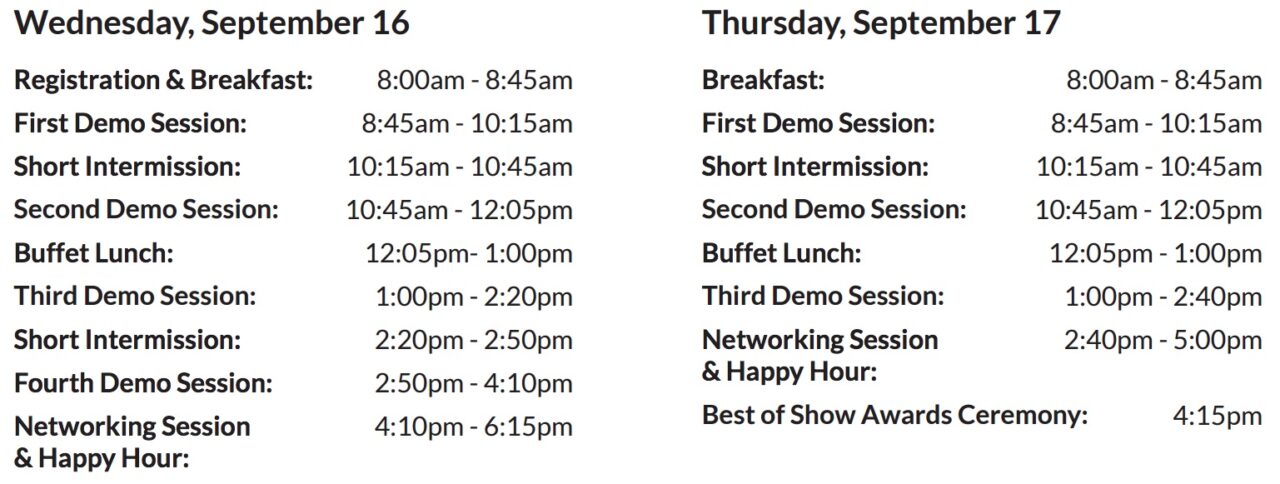

The Sneak Peek series looks at the innovators demoing live onstage in front of 1,500 execs at FinovateFall. Get your tickets today and we’ll see you in New York, 16/17 September!

InforcePRO will show a post-sale life insurance policyholder platform which enables one-click policy reviews by highlighting issues and opportunities in real time.

will show a post-sale life insurance policyholder platform which enables one-click policy reviews by highlighting issues and opportunities in real time.

Features:

- One-click policy reviews with conversion options, UL funding tracking, etc. on life insurance Inforce book

- No manual effort in data acquisition

- Orphan policyholders engagement

Why it’s great

Post-sale life insurance policyholder engagement simplified through automated in-force policy annual reviews.

Presenters

Presenters

Karan Kanodia, Co-Founder

Kanodia is co-founder of InforcePro and is responsible for the overall strategic direction as well as designing the product architecture and leading InforcePro’s development teams.

LinkedIn

Cameron Jacox, Co-founder

Cameron Jacox, Co-founder

Jacox is responsible for sales and marketing management, working to achieve profitability for clients such as ScotiaBank, Desjardins, and Financial Horizons.

LinkedIn

Presenter

Presenter

Additiv

Additiv Presenter

Presenter

Presenter

Presenter

Why it’s great

Why it’s great Kate Miroslaw, Key Account Manager

Kate Miroslaw, Key Account Manager