What if you could keep all the things you like about the in-person customer experience and leave out everything you don’t like?

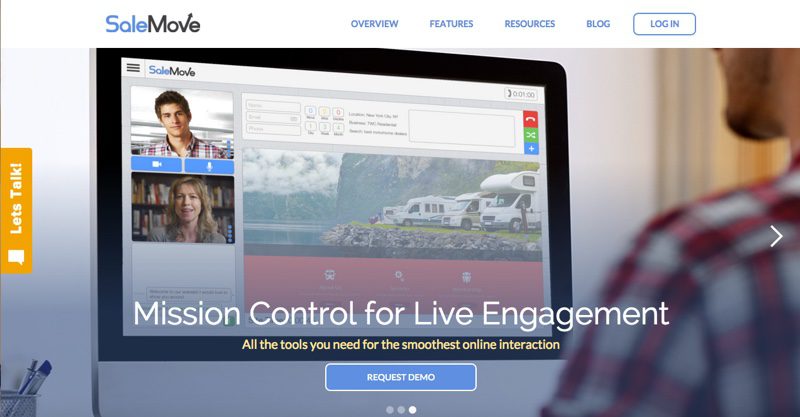

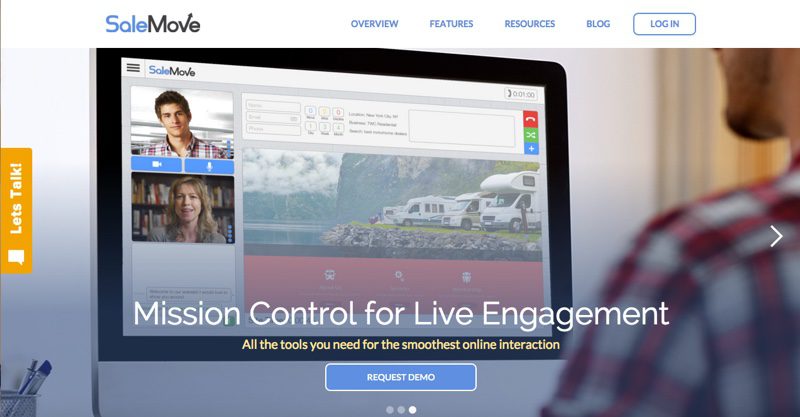

That’s the goal of SaleMove, the company that has built a platform to enable businesses selling services, such as banking, mortgage, insurance, to provide an online user experience that exceeds the in-person version.

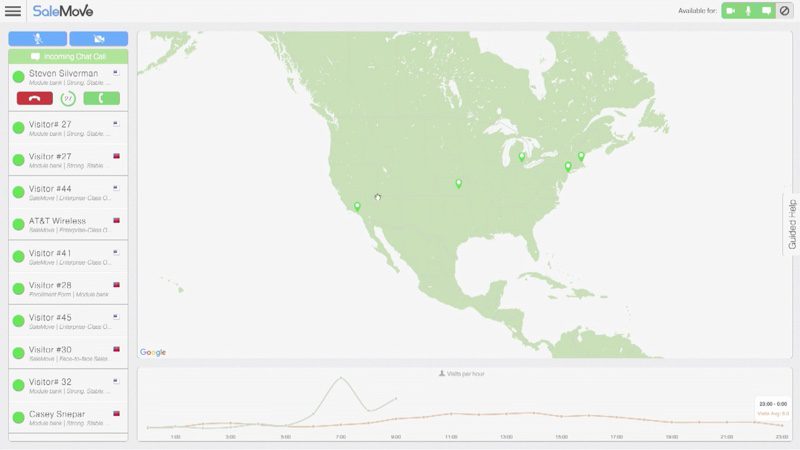

SaleMove Founder and CEO Daniel Michaeli demonstrated the SaleMove Engagement Platform and Omni Call at FinovateFall 2015.

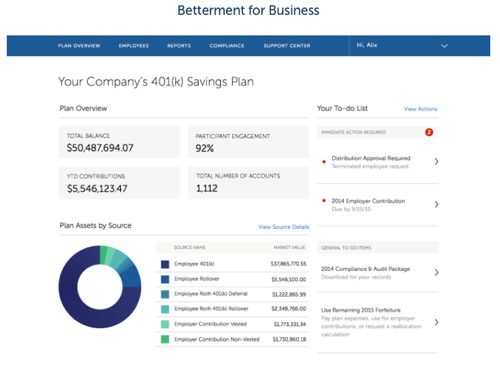

With its Engagement Platform, which won Best of Show honors at FinovateFall 2015, SaleMove offers financial services companies and others the ability to provide an omnichannel experience. Whether using instant video, voice, co-browsing or a combination, the platform is an enterprise-caliber, FINRA- and SEC-compliant solution-increasing engagement.

Company facts:

- Founded May 2012

- Headquartered in New York City, with offices in Estonia and Irvine, California

- 100+ customers

- $7 million in funding raised

How it works

The premise behind SaleMove is that it is difficult for consumers to make online purchases of complex financial products. According to Founder and CEO Daniel Michaeli, the lack of face-to-face interaction makes it easy for customers to be intimidated by these kind of purchases.

“Too often our interaction with businesses is asynchronous,” Michaeli says. “Even email and social media posts are more traditional, turn-based ways of communicating.” And what passes for real-time communication online is limited to IVR script or chats. “Walking into a website should be the same as walking into a store.” But the challenge is that much greater for businesses that are trying to sell complex services.

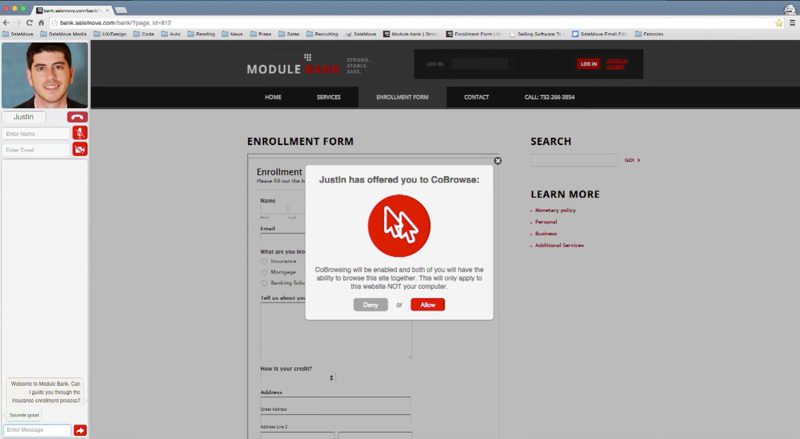

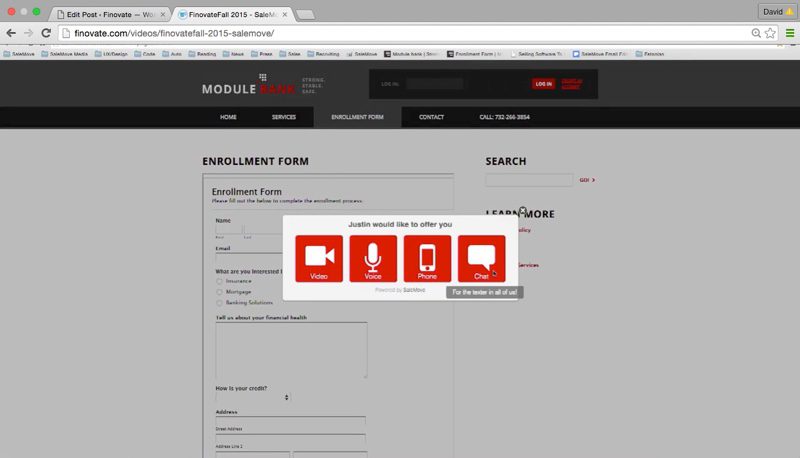

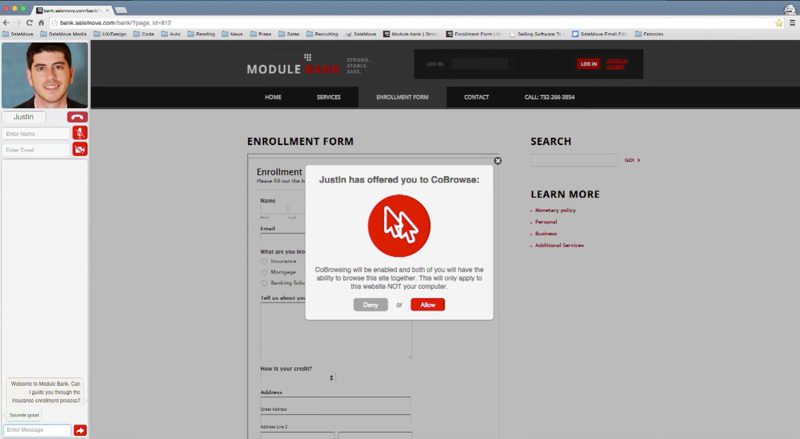

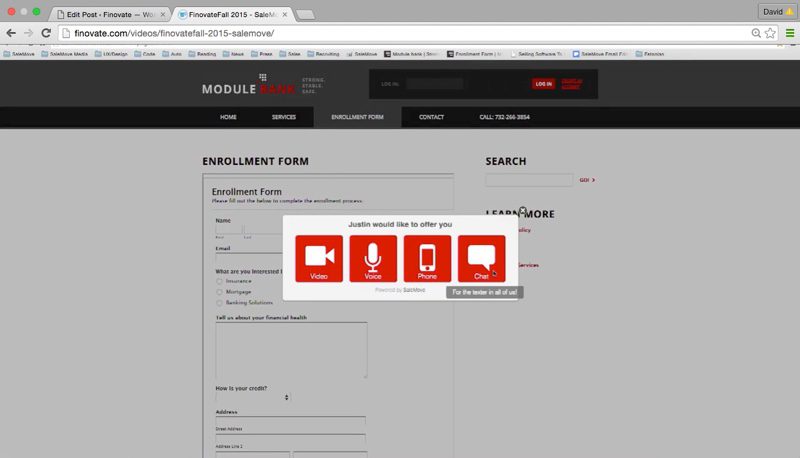

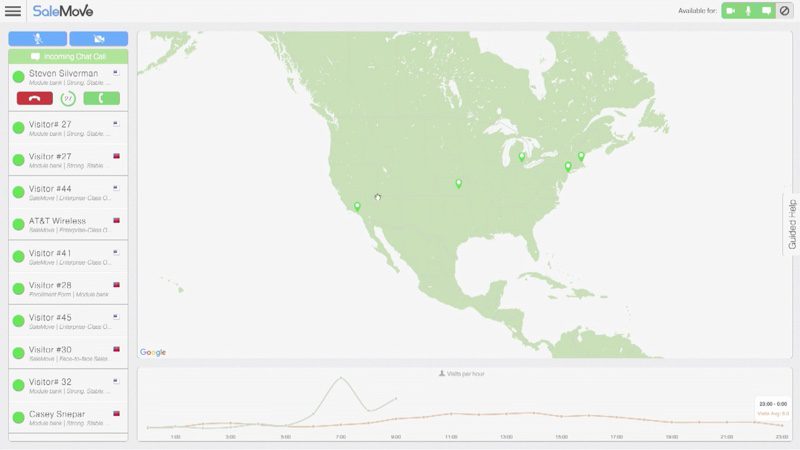

At Finovate, Michaeli elaborated on a few use-cases of the SaleMove platform in action. Starting with the Engagement Platform, he showed how a person completing an online insurance form, for example, was able to request real-time help from a customer-service representative via his preferred mode of communication—video, voice, phone, or chat—at any point during the process. The customer may opt in for co-browsing, giving the agent a cursor and the ability to enter data into on-screen fields. The communication mode can be changed any time during the interaction.

Michaeli also showcased SaleMove’s OmniCall. The service enables a customer to call an online merchant and immediately begin a co-browse session, made possible by a unique number that pairs the browsing session with the merchant’s number. “[Co-browsing] allows us to pre-authenticate the visitor,” Michaeli says. “[The merchant] knows exactly where I am. He can start co-browsing with me right away. It saves time, it saves cost, and it dramatically enhances the customer experience.”

SaleMove’s platform not only makes real-time online communication as seamless as in-person communication, but also works without the user or operator having to download or install anything; the platform is compatible with all browsers. “Everything happens through the browser,” Michaeli said. “All browsers, all operating systems.”

The future

When talking about the company’s current plans, Michaeli focuses on features. He talks about an engagement center that provides professional services. The idea is to determine KPIs “right off the bat,” and then build the program around the metrics that clients want to impact. “Many companies we work with—early adopting innovators—share our wavelength,” Michaeli said.

This is Michaeli’s central theme: tailoring the solution, making sure that even at the enterprise level the experience is unique and engaging. In terms of potential markets for the technology, Michaeli says financial services are a top-three vertical, along with auto and e-commerce. He says the breadth of applications in the financial service vertical enables a “whole host of things you can do: advisory, brokerage, insurance.”

“We have such great initial customers in the financial space,” Michaeli says. “I want to find more like-minded people who get the value of customer experience.”

Check out the demo video from SaleMove

![]() A look at the companies demoing live to 1,500 fintech professionals. Register today.

A look at the companies demoing live to 1,500 fintech professionals. Register today.

Pedro Almeida, Member, Board of Directors

Pedro Almeida, Member, Board of Directors Maria Domingues, Market Manager

Maria Domingues, Market Manager

Nikita Blinov, CEO

Nikita Blinov, CEO Alexander Fonarev, Chief Data Scientist

Alexander Fonarev, Chief Data Scientist Anna Laskovaya, Project Manager

Anna Laskovaya, Project Manager

David Sosna, CEO, Co-founder

David Sosna, CEO, Co-founder

Taulia CEO Cedric Bru called Holzapfel a “powerhouse” and praised her expertise in strategic marketing and operations. “From incubating SAP’s supplier-relationship management business to driving significant growth through innovation strategies, she has time and again proven her leadership and marketing savvy,” Bru said.

Taulia CEO Cedric Bru called Holzapfel a “powerhouse” and praised her expertise in strategic marketing and operations. “From incubating SAP’s supplier-relationship management business to driving significant growth through innovation strategies, she has time and again proven her leadership and marketing savvy,” Bru said.