Wealth tech company Personal Capital has launched a new 401(k) product through Alight Solutions, which will market the product to employers. WealthSpark, the new offering, is a joint effort between Personal Capital and AllianceBernstein (AB).

The new tool is a qualified default investment alternative (QDIA) in an employer-provided savings plan. A QDIA aims to encourage employees to invest assets in appropriate long-term savings vehicles.

To help users find those savings vehicles, WealthSpark leverages AB’s customized investment portfolios and combines it with Personal Capital’s digital wealth management planning tools, which curate 18 data points about a user’s financial situation and future plans. This information helps WealthSpark users understand their current finances as well as gain insight for decisions about their future, such as education, retirement, and buying a home.

Jennifer DeLong, head of defined contribution at AB, said, “The solution combines asset allocation with technology to deliver a more personal participant experience. By better understanding a participant’s individual circumstances, we can create a series of optimized glide paths to tailor outcomes to participants’ unique financial objectives.”

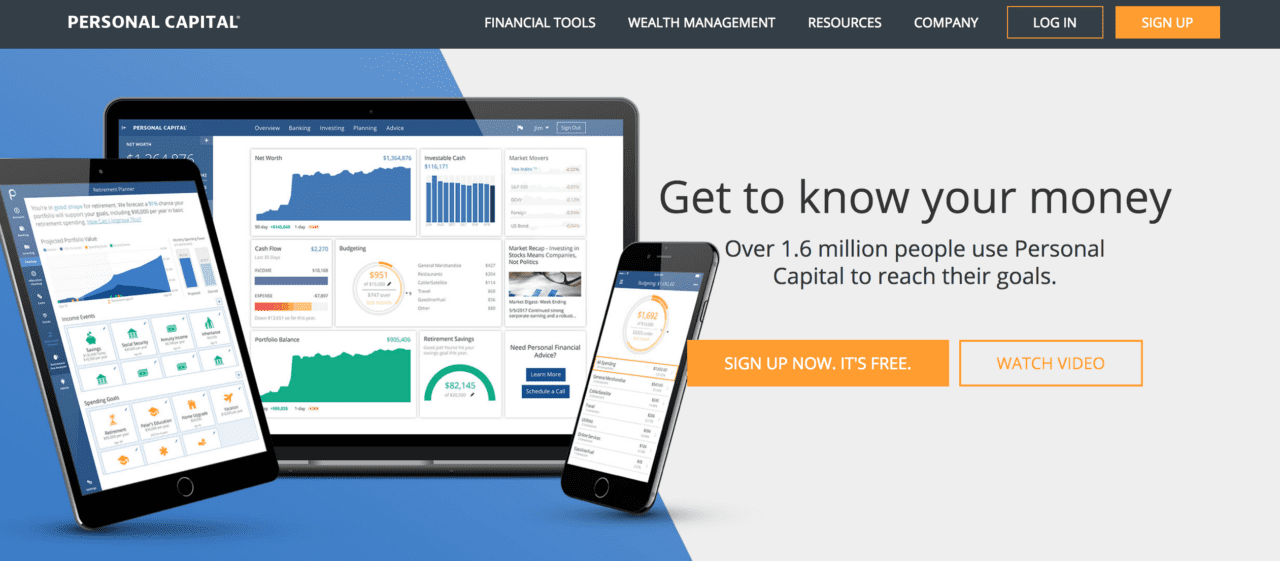

WealthSpark isn’t Personal Capital’s first foray into employer-sponsored plans. At FinovateFall 2012, the California-based company launched its own plan– the Personal Capital 401(k)— a professionally managed alternative to a traditional 401(k). “We scoured the landscape for better 401(k) plans,” said then-CEO Bill Harris in the demo. “Finally a light went on– let’s build a better 401(k) plan. So we did and I’m delighted to launch here at Finovate, America’s Best 401(k).”

The plan offered solo 401(k)s for sole proprietors, custom 401(k)s for large and complex businesses, 403(p) plans for non-profits, defined benefits plans for tax benefits, and cash balance plans. The plan boasted fees of one half of one percent and access to the Personal Capital dashboard.

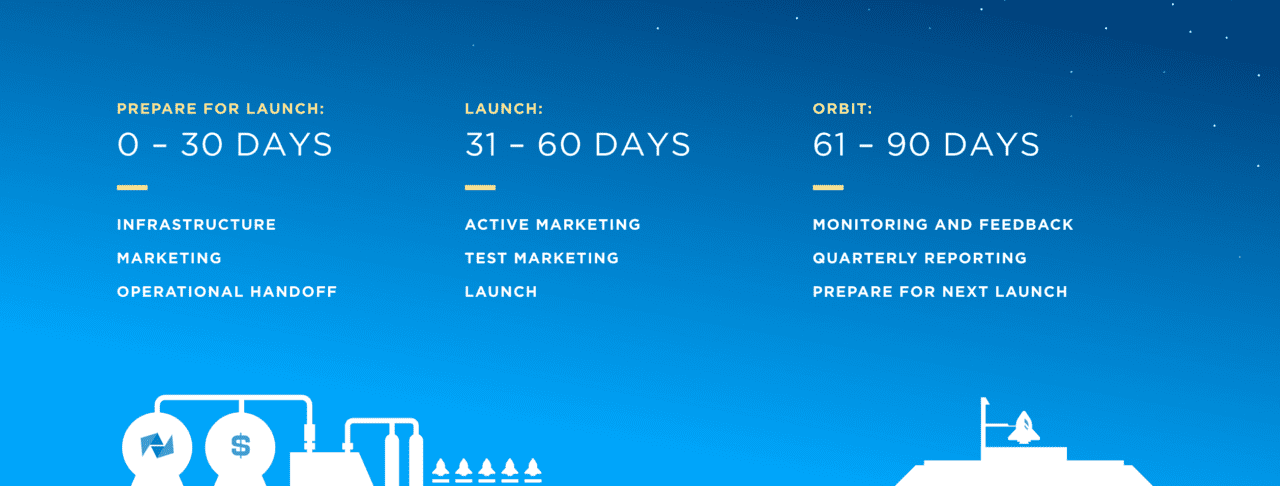

WealthSpark, the new offering, will help Personal Capital focus on its core competencies– financial analysis and wealth management planning– by relying on partnerships. Alight Solutions will tap into its existing customer base of 1,400 business clients to market WealthSpark, and AB will use its pre-existing portfolios for the investment side.

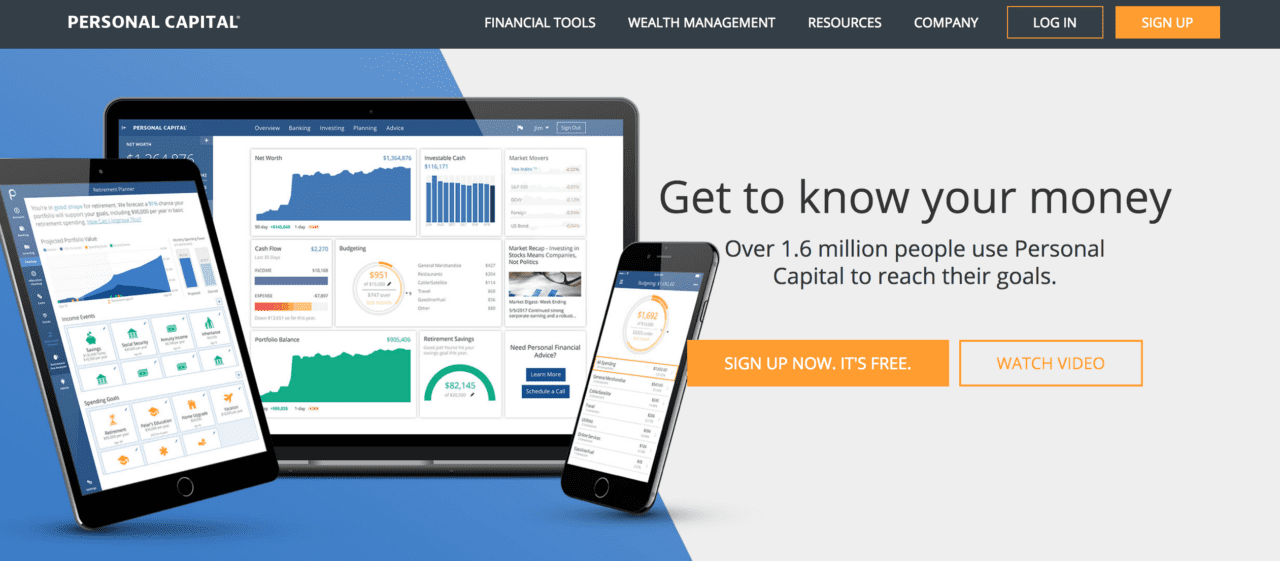

Founded in 2009, Personal Capital most recently presented at FinovateSpring 2014 where it debuted One Click Investment Portfolios. Earlier this spring, the company began offering socially responsible tools that make it easy for investors to put money into causes that matter to them. Personal Capital has raised $240 million.

A look at the companies demoing live at FinovateSpring on May 8 through 11, 2018 in Santa Clara, California. Register today and save your spot.

Presenters

Presenters Ori Hay, Founder & Chairman

Ori Hay, Founder & Chairman

To help drive future growth, Unison appointed Cari Jacobs (pictured) as the company’s Chief Marketing Officer. Jacobs most recently served as VP of integrated marketing at ModCloth and has previously driven marketing objectives at well-known brands such as Toyota, Lexus, Procter & Gamble, Intuit, General Mills, Levi’s, Coca-Cola and Prudential Real Estate. The company also appointed Quintin Gomez as the director and head of engineering.

To help drive future growth, Unison appointed Cari Jacobs (pictured) as the company’s Chief Marketing Officer. Jacobs most recently served as VP of integrated marketing at ModCloth and has previously driven marketing objectives at well-known brands such as Toyota, Lexus, Procter & Gamble, Intuit, General Mills, Levi’s, Coca-Cola and Prudential Real Estate. The company also appointed Quintin Gomez as the director and head of engineering.