A new partnership between real-time electronic payment and banking solutions provider, ACI Worldwide, and behavioral biometrics specialist, BioCatch, will deliver better online and mobile fraud prevention to banking customers. Along with the advanced analytic capabilities of ACI Worldwide’s UP Payments Risk Management, BioCatch’s behavior assessment technology will help institutions better defend themselves and their customers from a growing variety of cyberthreats.

“As online and mobile banking proliferates, fraudsters are consistently finding new ways to infiltrate banks’ systems, creating havoc for consumers and businesses alike,” BioCatch CTO and founder Avi Turgeman said. “By using behavioral data to distinguish between a genuine customer and a fraudster – whether human or non-human – we are able to detect fraudulent activity in real-time and protect consumers.”

ACI Worldwide global director for Payments Intelligence & Risk Solutions Cleber Martins pointed to threats like account takeover, social engineering, and bots as the main obstacles for institutions that are attempting to provide “enriched customer experience(s).” He praised the way BioCatch offers “cost-efficient access to behavioral biometrics” solutions to enable banks to “further promote safety and loyalty through the online relationship with their clients.”

BioCatch demonstrated the Passive Biometrics/Invisible Challenges mechanism of its cognitive behavioral biometrics technology at FinovateFall 2014. The mechanism injects a dynamic, cognitive challenge during the user’s interaction with an app. The challenge is so subtle that the user responds to it without being aware that the challenge has occurred. This response helps define the user’s relationship with the app, providing a unique user profile that reduces vulnerability to a variety of cyber threats.

Founded in 2011 and headquartered in Israel, BioCatch has raised $41.6 million in funding, and includes Blumberg Capital, OurCrowd, and Maverick Ventures Israel among its investors. In October, the company announced that it was partnering with seven, tier-one Latin American banks in Brazil, Chile, Colombia, and Mexico. Earlier this year, BioCatch teamed up with ForgeRock, offering its behavioral biometrics solution as an integrated module to ForgeRock’s platform.

ACI Worldwide powers electronic payments for more than 5,000 institutions globally, including more than 1,000 of the world’s largest financial institutions and service providers. The company participated in our developers conference, FinDEVr Silicon Valley 2016, presenting Simple, Global, and Secure eCommerce Payments with ACI Worldwide’s Next-Generation API. The discussion focused on the technical challenges of payments integration and the value of using an end-to-end solution with integrated real-time fraud prevention.

Founded in 1975 and based in Naples, Florida, ACI Worldwide trades on the NASDAQ under the ticker ACIW, and has a market capitalization of $3 billion.

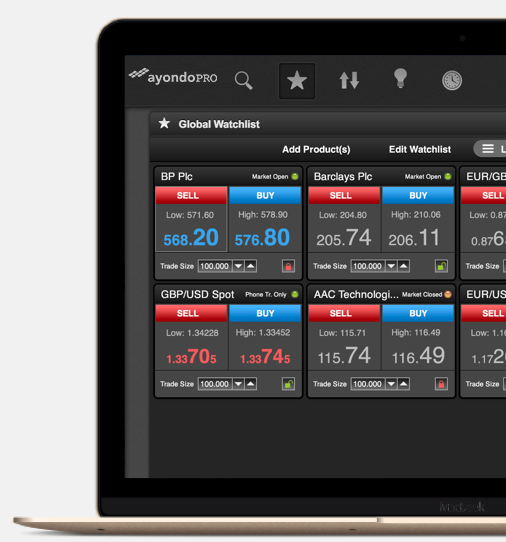

Specifically, ayondoPRO clients will be able to trade more than 2,000 instruments with leverage of up to 200 times. Participants can also join a Spread Rebate Program that gives clients part of the spread they have paid back to their trading account. And professional traders don’t need to sacrifice ayondo’s standard benefits such as negative balance protection and free additional insurance that covers each Financial Services Compensation Scheme (FSCS) eligible customer up to $1.3 million in excess of the FSCS standard.

Specifically, ayondoPRO clients will be able to trade more than 2,000 instruments with leverage of up to 200 times. Participants can also join a Spread Rebate Program that gives clients part of the spread they have paid back to their trading account. And professional traders don’t need to sacrifice ayondo’s standard benefits such as negative balance protection and free additional insurance that covers each Financial Services Compensation Scheme (FSCS) eligible customer up to $1.3 million in excess of the FSCS standard.