IoT technologies are on the rise– in fact, Gartner predicts that connected things will reach 20.4 billion by 2020. This flood of new capabilities comes with the need for enhanced security in a field where developers have hacked everything from self-driving cars to wifi-connected Crock Pots.

That’s why IBM announced yesterday that its security arm is launching testing services for the internet of things (IoT). The company’s Watson IoT offers configuration and management capabilities for IoT environments. The company also launched testing services for automotive security.

One of IBM’s designated research teams, the X-Force Red researchers, will deliver the testing service alongside the Watson IoT platform. IBM reports that 58% of companies only test their IoT apps during the production phase, which could possibly introduce vulnerabilities into existing systems. To combat this, the researchers are incorporating an added layer of security and penetration testing.

IBM describes the new cloud-based service as “programmatic, on-demand” testing that will occur “through the entire lifecycle” of IoT products. Clients of the Watson IoT platform can leverage the expertise of X-Force Red researchers throughout the process of development and deployment of IoT products.

Charles Henderson, Global Head of IBM X-Force Red said, “Over the past year, we’ve seen security testing further emerge as a key component in clients’ security programs.” Henderson added, “Finding issues in your products and services upfront is a far better investment than the expense of letting cybercriminals find and exploit vulnerabilities.”

Ayelet Avni, Senior Offering Manager of IBM Trusteer and Shaked Vax, Product Strategist of IBM Trusteer demo IBM Trusteer Rapport at FinovateSpring 2017

New York-based IBM was founded in 1911 and debuted its Customer Insight for Banking product at FinovateFall 2016. The solution uses predictive analytics and pre-built data models to help banks perfect customer segmentation models by analyzing transactions, spending behavior, and life events. The company’s security arm most recently demonstrated its Trusteer solutions. Ayelet Avni, Senior Offering Manager, and Shaked Vax, Product Strategist of IBM Trusteer, took the stage at FinovateSpring 2017 to debut how IBM Trusteer Rapport protects against phishing attacks.

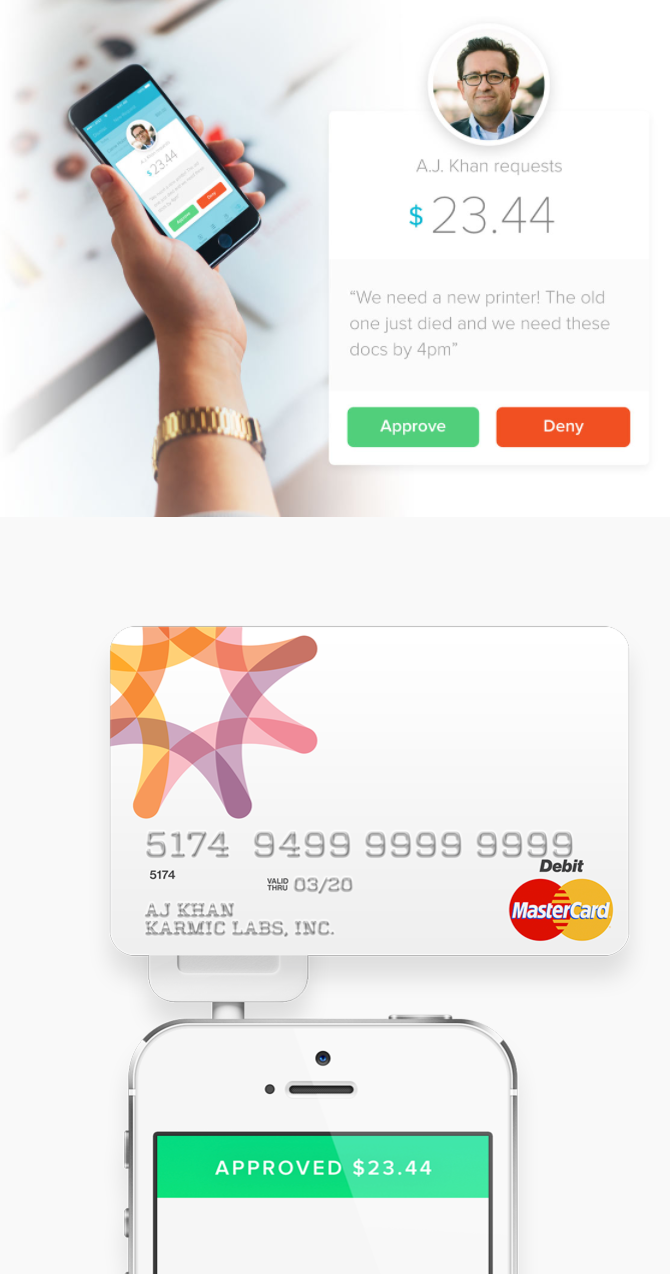

Karmic Labs

Karmic Labs