Payment technology company Dynamics announced today it has introduced its battery-powered, interactive debit and cash cards to the Japanese market. The move comes via a partnership with GMO Aozora Net Bank.

The Tokyo-based bank is a technology-focused bank aimed to help clients better manage their money. Offering the Dynamics card, which features a touch keypad and digital display, will further GMO Aozora Net Bank’s technology-first reputation.

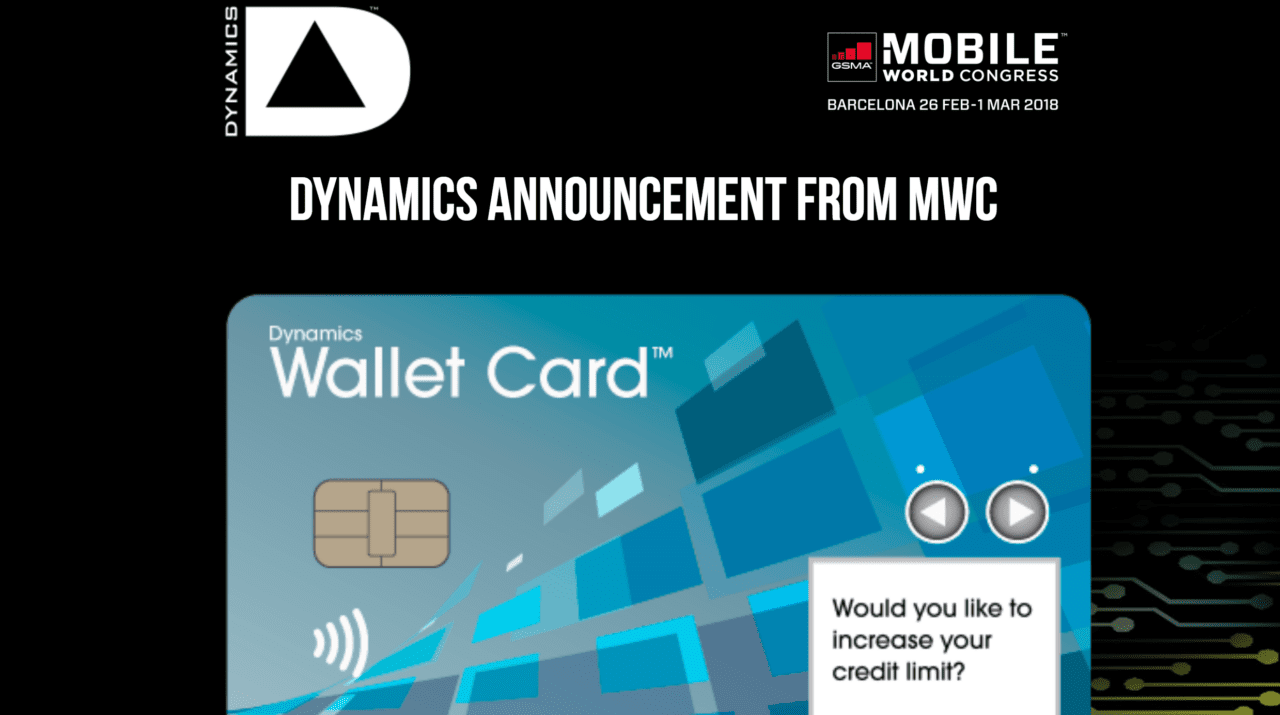

The keypad and digital display work together to secure the card by requiring the user to enter a passcode to activate the card for use. If the passcode is correct, the card number appears in the display screen on the card. Using the keypad, the user selects whether they want the card to act as a debit or cash card. Once it is activated, they can swipe, tap, use the mag stripe, or contact/contactless EMV chip to make a payment at a traditional payment terminal; no special infrastructure is required.

In the press release, Dynamics CEO Jeffrey Mullen said, “Through this new card, we shall provide new convenience and security to the Japanese consumer, and together with GMO Aozora Net Bank we will deliver further value into the future.”

Headquartered in Pennsylvania, Dynamics maintains APAC headquarters in Singapore, LATAM headquarters in Brazil, and EMEA headquarters in New York. The company is partnered with financial institutions in Europe, the U.S., and Asia for card distribution. Dynamics also maintains a processing partnership with a major Canadian financial institution, and a mobile payment partnership with a major mobile handset carrier in Korea.

Dynamics has won Best of Show eight times since its first Finovate appearance in 2010. At its most recent demo at FinovateSpring 2018, the company showed off its Wallet Card, a network-approved payment card that uses Sprint’s wireless network and boasts a 65,000 pixel display that depicts all cardholder information.