Is it a contradiction that technology can make it easier for bank relationship managers and other financial professionals to do a better job of providing more “human” engagement?

That’s the goal of Novabase, a new Finovate alum based in Portugal that is leveraging the cognitive computing of Watson to give financial professionals sophisticated resources to better serve their clients and customers.

You may remember Watson as the supercomputer that surprised viewers of the game show Jeopardy! with its ability to outwit its human opponents. Now that same technology that was used to answer questions ranging from cable TV personalities to New Testament geography is being used in industries ranging from transportation and telecommunications to energy and financial services.

“Our vision is to make life simpler and happier for people and businesses, through technology,” the company said in response to questions about its experience at FinovateEurope 2015 in London. “Wizzio is a Novabase solution for a next generation sales tool for bank relationship managers and financial advisors that provides a unique approach to sales and engagement.”

The Stats

- Founded in 1989

- Headquartered in Lisbon, Portugal, with offices in Angola, UAE, Spain, Mozambique, and the United Kingdom

- Has more than 2,000 employees

- Invested more than €22 million in research and development for specialized products over the past three years

The Story

Novabase believe that the greater connectivity and greater independence ushered in by the mobile world has made a major impact on consumers’ attitudes. Consumers now expect the institutions they rely on to be both more responsive and better able to meet us on our own, increasingly on-the-go terms.

Consumers also increasingly expect personalization and customized service. Not only do consumers and clients expect you to be where they are. They also expect you to know, understand, and treat them as unique individuals, with unique, specific challenges.

Technology like Novabase’s Wizzio Powered by Watson can help banks and other financial institutions respond to these demands with a proactive, multichannel approach. To the extent that getting to know customers is essentially data work, technology like Wizzio handles the heavy lifting, giving the sales professional the time and energy to focus on the “personal touch”.

The Technology

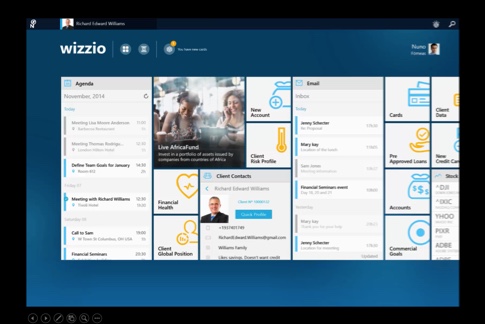

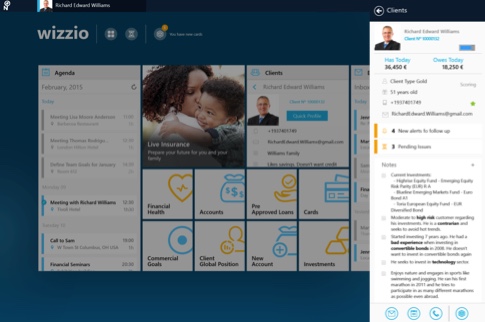

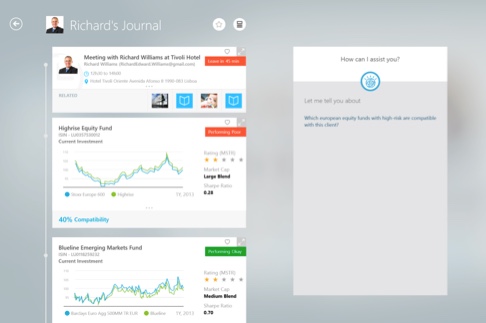

Wizzio powered by Watson can be thought of as an “intelligent ecosystem of apps and widgets” designed to help financial professionals keep track of everything they need to do their jobs more efficiently. Information on client accounts, finances, and investments are as readily available as agenda, email, and real-time stock market information.

With Watson, the Wizzio is capable of responding to questions in natural language, and combines predictive analysis and cognitive computing to put critical and insightful information into the hands of financial professionals sooner. These time-savings equate into both more personal one-on-one time with customers as well as greater opportunity to add new clients.

Platform features include the ability to interrupt processes and return to them later without losing place, and a “meeting mode” that allows professionals to share their device with clients and keep sensitive information hidden. Wizzio powered by Watson integrates with banks’ existing systems, and can be added to by third party and in-house development teams.

The Future

Novabase comes away from its first Finovate with high marks, calling the live demo format and networking environment, “refreshing” and “intimate”.

Datamonitor Financial gave Novabase a “5/5” rating based on originality, potential to have a long-lasting effect, game-changer potential, novelty or newness to consumer, and ability to change the market. Wrote analyst Daoud Fakhri, “it’s a perfect score for Novabase’s multi-channel banking platform, Wizzio.”

The company sees its growth very much tied to the spread and proliferation of smart machines – from phones, to tablets, to wearables and beyond. And as computers and artificial intelligence change our ability to process and integrate data, we should anticipate more ways tools like cognitive computing can and will be applied to our daily lives.

“Wizzio will extend the degree that cognitive computing reshapes the way we work,” Novabase said in a statement after the conference. “With more connected devices in the world, the role of smart machines will set a new standard for collaboration.”