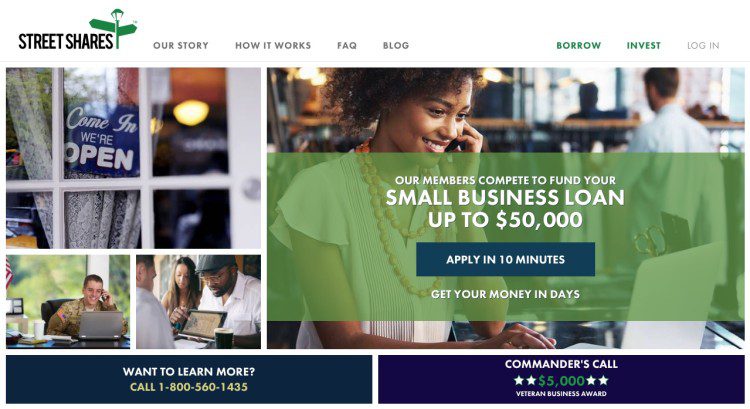

StreetShares is a specialist in what the company calls “affinity-based social lending.” The idea is to take crowdfunding a step further by connecting small business owners in need of capital with investors with shared affinities. The first shared affinity StreetShares has been able to serve is the veteran and veteran-owned business community.

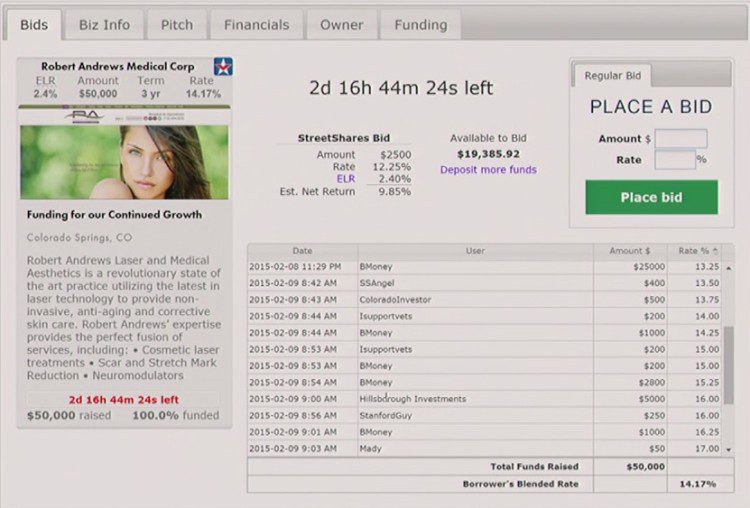

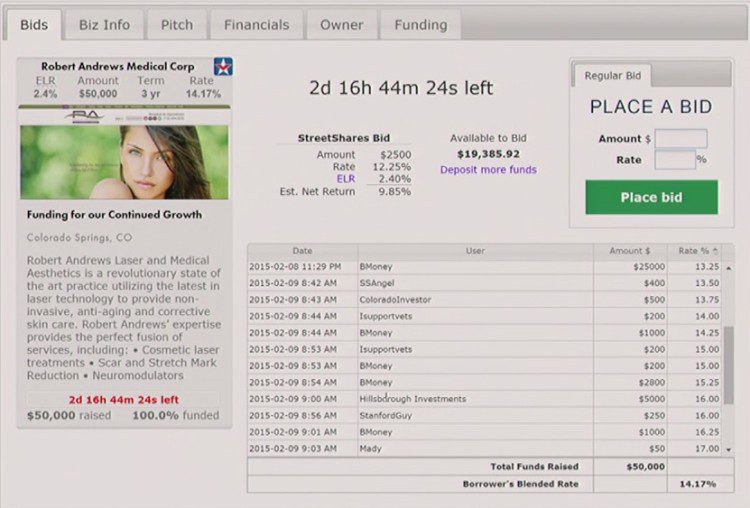

Calling the platform “Shark Tank Meets eBay,” business owners on StreetShares pitch their business to interested, accredited investors who compete for the opportunity to fund the loan.

“We are bringing the ‘peer’ back to peer-to-peer lending in the U.S. market,” StreetShares CEO Mark Rockefeller said, in explaining P2P lending’s origins in Great Britain and its evolution in the U.S. “We are talking about veterans funding veterans; female executives funding female executives; alumni from one school funding fellow alums from the same school.”

StreetShares’ stats:

- Founded in July 2013

- Headquartered in Reston, Virginia

- CEO Mark Rockefeller, COO Mickey Konson, and CTO Ben Shiftlet are co-founders

- Raised more than $1 million in funding

- Maintains 12 FTEs

- Provides small business loans of up to $50,000

The story

The idea behind StreetShares originated from the concept of the GI Bill, which gave millions of servicemen returning from World War II the opportunity to buy homes, start businesses, and raise families, giving birth to a true middle-class in America.

(Left to right): COO Mickey Konson and CEU Mark Rockefeller presented StreetShares at FinovateEurope 2015.

And while the circumstances have changed since 1945, many of the challenges remain: entrepreneurs, many of them veterans, still struggle to raise the capital help get their businesses off the ground or to move to the next level in terms of growth and expansion.

This is where StreetShares comes in. The company believes that businesses are more likely to get funded by (a) investors who have some sense of connection with the borrower and (b) investors who feel as if they know exactly where a business is headed and how it plans on getting there.

Add to this the extensive information about applicants provided to potential investors—and located on each applicant’s “tile”—and an investor has everything needed to make a lending determination. This includes information on the business itself, with links to websites and social media; a pitch with the ability to attached additional information, including spreadsheets, background on the applicant; and information on the status of the bidding for that company’s loan.

What do businesses need in order to apply for a loan via StreetShares? SMEs can apply online or by phone, and any U.S. citizen-owned business that has been in operation for at least a year is eligible. Businesses must earn a minimum amount of revenue, be incorporated, and have a business guarantor “with reasonable credit.” More information on the application is available at StreetShares.com.

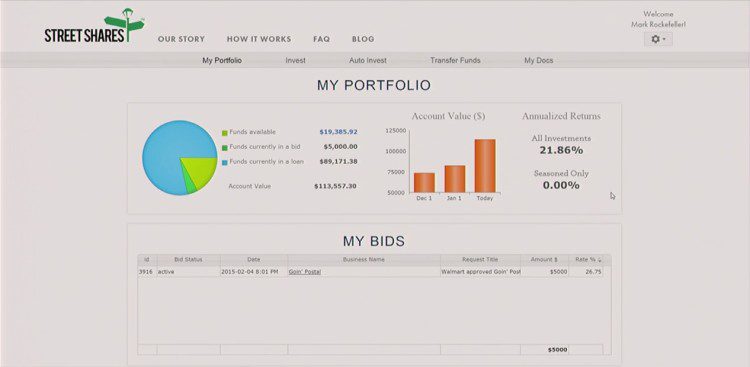

Individuals with “accredited investors” can participate on the platform. Accredited investors need a StreetShares account, and must have an income of $200,000 or more ($300,000 for a couple), or have a net worth of $1,000,000, excluding the value of a primary residence.

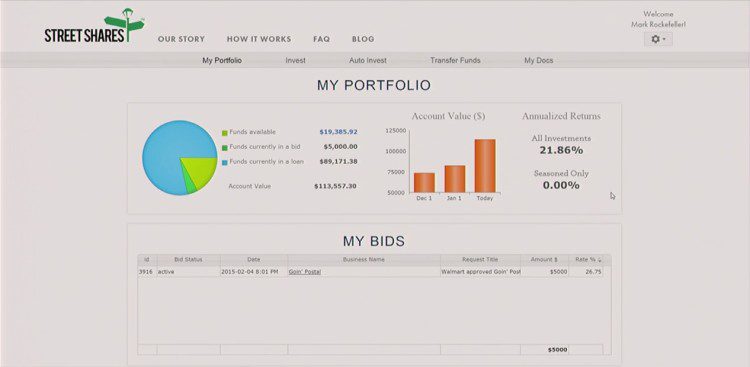

At FinovateEurope 2015, StreetShares showed its auto-invest feature. Auto-invest enables the platform to make investments for the investor based on a set of prearranged criteria such as risk-tolerance level, affinity type, interest rate, bid amounts and more. Once set, the platform bids on open loans on the investor’s behalf. The investor can review the bids in the invest tab, as well as in the investor portfolio.

The future

StreetShares believes three key factors distinguish it from others in the SME lending space. The first, and most prominent, is the use of social affinity groups to “build bonds of trust” between borrowers and lenders. This trust results in lower-cost loans. The second factor is a fully transparent platform in which all investors, retail and institutional, compete for loans fairly side by side. And the third factor is co-investment, in which StreetShares puts its own capital to work as a co-investor on each loan that is made.

The company remains focused on expanding its capacity to provide loans, especially in the below-$100,000 category, which Rockefeller says is a $136 billion market. “We think lending is about risk and risk is about data,” Rockefeller said from the Finovate stage in February. “But what if we could tap into human trust, and apply that to lending. We think we have a way.”

That way has been brightened by news last month that StreetShares has picked up a $200 million commitment from Direct Lending Investments, Community Investment Management (CIM), and Eagle Bank Corporation to help fund loans. Speaking for Direct Lending Investments, Brendan Ross said, “Our mission is to put money to work funding small businesses. We are excited about this business partnership with StreetShares and the unique business owners they serve.”

Watch StreetShares demo its technology live at FinovateEurope 2015.