with Rabobank to launch a Digital Identity Service Provider (DISP) to provide a variety of online login, identity, and signature solutions. Check out our profile of Signicant from last spring: Signicat Delivers On Demand Digital ID Verification.

AutoGravity’s milestone comes less than six months after the company announced

AutoGravity’s milestone comes less than six months after the company announced

Halfacre (pictured) brings more than 20 years of experience in the investing industry, including five years as Head of Real Estate New Product Development for BlackRock. In addition to serving as Head of Strategic Relations for Cole Capital and Strategic Consultant for GMH Associates, Halfacre was also President and Chief Investment Officer for Campus Crest, a publicly traded student housing REIT. He has a BA in Accounting from College of Santa Fe and earned an MBA in Finance from the Jesse H. Jones Graduate School of Management at Rice University.

Halfacre (pictured) brings more than 20 years of experience in the investing industry, including five years as Head of Real Estate New Product Development for BlackRock. In addition to serving as Head of Strategic Relations for Cole Capital and Strategic Consultant for GMH Associates, Halfacre was also President and Chief Investment Officer for Campus Crest, a publicly traded student housing REIT. He has a BA in Accounting from College of Santa Fe and earned an MBA in Finance from the Jesse H. Jones Graduate School of Management at Rice University.