Analytics and visualization company MapD has its head in the cloud this week. That’s because the San Francisco-based company launched a cloud-based offering,¬†MapD Cloud.

The new service has been in the making since the company launched in 2016, but proved difficult to implement without widespread availability of GPUs in the public cloud. Previously, it was difficult for customers to set up a cluster of GPUs to run MapD software because it was challenging to find a hardware manufacturer that carried GPU server SKUsРthey were scarce in public clouds. This has shifted, however, with the rise of GPU computing adoption and major technology players providing support for GPU infrastructure.

Leveraging this shift, MapD has partnered with hardware vendors to standardize on-premises deployments and launched on the AWS marketplace. These moves have helped the company become a leader in GPU-accelerated analytics.

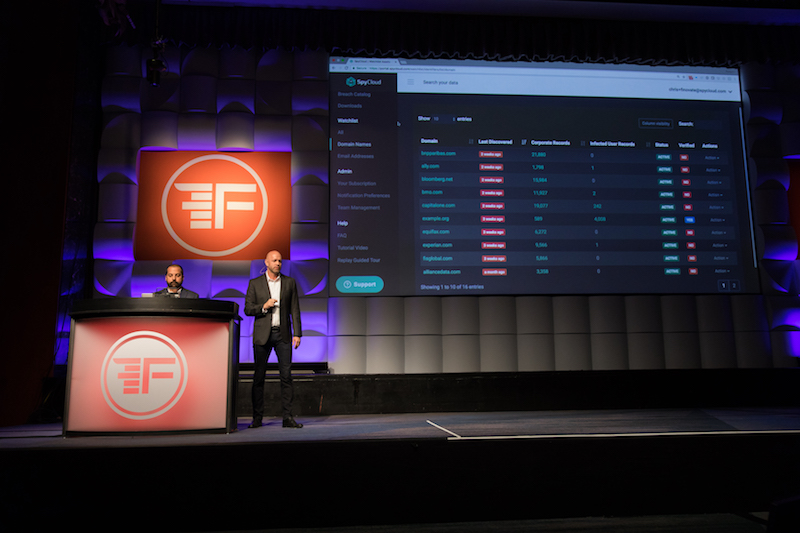

MapD was founded in 2013. The company’s CEO Todd Mostak most recently demoed the company’s Core and Immerse components at FinovateSpring 2017. Mostak also gave a presentation at FinDEVr New York 2017 titled How GPU-Powered Visual Analytics Are Remaking Financial Services. Last fall, MapD teamed up with IBM Power Systems to enhance the speed at which SQL queries can be performed.

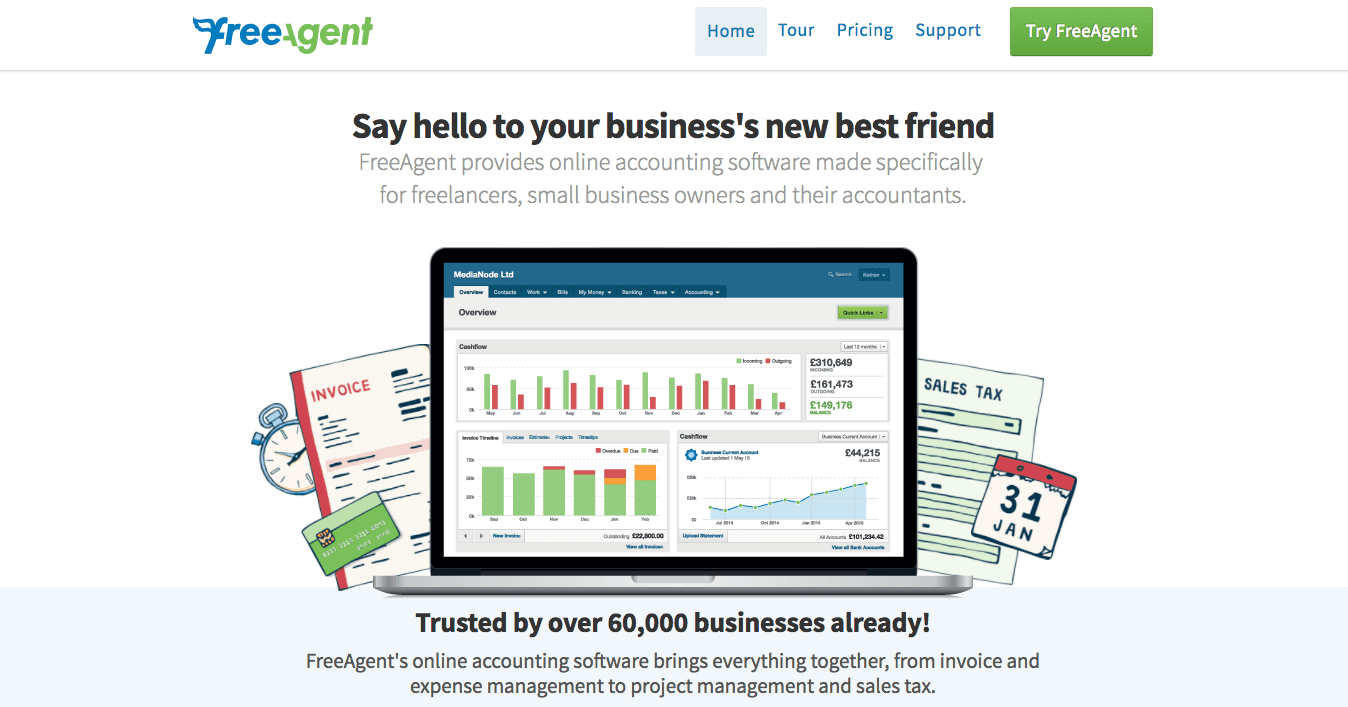

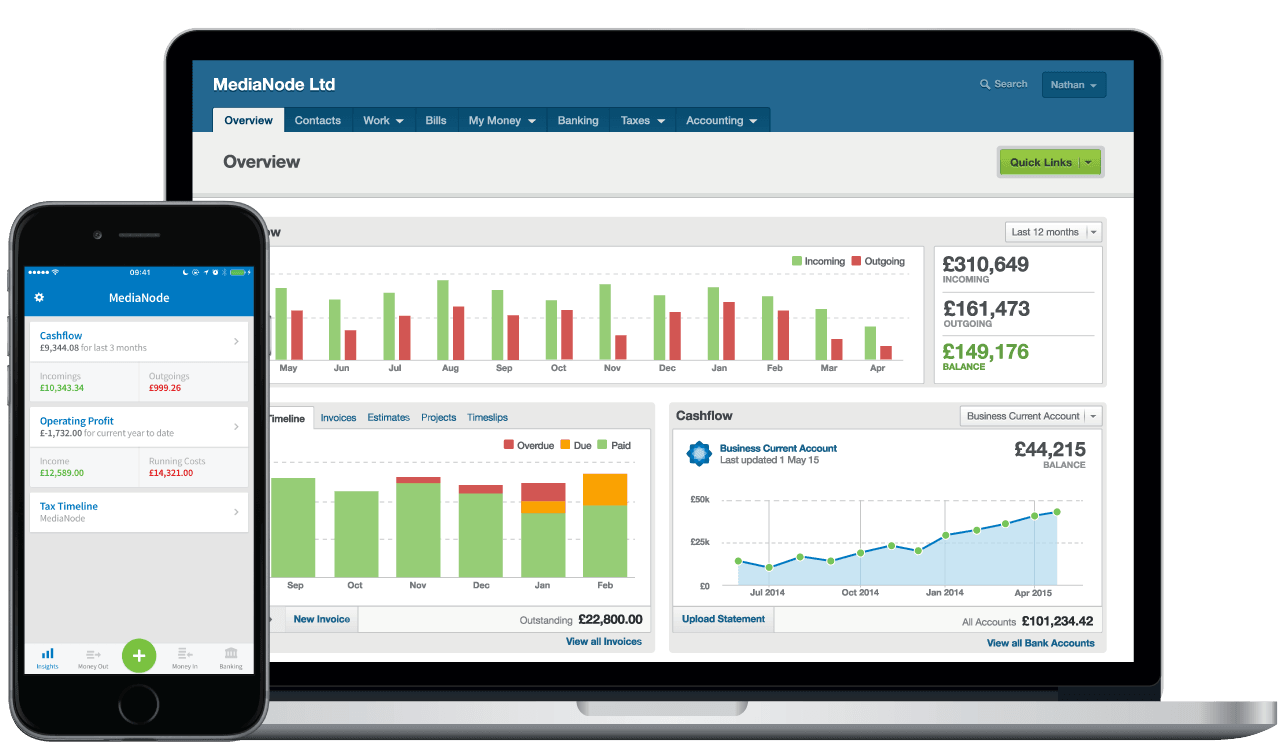

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as¬†Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as¬†Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”