The new digital home lending experience from HSBC Bank USA, a division of HSBC Group, will be powered by mortgagetech innovator, Roostify. The new offering is designed to provide borrowers with a mortgage loan transaction journey that has less stress and friction and more ease of use.

HSBC Bank’s solution will provide borrowers with a streamlined application and fulfillment process for both new home buyers and those looking to refinance. Mortgage customers will be able to submit loan requests online and securely share documents digitally. The platform gives borrowers transparency into the entire process, enabling them to track their loan status in real time from application through closing. The technology is integrated into HSBC’s loan origination system to make it easier for lenders and borrowers to communicate and exchange information.

“HSBC has been a great partner in driving innovation to improve their customer experience,” Roostify co-founder and CEO Rajesh Bhat said. “Information exchange is a vital part of the home buying experience, and it can be a game-changer when done right. This solution provides HSBC’s customers with a modern, improved way of applying for and closing a mortgage, and delivers transparency to both the customer and lending team from start to finish, for an optimal experience.”

Head of Mortgage, Retail Banking and Wealth Management for HSBC Bank Raman Muralidharan underscored the role of digital in helping the firm pursue what he called “customer experience-led growth.” He pointed out that mortgage customer increasingly want a lending experience that mirrors the other digitally-oriented financial experiences in their lives. Muralidharan credited Roostify for delivering a solution that “provides a superior experience to our customers and to our mortgage consultants.”

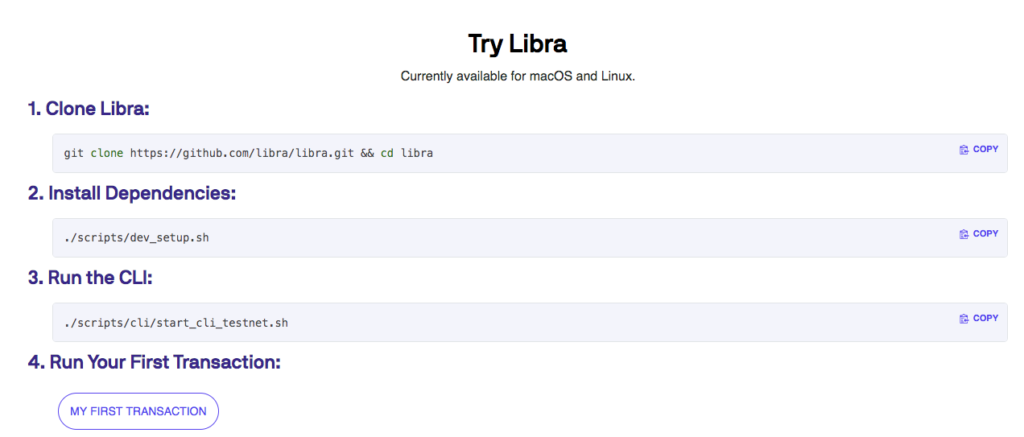

Roostify demonstrated its digital lending platform at FinovateSpring 2018. The company began the year teaming up with Glacier Bancorp, a $11.9 billion regional bank serving customers in the Mountain West and Pacific Northwest. This spring, Roostify partnered with mortgagetech solutions provider Mortech, combing its platform with Mortech’s product and pricing engine (PPE). Last month, the company announced that it had completed its integration with e-document signature and print fulfillment company, Docutech.

Founded in 2012, Roostify has raised $33 million in funding from investors including Cota Capital and USAA. We featured the San Francisco, California-based company in our Earth Day look at fintechs whose technology helps support a greener environment.