In what The New York Times is calling The Great AI Awakening and Forbes has dubbed The Year of AI, 2017 is shaping up to be obsessively focused on artificial intelligence, a field that has been around for awhile (remember playing checkers against a computer?) but has finally matured to the point of usefulness.

Because the technology has finally reached its tipping point, AI, and its close relative machine learning, have taken a variety of industries by storm, bringing self-driving Ubers to the streets of San Francisco (and then carting them away); robotic vacuum cleaners to dirty household floors; and natural language processing to chat bots and IVR communications. With AI already embedded into these industries, it’s easy to find examples of how the technology is shaping fintech.

Below are eight areas of fintech into which AI has made inroads. Each area is ranked and rated (out of 5 stars) based on how it is currently influenced by AI and based on AI’s potential to add value.

Robo advisory

- Fintech example: Robo advisors are built on AI technology, which is used to augment portfolio management and rebalancing decisions typically made by a (sometimes biased) human. To see tens of dozens of these examples, check out our post on B2C wealth tech.

- Current AI application: 4 stars

- Potential AI application: 5 stars

AI is already a standard tool in robo advisory. Because the very nature of robo advisors is to replace humans, the potential application of AI in this space is huge, especially when enhanced with machine learning and held accountable using blockchain.

Advisory tools

- Fintech example: Similar to B2C robo advisory platforms that leverage AI to automatically manage and rebalance users’ portfolios, advisors can automate their clients’ portfolios to minimize human error while still offering a personal touch. Kensho (FEU14) introduced Warren to helps advisors perform quantitative analyses on market data. ForwardLane (FS16) uses AI powered by IBM Watson to offer financial advisors access to quantitative modeling and highly personalized investment advice generally only available to ultra high net worth individuals.

- Current AI application: 4 stars

- Potential AI application: 5 stars

Just as AI is already standard in direct-to-consumer robo advisory, so is it with advisory tools, since many were built on the premise of AI.

Fraud detection

- Fintech example: Multiple card issuers use AI to detect unusual spending activity. Feedzai (FEU14) uses AI combined with machine learning to analyze sets of big data created during a user’s online sessions to mitigate fraud associated with online account opening, payments, and ecommerce.

- Current AI application: 4 stars

- Potential AI application: 5 stars

AI is already heavily leveraged for use in fraud detection. Combining it with the blockchain, which can provide an un-editable ledger of events, paired with AI’s ability to analyze large data sets in real time makes it even more powerful.

Underwriting

- Fintech example: AI can help underwriters create a uniform metric that accurately identifies risk across borrowers. Aire.io (FEU15) leverages the power of AI to create and assign credit scores to thin credit file individuals.

- Current AI application: 4 stars

- Potential AI application: 5 stars

The lending industry has already transformed its underwriting practices from relying on large databases to now using AI to analyze large amounts of scattered, unstructured data. Because AI can analyze these data sets in real time, there’s great potential for both borrowers and lenders to benefit.

Regulatory compliance

- Fintech example: Banks can use AI to quickly scan legal and regulatory text for compliance issues, and do so at scale. IpSoft’s Amelia is a customer service bot that helps banks maintain compliance in conversations with customers.

- Current AI application: 3

- Potential AI application: 5

Relying on AI to scan for compliance issues instead of a team of employees helps avoid human error and allows financial institutions to quickly analyze multiple documents and practices. Because it removes human biases and error, AI has great potential in regulatory compliance.

Marketing

- Fintech example: Marketers can better up-sell or cross-sell banking and finance products by using AI to identify and anticipate client needs. SBDA Group (FEU 16) helps banks leverage their data using algorithms and machine learning to create targeted marketing campaigns for individual customers.

- Current AI application: 3 stars

- Potential AI application: 4 stars

Fintech companies have been using AI to draw conclusions from bank data for a few years now, but marketing is an area in which human input still adds a lot of value.

Customer service

- Fintech example: Firms can leverage AI to identify which clients are at most risk of leaving a bank or advisor. FinovateAsia 2016 Best of Show-winner, Finn.ai (FA16), offers a white-labeled chat bot that integrates into existing messaging platforms such as Line, Facebook Messenger, Alexa, and even the bank’s web chat interface.

- Current AI application: 2 stars

- Potential AI application: 5 stars

Banks have been hesitant to adopt chat bots and other AI-based customer service products because the technologies are not quite smart enough. Finn.ai overcomes this challenge by offering a Talk to a Human button at the bottom of the chat interface. This technique, combined with the implementation of machine learning and advanced natural language recognition, makes this space prime for growth in 2017.

Reporting tools

- Fintech example: Advancements in natural language, along with AI’s ability to analyze large data sets, have made it possible for banks to rely on software to automatically create and distribute reports. Narrative Science (FF13), for example, automates the creation of anti-money laundering reports and allows the bank to adjust for the tone of the writing.

- Current AI application: 2

- Potential AI application: 4

We’ve seen AI used to generate reports, both in written and video form, in the wealth management and compliance sectors. However, there is still room for natural language reporting to extend to other forms (such as inside of a chat interface) as well as to other sectors of fintech.

In addition to these eight areas of fintech, there is a miscellaneous category that comprises technology such as ColletAI, which automates debt collection. Check out CollectAI, Comarch, and MoneyHub, along with other AI-based fintech at FinovateEurope next month.

While AI is widespread in many areas of fintech, it is still far from others, such as tax and estate planning, which require complex inputs and decision making. However, bolstering AI in these difficult areas using machine learning, the blockchain, and human intervention offers some potential for growth in 2017.

Since AI is pervasive throughout many sectors of fintech, it may not be too early for your company to begin searching for a Chief Artificial Intelligence Officer.

Nathan Snell, Co-founder and SVP Product Development

Nathan Snell, Co-founder and SVP Product Development

The name

The name  From left: Steve Polsky, CEO, founder, and Jason Robinson, VP product, demo at FinovateFall 2016

From left: Steve Polsky, CEO, founder, and Jason Robinson, VP product, demo at FinovateFall 2016 We interviewed Steve Polsky, CEO and founder of Juvo, to get more information about the company and its plans for the future.

We interviewed Steve Polsky, CEO and founder of Juvo, to get more information about the company and its plans for the future. Juvo’s gamified balance screen

Juvo’s gamified balance screen

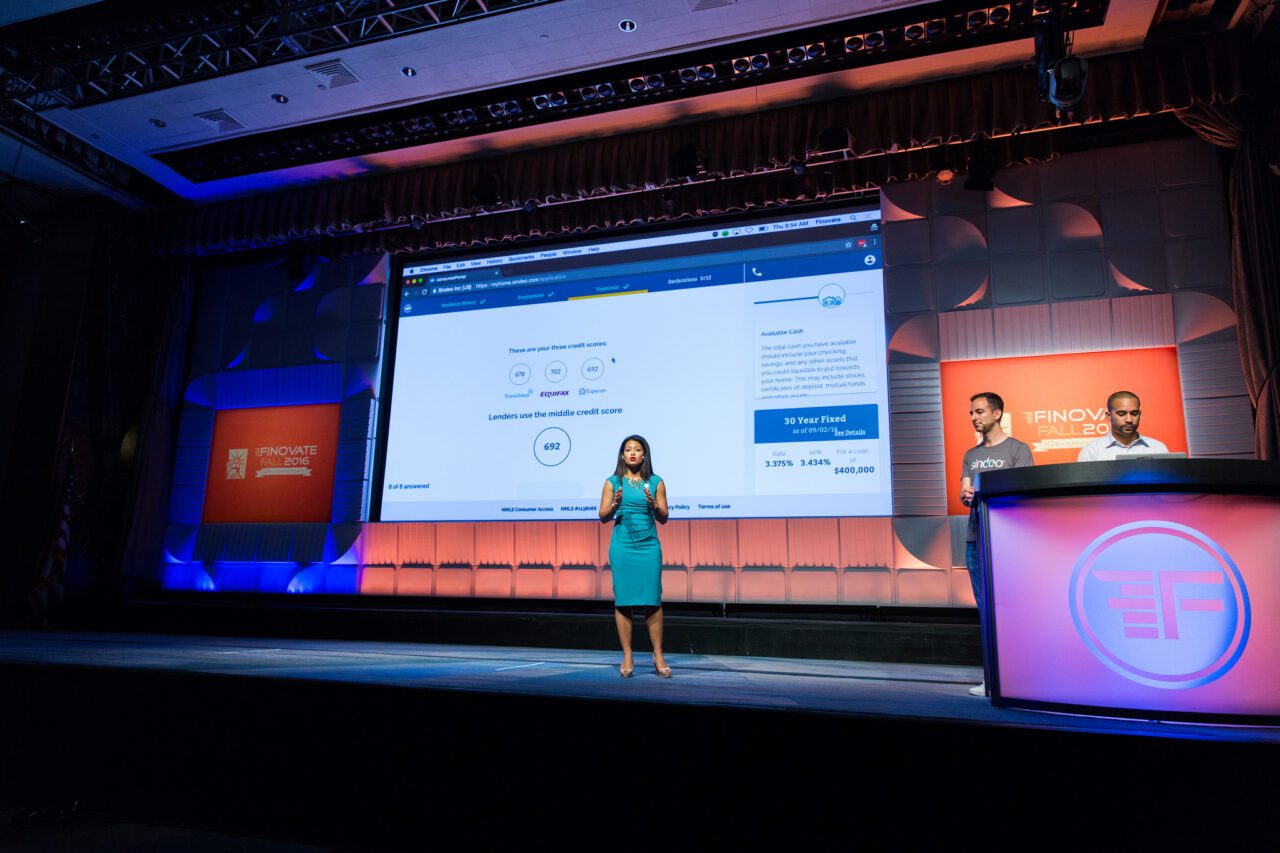

Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder) demo Sindeo at FinovateFall 2016 in New York

Aimeelene Gaspar (SVP, Product) and Ori Zohar (Co-Founder) demo Sindeo at FinovateFall 2016 in New York

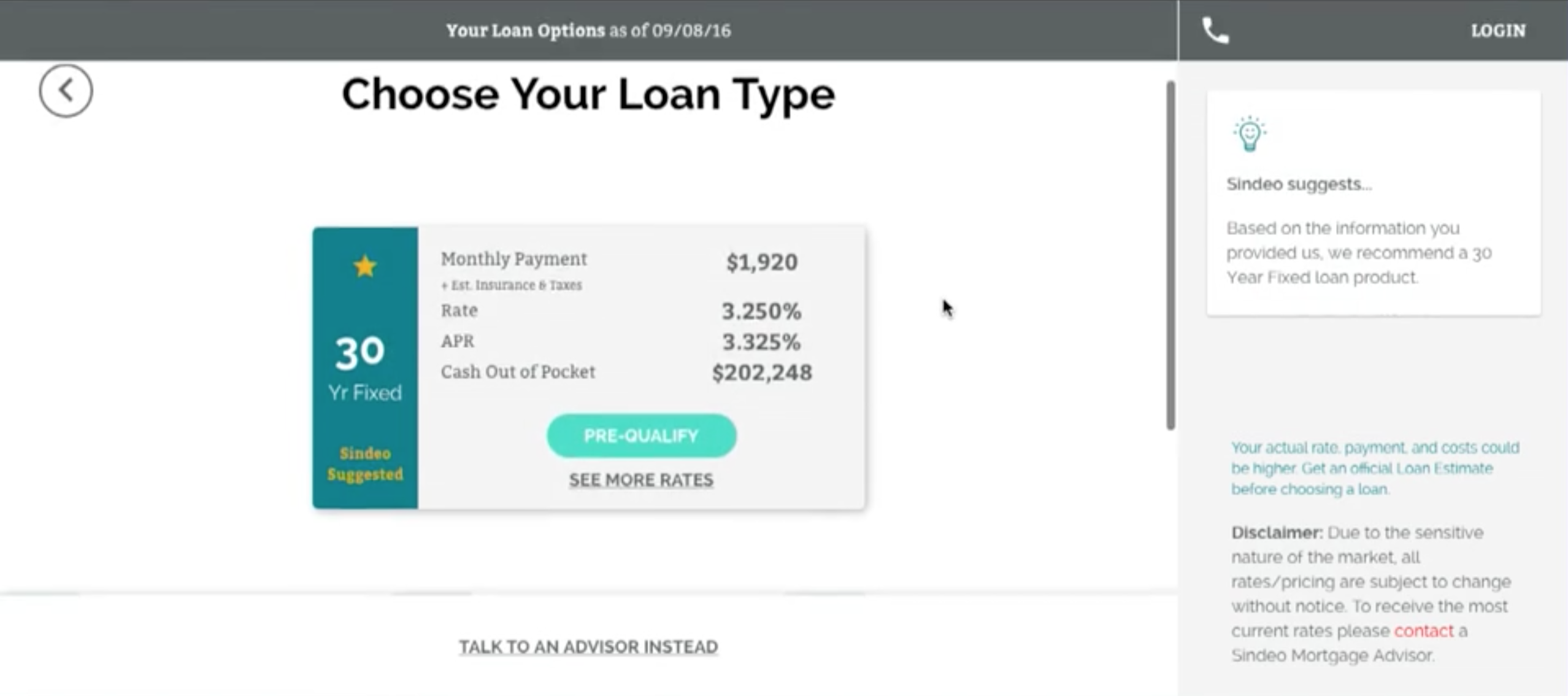

(above) A screenshot from Sindeo’s loan marketplace

(above) A screenshot from Sindeo’s loan marketplace