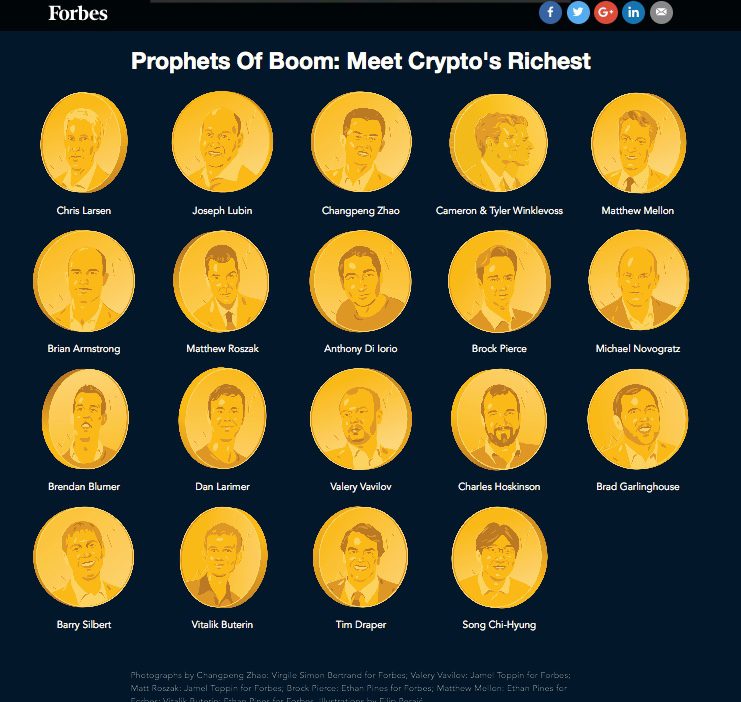

Mirror, mirror, on the wall … Who has reeled in the biggest cryptocurrency haul of them all?

Forbes has published its first – and hopefully not last – list of the richest “secretive freaks, geeks, and visionaries” in the world of cryptocurrencies. And on a list that features widely-known tech luminaries like Cameron and Tyler Winklevoss (“the Winklevoss Twins”), and Tim Draper, Forbes’ roster of cryptocurrency’s richest also features a handful of Finovate alums including Chris Larsen and Brad Garlinghouse (founder and current CEO of Ripple, respectively), as well as Brian Armstrong, CEO of Coinbase.

Not just that, but by Forbes’ estimation, Chris Larsen is the richest person in cryptocurrency, with an estimated crypto net worth between $7.5 billion and $8 billion. Armstrong comes in at between $900 million and $1 billion in crypto net worth, with Garlinghouse’s crypto net worth estimated between $400 million to $500 million.

Introducing their new roster, Forbes noted that they based their rankings using the “estimated holdings of cryptocurrencies, post-tax profits from trading crypto-assets and stakes in crypto-related businesses” as of January 19, 2018. Additionally, in order to qualify for the list, cryptocurrency investors needed to have holdings valued at at least $350 million.

The publication acknowledges that there may be richer crypto investors out there who were inadvertently overlooked. Additionally, Forbes concedes that its estimated valuations of cryptocurrency investments may be “wide of the mark.” But the editors suggest that the list remains valuable for the same reason its list of the Forbes 400 richest Americans first published in 1982 was of value: by “(making) the world a better place by shining a light on the invisible rich.”

See the full list. In addition to the names and estimated cryptocurrency wealth figures, the Forbes feature shared some additional interesting data on the Kings (and they are all men, by the way) of Crypto. They found, for example, that the average age of cryptocurrency’s richest was 15 years younger than the average age of their Forbes 400 wealthiest Americans (42 years old versus 67). The article also noted the average price change in 2017 of the most common cryptocurrencies (more than 14,000% for Bitcoin, Ethereum, and XRP). The piece also included an interesting comparison of daily price volatility of various assets, with gold at the low end of 0.7%, shares of Apple stock at 1.37%, and XRP topping the list at 16.75%. Whee!

Ron van Wezel

Ron van Wezel Kieran Hines

Kieran Hines Michelle Evans

Michelle Evans Oliwia Berdak

Oliwia Berdak