The 70+ presenters that will showcase their new tech on stage at FinovateEurope in two weeks are now unveiled. To take a closer look at the presenting companies, we’re continuing our Sneak Peek series. Today, we’re featuring Financial Media Solutions, Fiserv, Intelligent Environments, mBank & i3D, Pirean, and Telenor banka & Asseco SEE.

Don’t miss our other Sneak Peeks, available here:

Don’t miss our other Sneak Peeks, available here:

- Sneak Peek Part 1: ebankIT, Jumio, SOFORT, TradeRiver Finance, Xignite, and Yoyo

- Sneak Peek Part 2: AlphaPoint, Avoka, Encap Security, investUP, Nostrum Group, and StreetShares

- Sneak Peek Part 3: CoinJar, EVRY, FOBISS, Strands, Trunomi, VATBox

- Sneak Peek Part 4: Bendigo and Adelaide Bank, CPB Software AG, Ixaris, JSC Delta Bank, QCR, and Topicus Finance

Financial Media Solutions’ MAPPS simplifies Videographics, making it possible to create financial content in digestible bite size video formats for broadcast to any device, including smartphones.

Features

- Makes Videographics easy

- Empowers institutional users to convey financial concepts in concise video formats

- Rapidly broadcasts dynamic content to any client device, including smartphones

Why it’s great

Communicating client content by video is the future. MAPPS resolves the challenge of how institutions better engage clients in financial concepts, even via their smartphone.

Presenters

Ian Park, Owner Director & CEO

LinkedIn

Christopher Thomas, Marketing Director

LinkedIn

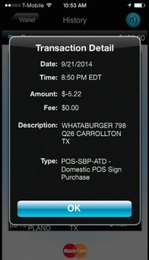

Fiserv is one of FORTUNE magazine’s World’s Most Admired Companies and will demonstrate next generation digital banking interactions.

Features

- Focuses on a truly integrated payments user experience

- Allows customers to manage their spending habits and banking products

- Visually stimulates consumers using augmented reality technology

Why it’s great

This innovation is geared towards the consumer and will allow greater control and transparency over their spending and banking habits.

Presenters

Jonathan Atkinson, Market Development, Digital Channels and Payments

Atkinson is a Sales Executive in Digital Channels and Payments team at Fiserv, Inc., focused on new clients across EMEA, with previous experience in core banking and CRM.

LinkedIn

David Abbott, Payments Lead, EMEA

Abbot has 25 years’ sales, business development experience in payments & eCommerce joined Fiserv’s payments business to support development activities in the EMEA region.

LinkedIn

Intelligent Environments is an innovative provider of mobile and online solutions for financial service organisations.

Features

Hopes to fight against cybercrime

Why it’s great

No firm is an island – we all have a shared interest in responding to the growing threat against cybercrime.

No firm is an island – we all have a shared interest in responding to the growing threat against cybercrime.

Presenter

Clayton Locke, CTO

Clayton Locke is a keen sailor. He is hoping for calm waters come Finovate!

LinkedIn

mBank, financial sector innovator & i3D, world-class provider of high-tech virtual reality solutions, developed an ultra-modern interactive digital bank branch.

Features

- Digital wall with unlimited touch points and innovative UI/UX

- Proximity-motion-sensing and face recognition technologies for dynamic content adjustment

- Integration with sales support systems

Why it’s great

mBank & i3D dare to challenge the traditional notion of physical bank branches with ultra-modern multi-touch screens, motion-sensing and face recognition technologies.

mBank & i3D dare to challenge the traditional notion of physical bank branches with ultra-modern multi-touch screens, motion-sensing and face recognition technologies.

Presenters

Jacek Iljin, Managing Director Sales & Processes, mBank

LinkedIn

Marcin Wiśniewski, Sales & Marketing Director, i3D

LinkedIn

Pirean enables organisations to provide secure, people-focused access for employees, customers, and partners across on-premise and cloud-based applications.

Features

- Reduces lead-time to value for application access

- Provides secure self-service capabilities for users

- Introduces a single point of control and audit for all access management

Why it’s great

Pirean’s Access: One is an Identity and Access Management solution designed to provide a first class user experience anytime, anywhere.

Presenters

Rob Macgregor, Pirean’s Principal Consultant and Access: One’s Product Manager

Rob Blowers, Pirean’s Development Team Lead

With Telenor banka & Asseco South Eastern Europe, banking goes mobile – changing customer experience and reshaping banking products & services to fit mobile, brought by Telenor banka in synergy with Telco, powered by Asseco SEE multichannel solutions.

Features

- Big data processing enabling relevant offer at relevant moment and place

- Superb customer journey supported by straight-through processing and full automation

- Utilization of synergy

Why it’s great

IT is a fully automated and personalized online handset loan enabled by Telenor banka and Telenor, powered by Asseco SEE.

Presenters

Martin Navratil, Chairman of the Executive Committee at Telenor banka

Managing Director of Telenor banka responsible for the design and implementation of the bank’s strategy, having great experience in Telco and Finance sector.

LinkedIn

Piotr Jeleński, Group President of the Management Board of Asseco SEE

Executive manager with experience in running and establishing new business in Poland, SEE region and Turkey. Managing international structure with over 1,400 people in 12 countries.

Marko Carevic, Marketing Director at Telenor Banka

Started his career in Telenor, initiated Telenor M&A initiative in financial services, currently responsible for entire customer value chain and go-to-market process.

LinkedIn

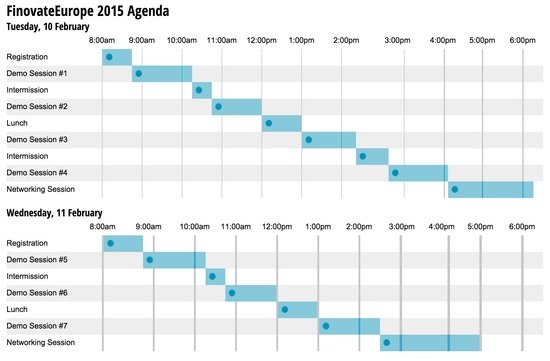

We’ll feature six more companies later this week. To see them all demo live, get your ticket to FinovateEurope 2015.