This post is part of our live coverage of FinovateSpring 2015.

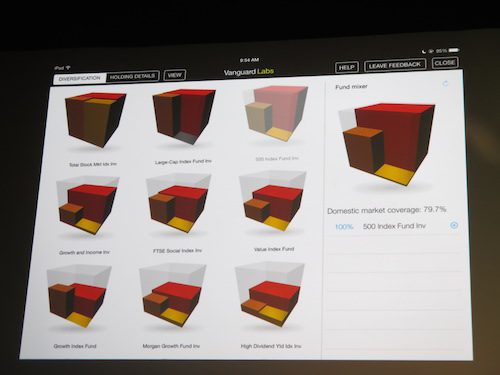

Trizic debuted its Accelerator that delivers investment advice:

Trizic debuted its Accelerator that delivers investment advice:

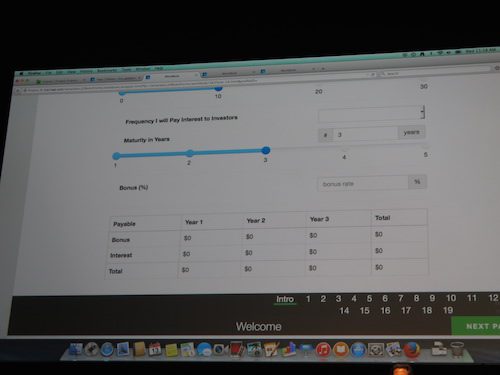

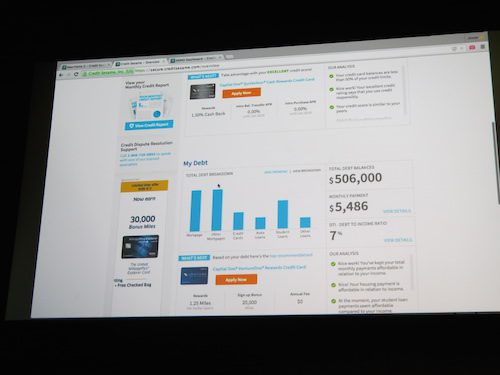

Trizic Accelerator is an elegant, cloud-based digital investment advisory platform. It comprises two elements: a beautifully simple, customized online experience for investors, and a powerful, back-end console that automates portfolio management, securities trading, rebalancing, compliance reporting, and client billing.

Using Accelerator’s sophisticated technology, financial firms will be able to serve clients across all mobile devices, in a more scalable and productive way by augmenting, not replacing, their high-touch, full-service business models.

At left: Brad Matthews, Trizic CEO and founder

Product Launch: October 2014

Metrics: 15+ employees, 30 financial firm clients, and a pipeline of prospective users

Product distribution strategy: Business-to-Business (B2B), through financial institutions

HQ: San Francisco, California

Founded: October 2012

Website: trizic.com

Twitter: @TrizicCo