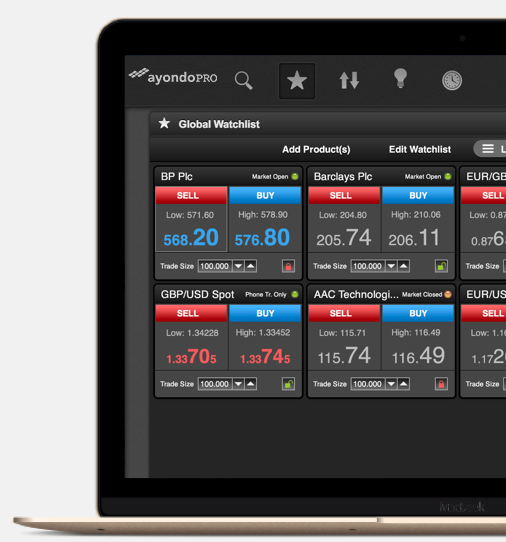

Social trading company ayondo announced a new professional trading platform this week. A complement to the Singapore-based company’s B2C product, ayondoPRO caters to the needs of professional traders.

Specifically, ayondoPRO clients will be able to trade more than 2,000 instruments with leverage of up to 200 times. Participants can also join a Spread Rebate Program that gives clients part of the spread they have paid back to their trading account. And professional traders don’t need to sacrifice ayondo’s standard benefits such as negative balance protection and free additional insurance that covers each Financial Services Compensation Scheme (FSCS) eligible customer up to $1.3 million in excess of the FSCS standard.

Specifically, ayondoPRO clients will be able to trade more than 2,000 instruments with leverage of up to 200 times. Participants can also join a Spread Rebate Program that gives clients part of the spread they have paid back to their trading account. And professional traders don’t need to sacrifice ayondo’s standard benefits such as negative balance protection and free additional insurance that covers each Financial Services Compensation Scheme (FSCS) eligible customer up to $1.3 million in excess of the FSCS standard.

To qualify as a professional for an ayondoPRO account, users must:

- Have executed significantly sized leverage trades at an average frequency of 10 per quarter over the last four quarters

- Have a financial instrument portfolio, including cash deposits, exceeding $569,000

- Currently work or have worked in the financial sector for at least one year in a professional position

“With ayondoPRO, professional and experienced traders will benefit from a combination of excellent service, great trading conditions, and customer protection. We have seen a lot of demand for a platform that provides high-leverage with trading conditions offering tight spreads,” said Raza Perez, Chief Product Officer of ayondo. “The launch of ayondoPRO is part of our commitment to keep improving and investing in our B2C product offering while introducing a PRO White Label facility for B2B clients, at the same time.”

Founded in 2008, ayondo offers a brokerage platform that lets users copy the moves of top traders to optimize returns. At FinovateEurope 2013, the company unveiled a new version of its service, its London brokerage, and a trader career training curriculum. The company became the first fintech to list on the Singapore Stock Exchange this March, following a failed reverse takeover deal from Starland Holdings. Earlier this fall, ayondo formed a white-label agreement with Phnom Penh Derivative Exchange to provide its TradeHub to its derivative broker clients in Cambodia.