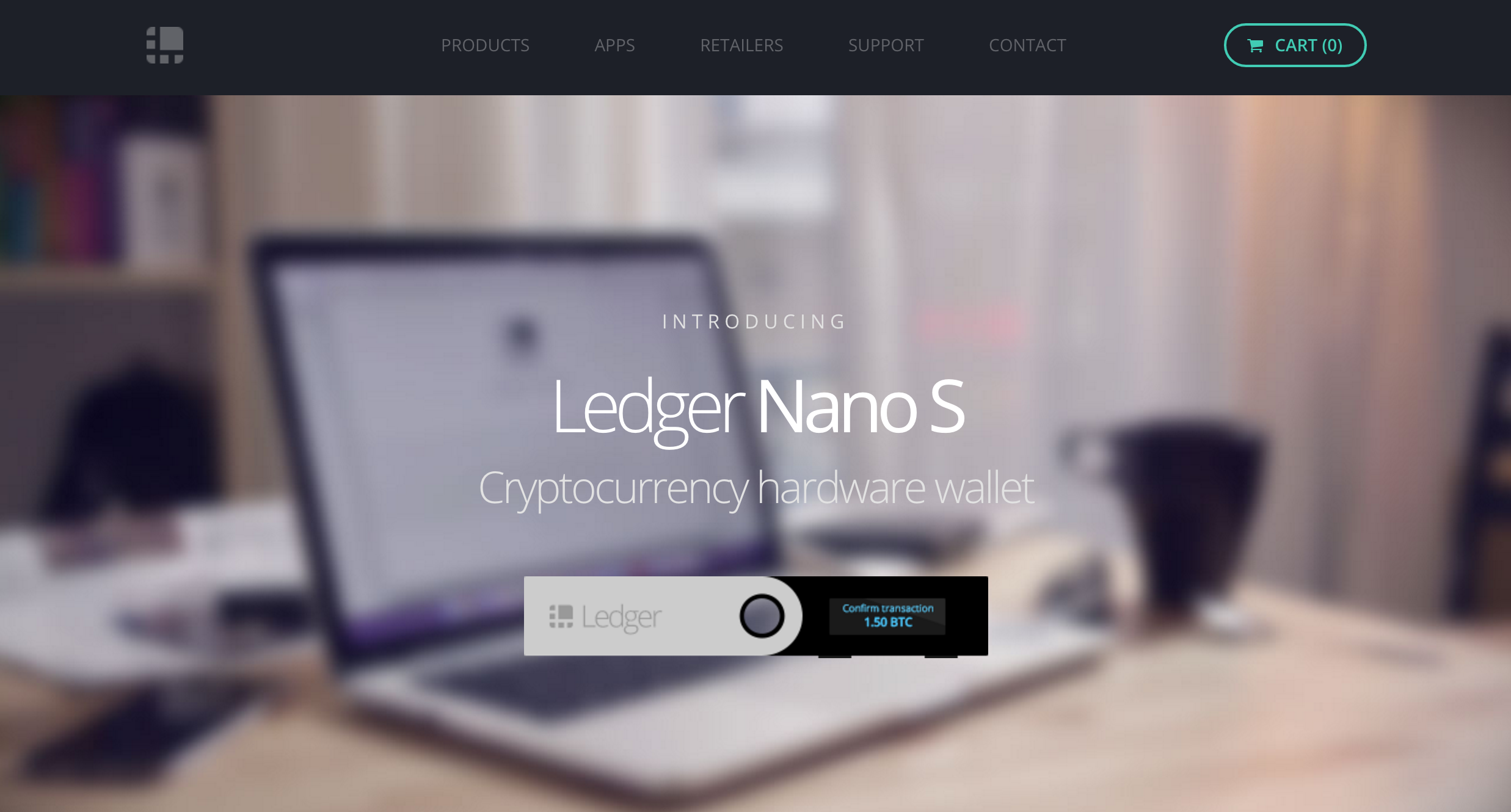

Blockchain hardware-solutions company Ledger announced a new hardware wallet today. A successor to the HW.1 and Unplugged wallets, Ledger’s Nano S differentiates itself by offering a built-in OLED display and by adding protection for Ethereum fund transfers.

The Paris-based company created the Nano S after spending 18 months improving the Nano, Ledger’s best-selling product. It connects to any computer through USB—allowing users to send and receive payments, check their accounts, manage multiple addresses—and even supports the FIDO Universal Second Factor standard.

The built-in OLED display on the Nano S allows the user to double-check and confirm each transaction by tapping the buttons on the device. While the Nano S includes built-in apps for both Bitcoin and Ethereum, it also supports other blockchain-based currencies.

The built-in OLED display on the Nano S allows the user to double-check and confirm each transaction by tapping the buttons on the device. While the Nano S includes built-in apps for both Bitcoin and Ethereum, it also supports other blockchain-based currencies.

Priced at 58€ ($66), the Nano S comes with a set of Chrome applications to help users manage their wallets. It is available for pre-order today and will be shipping at the end of July.

At FinovateEurope 2016 Ledger CEO Eric Larchevêque debuted Ledger Blue, a touch-screen smartcard for developers. Ledger Blue offers a second display that connects to devices via BLE, NFC, or USB and thwarts malware attacks by delivering the correct payment address.

Online wealth-management platform

Online wealth-management platform

Predictive marketing platform

Predictive marketing platform

Our

Our

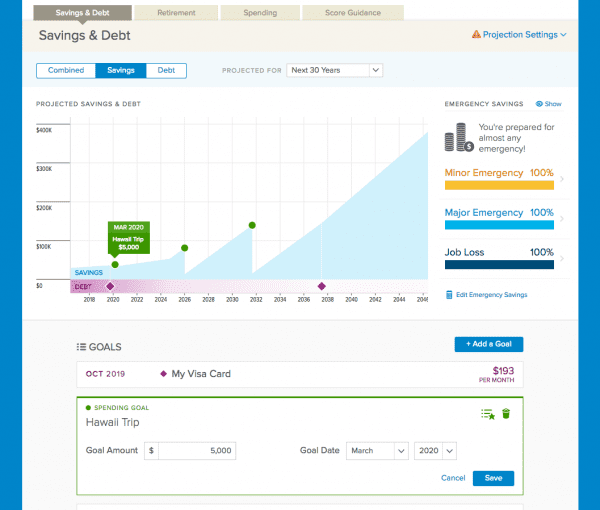

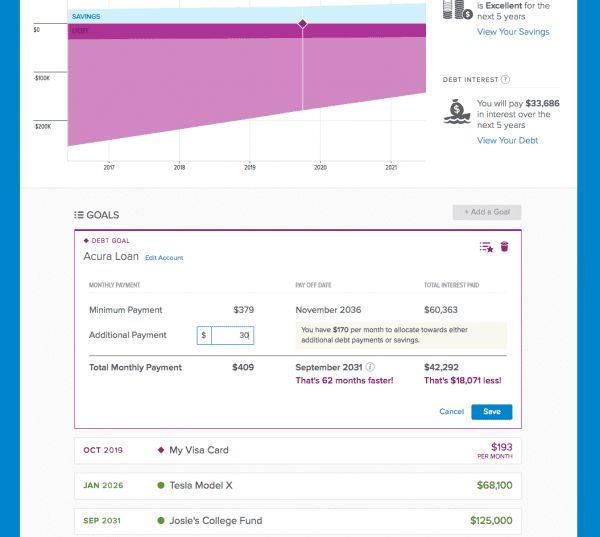

Matt Fellowes, chief innovation officer of Morningstar and the founder of HelloWallet; Andrew Vincent, senior product manager; and Gabe Gorelick-Feldman, software engineer, showcased Retirement Explorer, which won Best of Show at FinovateFall 2015.

Matt Fellowes, chief innovation officer of Morningstar and the founder of HelloWallet; Andrew Vincent, senior product manager; and Gabe Gorelick-Feldman, software engineer, showcased Retirement Explorer, which won Best of Show at FinovateFall 2015.