Branded payments firm Blackhawk Network has always been busy over the holiday season. Between its gift cards, digital rewards, and prepaid cards, the California-based company has helped people embrace the spirit of giving.

And while Blackhawk Network is still helping fuel the gifting and rewards economy this year, it is moving to an even more 2020-friendly (that is to say, digital-first) approach.

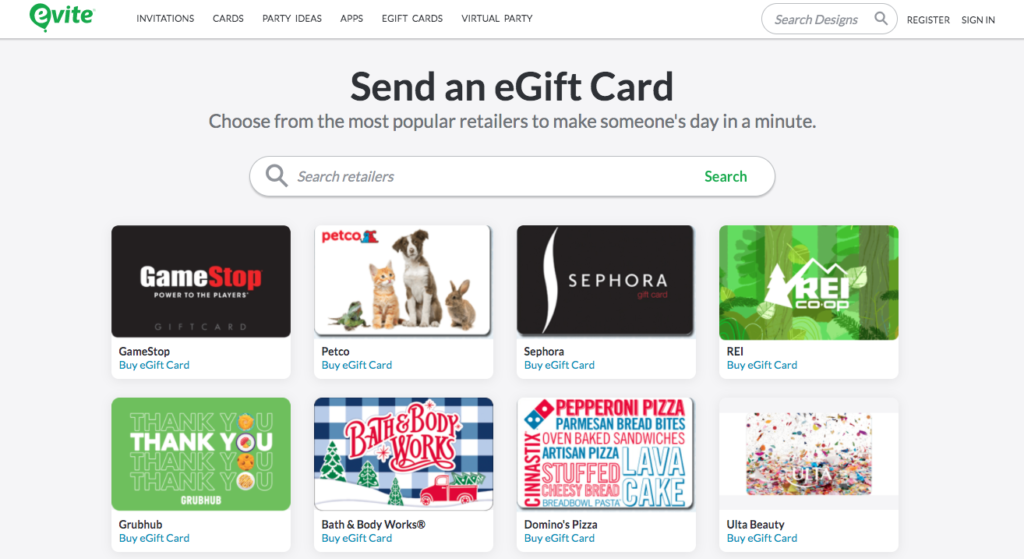

Last week Blackhawk announced it has teamed up with Evite to power the digital greeting card and invitation company’s eGift card program. Evite users can now choose from more than 100 eGift card options from popular brands including Lowe’s, Red Lobster, and Old Navy.

“It’s no surprise we’ve seen the demand for virtual gifts and greetings skyrocket in 2020. Contactless gifting is now a must-have, especially with the holidays approaching,” said Evite CEO Victor Cho. “Adding an extra touch like an eGift card can help people create personal connections with family and friends that they haven’t been able to see. It also helps our users stay safe, creates maximum flexibility for gifters and receivers, and modernizes the 2020 gifting experience. Thanks to Blackhawk’s expansive network of eGift card choices, our users have a broad selection to choose from at the tip of their fingertips.”

Brett Narlinger, head of global commerce at Blackhawk Network, noted that Blackhawk has seen a 70% increase in eGift sales– all before the peak holiday shopping season.

In addition to its partnership with Evite, Blackhawk announced a new payment solutions suite called Pay4It that connects physical and digital payments. The suite helps merchants reach underbanked populations with the ability to add cash to a digital wallet, mobile app or account, or make payments for digital goods with cash. It also offers consumers more choices to pay by enabling additional digital wallets and transforming loyalty points and rewards into purchasing power. Finally, Pay4It brings the gift card mall to non-traditional locations and into the digital realm.

“Retailers’ and merchants’ businesses changed instantly this year, and Blackhawk has responded with a product suite that brings once-disparate physical, digital and stored value payments together, keeping brands and consumers connected in a seamless way,” said VP of Global Product Strategy at Blackhawk Network Helena Mao.

An alum of FinovateFall 2012, Blackhawk Network was founded in 2001 and was acquired in January of 2018 by Silver Lake and P2 Capital Partners in a deal worth $3.5 billion. The company works with more than 1,000 brands and card partners, is in more than 200,000 retail locations in 28 countries, and connects with more than 300,000,000 shoppers each week. Talbott Roche is CEO.

Photo by Samira Rahi on Unsplash