At FinovateFall last week, Citizens Bank of Edmonds CEO Jill Castilla described how she is leading her bank through the pandemic. In her 16-minute address, she described how her bank navigated the decision making process and leveraged fintech relationships to help their small business customers survive COVID lockdown.

Citizens Bank of Edmonds was founded in 1901, has $400 million in assets, and 55 employees. The bank aims to serve everybody and has a goal to be the best at everything. And while that sounds like a lofty goal, the bank has proven that it is up to the task by implementing unique solutions that come alongside customers to meet their needs.

So what does it take to be such a successful bank in both the eyes of competitors and customers? Here are three takeaways from Castilla’s keynote that are worth considering.

Communication is foundational

By today’s standards, Castilla is very liberal about offering up her contact information. During the pandemic, she was quick to share her cell phone number; she even tweeted it out multiple times! Providing this open line of communication to both staff and customers was key to ensure that nobody fell through the cracks. Castilla even concluded her keynote by sharing her phone number, saying, “You’re welcome to text me any time.”

But it doesn’t end there. When the pandemic hit, Castilla made sure to contact all of Citizens Bank of Edmonds’ business customers to determine their main areas of stress. And when the bank had to close its lobby, it sent employees to meet customers at the curb to schedule time slots to serve its customers and maintain the personal touch.

Look forward

Castilla watched Frozen II during lockdown and the quote, “All one can do is the next right thing” caught on. In trying to make decisions for the bank, Castilla and her team would consider “the next right thing.” In other words, they would think about what the best decision would be for the future, and not for the present moment.

Castilla offered the example of using the mantra to determine if Citizens Bank of Edmonds should host its annual block party at a time when COVID was just getting started. Thinking about the next right thing made it easy for the bank to call off the party.

And while a block party may seem trivial, consider this mantra implemented for a larger, more strategic decision making. Questions such as, “should we make an investment in AI technology?” or, “should we partner with this up-and-coming fintech?” are a bit easier to answer when filtered through the lens of the next right thing.

Focus on the needs of clients

This takeaway ties back into the first two points, because if financial institutions maintain a foundation of communication while focusing on the next right thing, they will ultimately be doing what is best for their clients.

“Doing the right thing will help you find your people,” Castilla said during her keynote, “And talking about what’s important to you out on social media and the digital space will help you connect with people.” She also noted that both banks and fintechs are trying to do what is best during this challenging time, adding, “Collectively and individually, while working together and on our own, we’re going to change the world for [consumers and small businesses], we’re going to provide greater access to credit, we’re going to have a better understanding of what their financials are, (and) we’re going to help them run more successful businesses.”

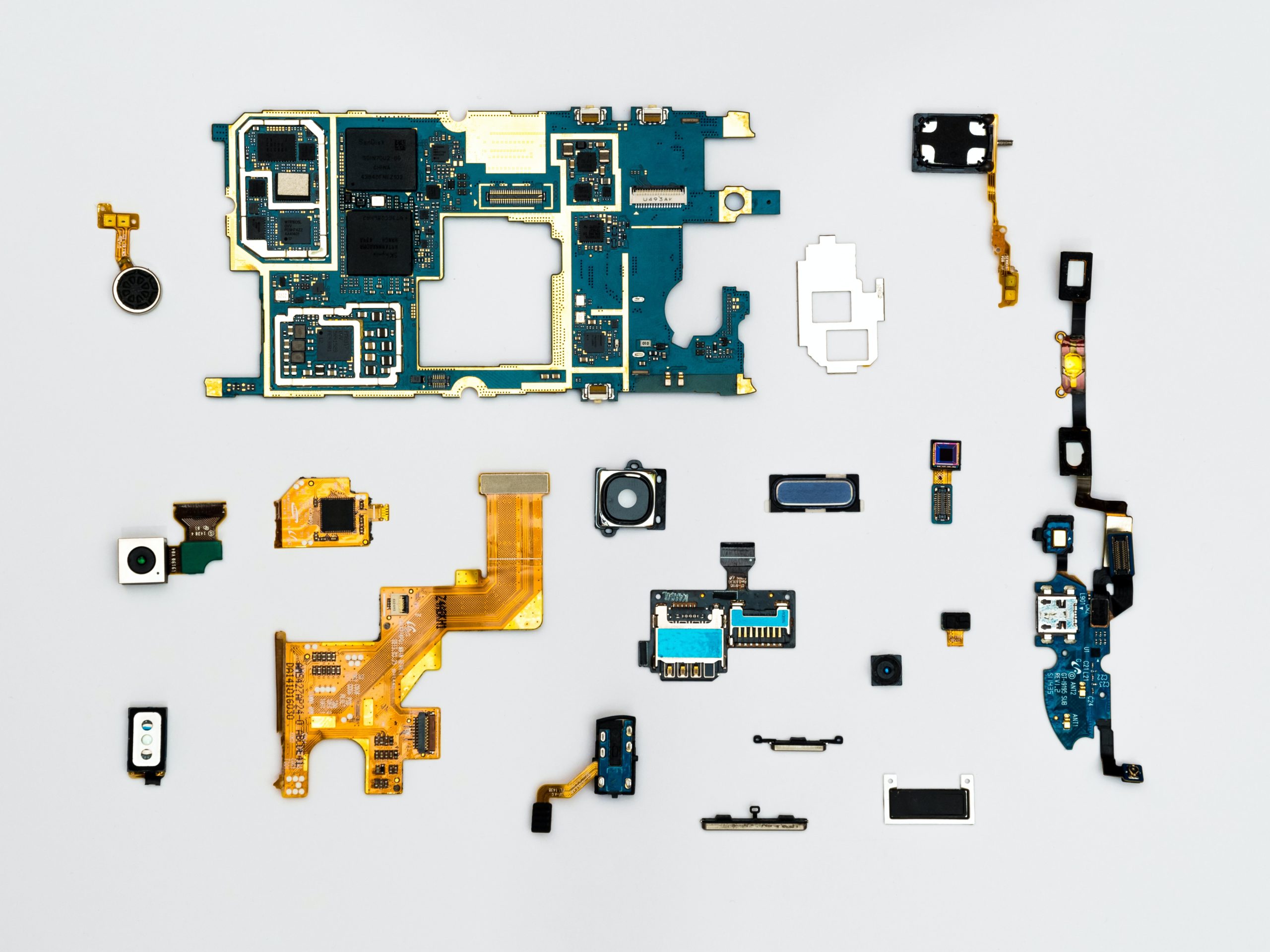

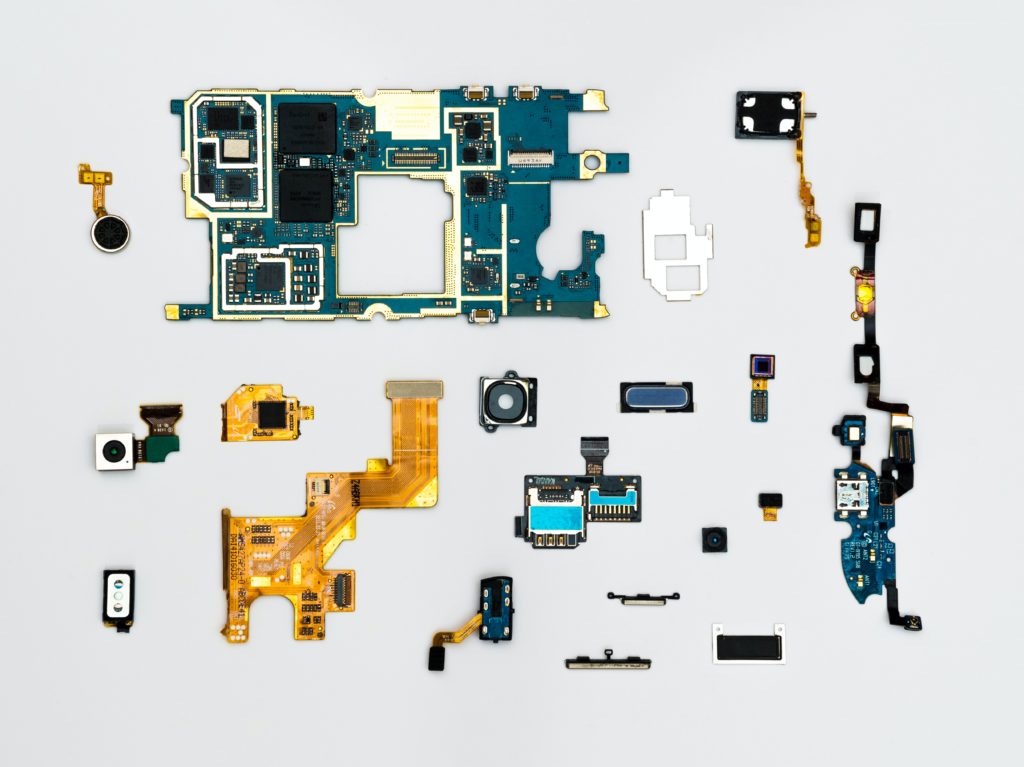

Photo by Adi Goldstein on Unsplash