- Plaid released updates to its digital identity verification tool it launched last fall.

- The update taps into the scale of the Plaid network to offer faster identity verification and a deeper risk insights.

- Plaid’s overhaul also expands the types of identity documents it accepts, adds front-end support for more languages, provides a fake ID risk score, and improves the document capture experience.

Financial infrastructure fintech Plaid is updating a feature it launched last year that tackles one of the most pressing topics in fintech– digital identity.

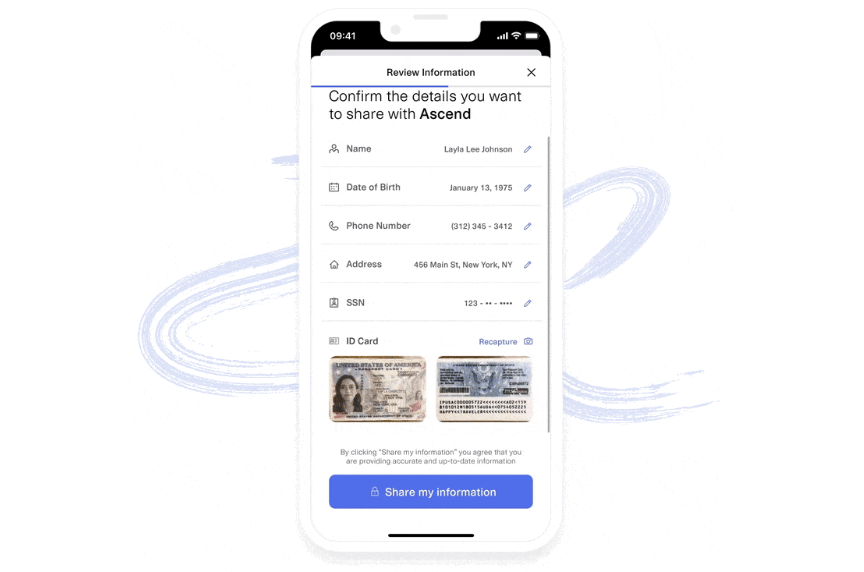

At launch, Plaid’s identity verification tool offered consumers a one-click identity verification product that standardized a “verify once, verify everywhere” approach. As a result, users could authenticate themselves faster and with less friction, and organizations could remain KYC compliant.

And on the business side, these efficiencies are paying off. Companies using Plaid’s identity verification are reporting an average of 50% improvement of identity verification success rates.

Today’s update makes a handful of improvements on the current offering.

First, the upgrade enables Plaid Identity Verification customers to benefit from the scale of Plaid’s network. By leveraging its network, Plaid is able to offer faster verification experiences for end users while providing the organization with a more complete view of a user’s risk via their identity, financial account, and transactions.

“Now, when a user verifies their identity and links their accounts with Plaid, we detect if your customer is linking a bank account that belongs to them,” the company explained in a blog post. “We match onboarding data from identity verification with the financial institution information on file for an added layer of security.”

Next, Plaid has added a new score that indicates the likelihood that an identity has been stolen, fabricated, or manipulated. The company has also expanded the ID document types it accepts to include green cards and temporary ID cards like B1/B2 visas, and now supports front-end support for more languages including Spanish, Portuguese, Japanese, and French. In addition, Plaid has improved its document capture experience to increase conversion by guiding the user’s capture window, optimizing image file sizes, and supporting more devices.

Plaid’s identity verification service is crucial for financial services firms and third-party providers. While these entities excel in their respective subsectors, they may lack a seamless identity verification solution. However, such a solution is essential not only for creating a pleasant user experience but also for meeting regulatory KYC requirements. Plaid’s service acts as a lifeline, bridging this gap and providing the necessary identity verification capabilities.

With $734 million in funding, Plaid helps 12,000+ financial institutions offer their customers access to its network of 7,000 third party financial services via a suite of APIs that connects consumers, financial institutions, and developers. The company also offers a suite of analytics products that provides further insights into transactions. Plaid was founded in 2013 and is headquartered in San Francisco, California.