Here is the first set of companies we spoke with. Stay tuned next week for more behind-the-scenes insight:

What they do

AdviceGames provides a solution to help banks, insurers, and independent financial advisors to be a virtual “guardian angel” of their customers’ finances. This includes everything from tailored advice such as when they should switch car insurance to advising them on mortgage decisions. In addition, it is dynamic, so it adjusts advice provided when a users’ circumstances change.

AdviceGames is currently focused on selling to larger banks in the European market, and has plans to expand to the U.S. in the future.

Stats

- Offices in Amsterdam, London, and San Francisco

- Created with funds from the sale of eyeOpen to Ageon/Transamerica

The experience

Because the financial guardian angel provides a tailored, personal touch for each customer, users benefit from the customized approach. They are also provided the convenience of an anytime, anywhere tool, since they can manage their account from the comfort of their own home, or even on-the-go.

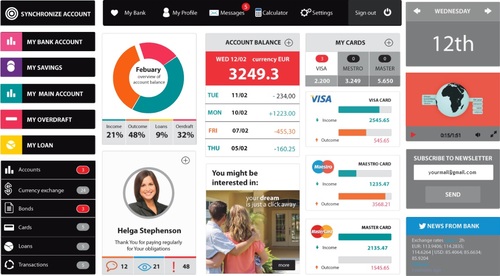

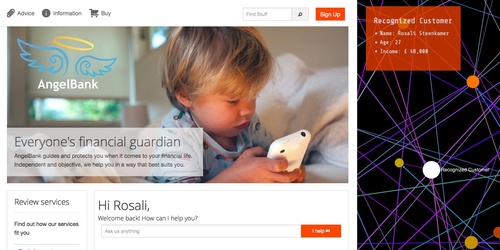

Below is a sample of a users’ homepage for AngelBank. Note the personalized greeting located at the middle of the page.

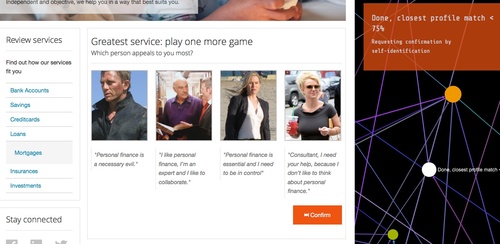

If a user is interested in a particular service, such as a mortgage, AdviceGames will walk them through the decision-making process to bring them the best product. In the below picture, the user is asked to identify which one of the four views matches how they feel about personal finance.

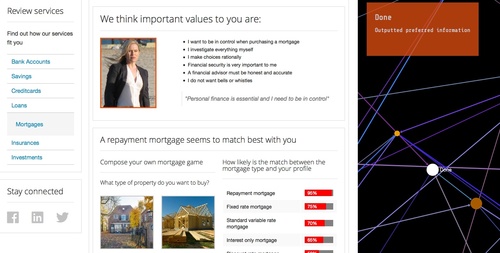

After the user answers the self-guided questions, they are provided with a recommendation. The below screenshot shows the users’ personal preference results, followed by a mortgage recommendation.

Benefits for the financial institution

By providing customers with this service, financial institutions also benefit. It enables them to reduce the number of branches and cut down on staff at existing branches. In fact, the company is currently in talks with a bank that needs to reduce its costs by $1 billion over the next year, and sees Advice Games as one of the tools for reaching that goal. By replacing their banks with intelligent agents, the business case is clear. Additionally, it can help banks decrease their risk profile by applying motivational models.

What they do

Nous has created a game called Spark Profit that runs on iOS and Android apps. The free game enables any user to make predictions in real-time about stock market behavior.

Users gain or lose points depending on the accuracy of their predictions. The incentives in the game are real. By making a correct prediction, users can earn real money. In fact, since May of last year, the 851 users have collectively earned almost $17,500.

Stats

- Self-funded

- Pre-revenue

- 5 full time employees

- Just under 20,000 users

- Plans to add more than 5 major stock indices before the end of March.

The experience

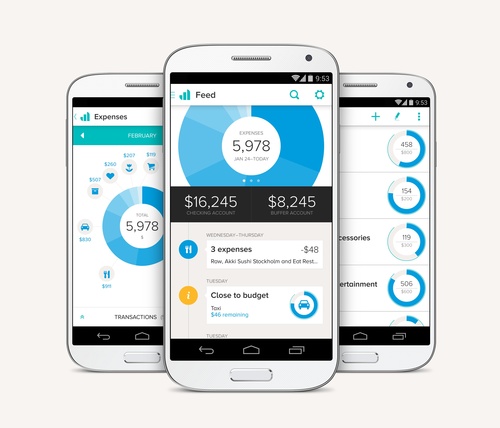

We were able to get our hands on the app, since it’s now available to the general public. The screenshots below were taken on an iPhone 5S in landscape mode.

Below is the home screen where users can opt to play different markets. There is even a bitcoin market.

Users see historical market data, and are prompted to set a profit price and a loss price at any point in the future. If the actual market price touches the users’ profit prediction, then they win. If the actual market price moves away from their prediction and instead touches the loss price, the user loses points.

Here, users can see a summary of the individual games they’ve played and the points earned and lost.

All of these predictions across the entire user base adds up to a massive amount of exclusive data over time. As a secondary use case, Nous is selling this valuable data to financial institutions.

Yseop

What they do

In its newest release, Yseop is using its artificial intelligence engine to support sales teams. Based on information gathered from a potential client, the new technology does everything from pre-drafting emails based on client information, to creating talking points for the sales rep to bring up in a follow-up call.

Stats

- Privately self-funded

- 30 employees

- Largest customer is a retail bank with 12,500 daily users

- Recently opened an office in London

The experience

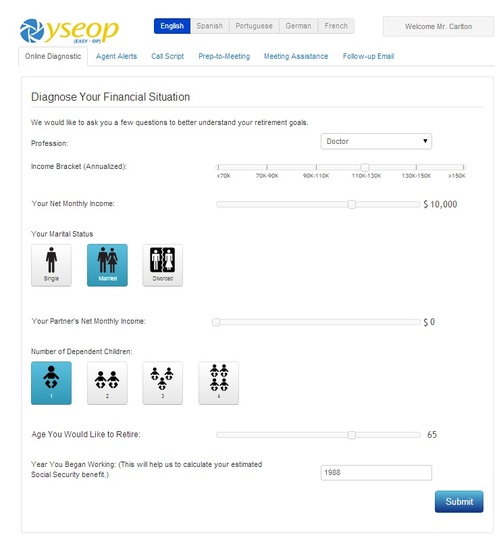

The intelligence software guides the user through a set of questions to determine their potential interest in a bank’s products and services. Below, they provide information regarding their marital status and number of dependents.

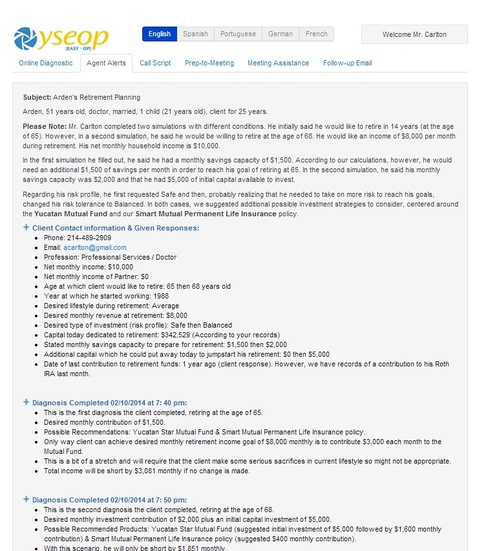

After the client’s information is submitted, the salesperson receives an alert, such as the one below, that informs them of the client’s demographic and financial situation, as well as their contact information for follow-up.

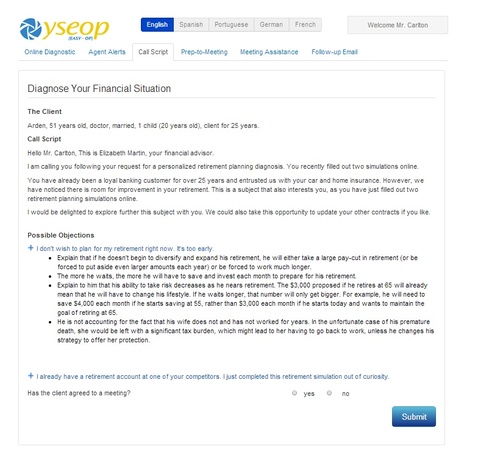

Then, the system provides the salesperson with a call script that includes responses to possible objections that the client may bring up during the call.

The system can also provide the salesperson with a prep-to-meeting report, meeting assistance, and will even draft an email to the client on the salesperson’s behalf (see below).

Keep in mind that banks can use YseMail in selected, individual pieces– they do not need to use all six aspects of the service.

Stay tuned next week for another behind-the-curtain view of FinovateEurope 2014.