Forget about presidents and painters. The next face I want on my paper currency is that of the ever-smiling ZenPayroll CEO Joshua Reeves, whose startup just raised $60 million in a round led by Google Capital.

Also participating in the Series B were Emergence Capital Partners, General Catalyst, Google Ventures, Kleiner Perkins Caulfield & Byers, and Ribbit Capital. The investment round takes ZenPayroll’s total funding to more than $85 million and, according to TechCrunch, values the company at more $550 million.

Coverage in the New York Times noted that round-leader Google Capital typically specializes in funding “older companies with more established businesses.” Google Capital partner Laela Sturdy pointed to the way ZenPayroll “changed payroll from an impersonal transaction into a meaningful connection between employers and employees.” And beyond ZenPayroll’s capacity to “solve every business owner’s biggest headache”—as another observer put it—Sturdy had high praise for the company’s human capital, as well. “We’re big believers in Josh and his team, and big believers in where they can take this company.”

Above: ZenPayroll co-founder and CEO Joshua Reeves presented at FinovateSpring 2014 in San Jose.

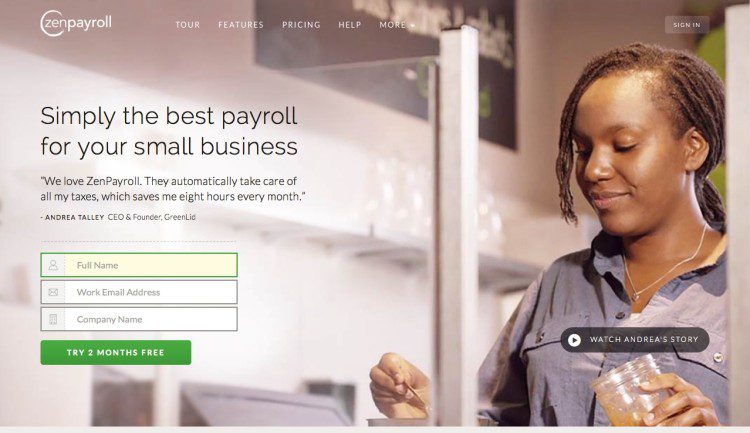

ZenPayroll offers all of its features: direct deposit; unlimited payroll runs; year-end W-2s and 1099s for $29 per month plus $4 per employee. There is no longer-term contract, and nothing to download. The online platform is accessible 24-7 from any web-enabled device. ZenPayroll is currently promoting a 2-month, free trial.

We last reported on ZenPayroll in September when the company opened up its API. The company processes billions of dollars in annual payroll for more than 10,000 SMEs in 47 states and the District of Columbia. With the additional funding, ZenPayroll anticipates going nationwide by the end of the month.

ZenPayroll made its Finovate debut last year at FinovateSpring 2014 in San Jose, Calif. Founded in October 2011 by Reeves, Tomer London (CPO), and Edward Kim (CTO), the company is headquartered in San Francisco, California.