markit.com | modl.markit.com | @markit | openf2.org | blog.openf2.org | @mod_labs & @openf2

![]() Markit is a leading global provider of financial information services. We provide products that enhance transparency, reduce risk, and improve operational efficiency. Our customers include banks, hedge funds, asset managers, central banks, regulators, auditors, fund administrators, and insurance companies. Founded in 2003, Markit employs 4,000 people in 11 countries. Markit shares are listed on Nasdaq under the symbol MRKT.

Markit is a leading global provider of financial information services. We provide products that enhance transparency, reduce risk, and improve operational efficiency. Our customers include banks, hedge funds, asset managers, central banks, regulators, auditors, fund administrators, and insurance companies. Founded in 2003, Markit employs 4,000 people in 11 countries. Markit shares are listed on Nasdaq under the symbol MRKT.

Markit perspective on our products

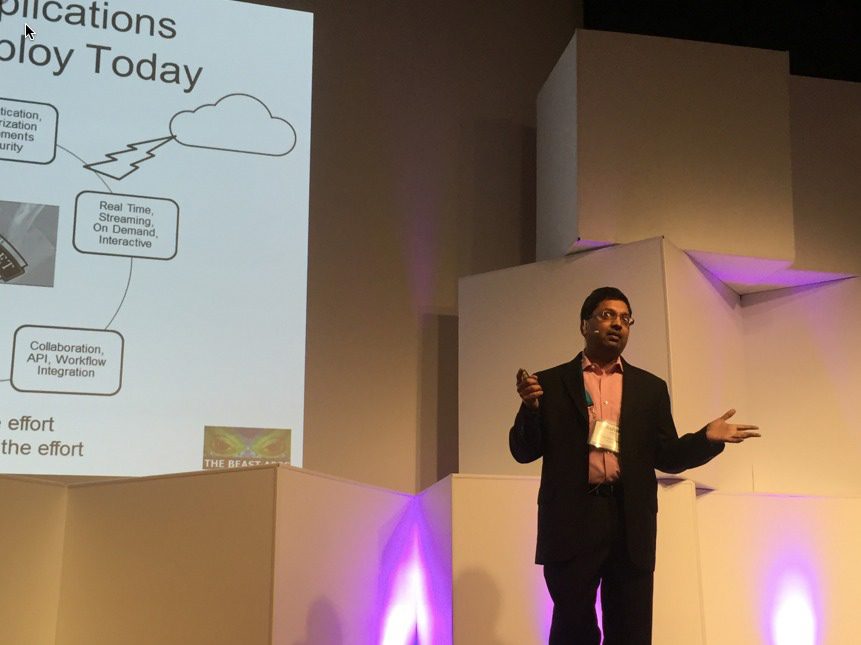

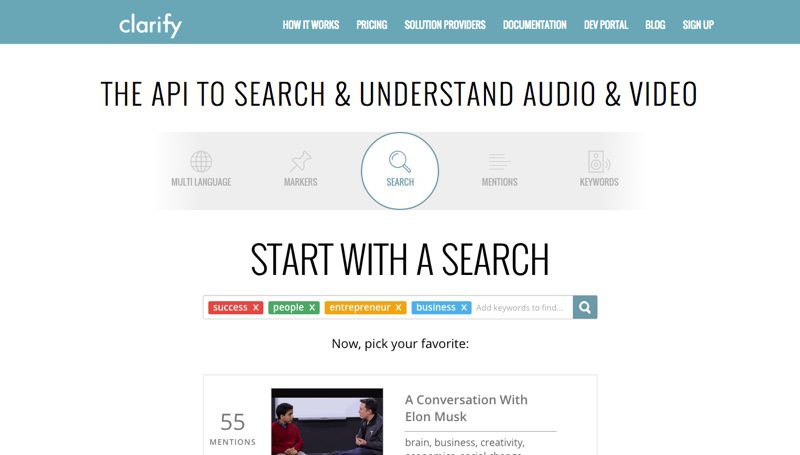

Using browser-based technologies and a capabilities-oriented modular approach, we can create anticipatory, personalized experiences that make desktop and terminal replacements a thing of the present. We will cover F2 (openf2.org), an open source foundation and web integration framework, as well as several key Markit capabilities (charting, smart text, personalization) as key building blocks for multi-party, integrated experiences.

Key takeaways:

- What F2 is, and how it can solve brokerage, wealth management, and banking-related problems

- The ease with which Amazon-like, personalized experiences for financial services can be created

- Markit’s capabilities and deep experience with key technologies for financial services, such as charting and super text

Presenter: Tim Burcham, Head of Labs

LinkedIn | [email protected]

For the past 16 years, Burcham has worked with Markit (formerly Wall Street On Demand) architecting, coding, managing, mentoring, and leading teams to deliver high-quality websites and rich user experiences under incredibly high-traffic volumes and tight timeframes.

Token

Token