Courtesy of African reseller, Global Solutions, three financial institutions in Ghana will be deploying Temenos T24 core banking software.

The announcement further distinguishes Temenos as one of the leaders in bringing banking innovation to sub-Saharan Africa. Currently more than 90 banks based in Africa are running software from Temenos.

Scalability and the capacity to work with new and existing functionality, including mobile functionality, are among the reasons cited by the various FIs in choosing Temenos to replace their legacy banking systems. Current systems in Ghana suffer from a lack of integration and redundancy, making administering the systems costly, complicated and vulnerable to downtime.

The institutions adding T24 are:

Provides personal and small business lending. Founded in 1995 as a licensed non-bank financial institution.

Among the oldest non-bank financial service companies in Ghana. Founded in 1991 and provides lending and asset management services.

Incorporated in 2011, the Royal Bank Limited operates under a universal banking license and provides accounts, savings, and investment services.

The growing middle class in Ghana is driving the demand for better financial services. Based on a report from the African Development Bank, Ghana’s middle class stands at 46% of the population, more than the continent-wide average of less than 34%. Additionally, half the potential bank customers in urban areas of the country remain unbanked, according to a national study.

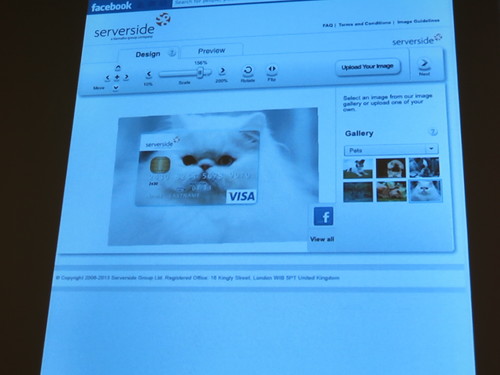

Temenos

demoed its

edgeConnect IXP with

Live Designer technology at FinovateEurope 2013. To learn more about our upcoming event in Europe, visit our FinovateEurope 2014 page

here.

Heckyl Technologies

Heckyl Technologies