With its first product, myInvenio, Cognitive Technology brings the blessings of big-data visualization to the banking industry.

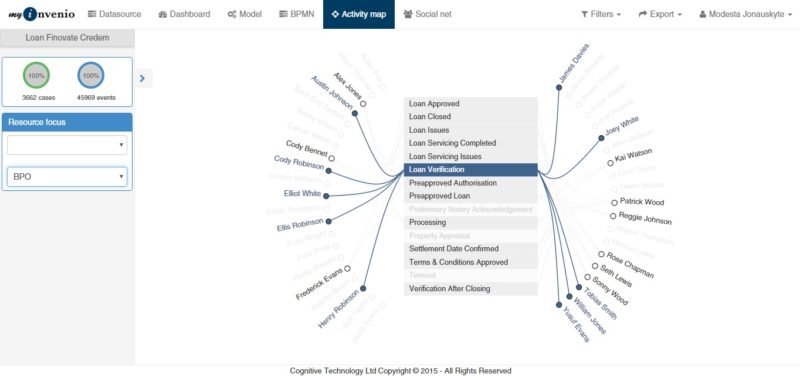

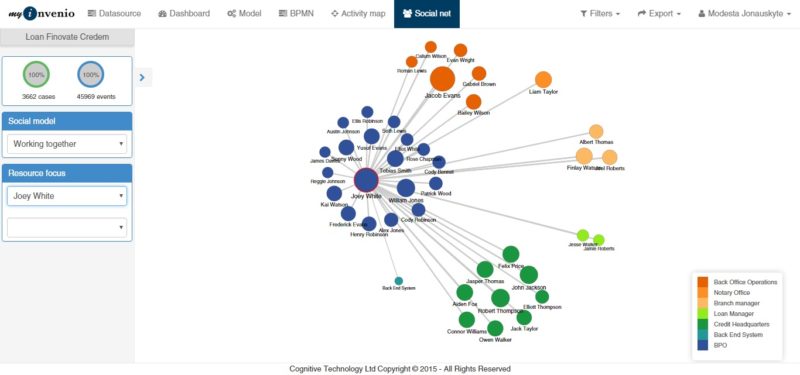

myInvenio analyzes the structured and unstructured data that financial institutions already have in their logs to help managers uncover inefficiencies and discover roadblocks. Leveraging Cognitive Technology’s talents in process intelligence, big data analytics, and data mining, myInvenio enables CIOs to analyze, monitor, and optimize banking processes.

“With myInvenio you can analyze the past, the present, and you can predict the future of your processes, providing the banking organization with a perfect solution for the process and operations governance,” says Massimiliano Delsante, myInvenio’s CEO.

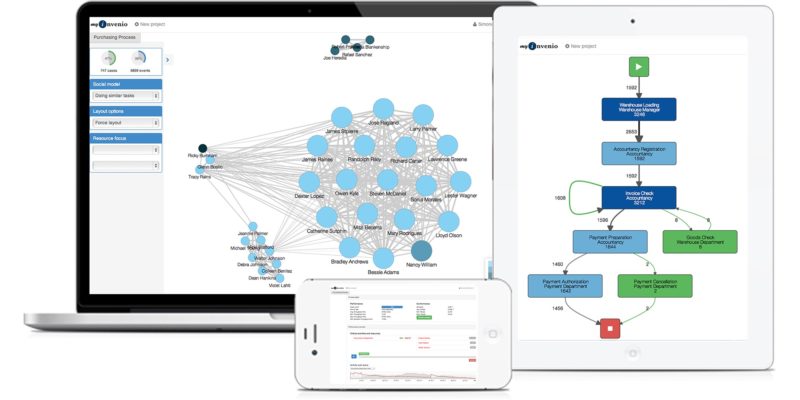

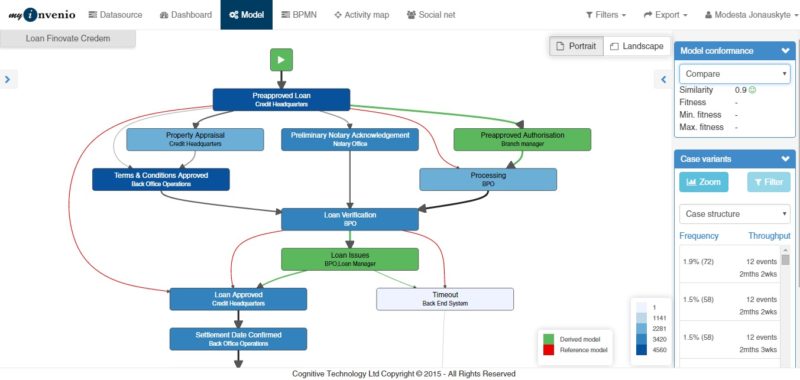

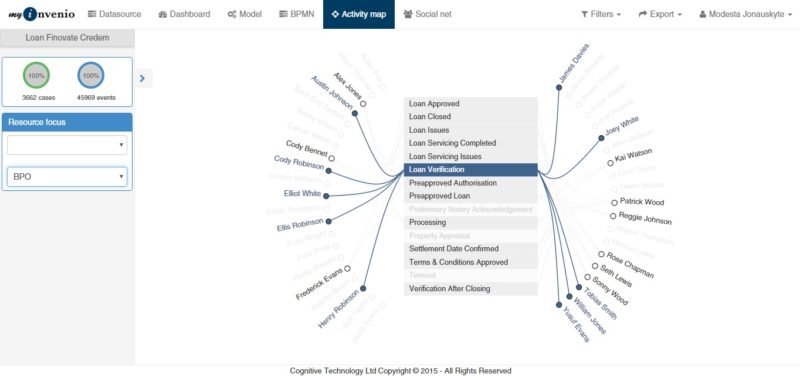

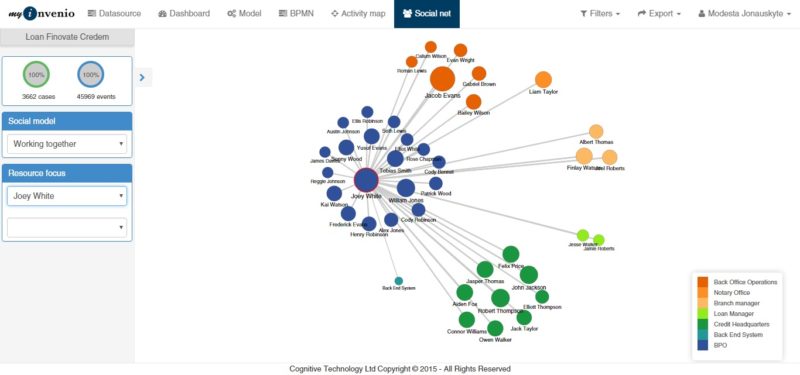

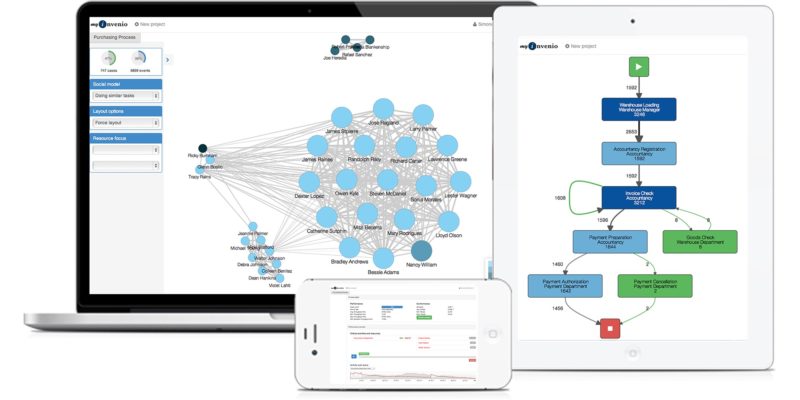

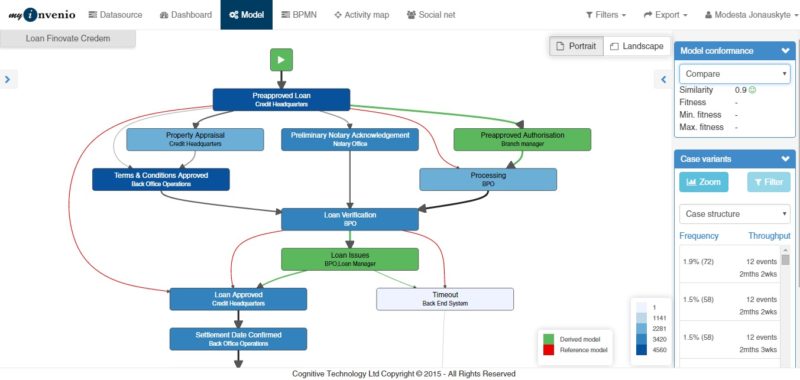

Like most data-visualizing technologies, seeing is believing. So be sure to check out myInvenio’s demo video from FinovateEurope for the full effect. The technology uses color, arrows, and even animated images to automatically visualize—and in some instances dramatize—business activities such as loan issuance. Accessing different views via an analytics dashboard allows managers to spot areas of potential non-compliance or to drill down to determine which processes are the most time-consuming and inefficient.

Pictured (left to right): Cognitive Technology’s Modesta Jonauskyte, sales and marketing, and CEO Massimiliano Delsante demonstrated myInvenio at FinovateEurope 2013 in London.

“Imagine how much time you would spend to get this kind of information using a traditional business-process-analysis approach,” myInvenio’s Modesta Jonauskyte said from the Finovate stage in London. “Instead of hiring a consultant, taking weeks or even months to interview all of the resources involved in the process, here you have myInvenio immediately indicating to you the most critical activities and resources involved.”

Managers can take advantage of the cloud-based, responsive technology to track process performance remotely via iPad, as well. The Performance View allows users to run an animation that follows a timeline of the various processes. KPIs, waiting times, waiting queues, resource allocation, and more.

myInvenio integrates with BPM and BI platforms and is fully compatible with BPMN2.0 and XPDL2.1. And courtesy of the myInvenio Connector for Qlikview and Qlik Sense, users of this popular business-intelligence solution now have access to myInvenio’s data-visualization technology, turning “data analysis into process analysis.”

Company facts:

- Founded in 2013

- Headquartered in Sliema, Malta

- More than 200 registered users

- Employs 14

- Launched myInvenio in January 2015

We spoke with Delsante and Jonauskyte about myInvenio on rehearsal day during FinovateEurope in February 2016. We followed up by email.

Finovate: What problems does myInvenio solve?

Massimiliano Delsante: Nowadays, organizations need a solution to quickly react to the fast-paced financial market. myInvenio is a Process Mining and Operational Intelligence solution that allows you to manage your financial process transformation by automatically reading the data and analyzing banking/financial processes. myInvenio constantly monitors your banking processes, performances, and compliance. It identifies bottlenecks, critical activities and resources, as well as suggests the improvements and transformations needed in order to anticipate the trends of the market.

Finovate: Who are your primary customers?

Delsante: Although business-process analysts can be advantageous optimizing any business process, so far myInvenio solution has been successfully implemented within financial, automotive and manufacturing industries. These industries remain at the top of myInvenio priority.

Finovate: How does myInvenio solve the problem better?

Delsante: myInvenio is a disruptive solution to automatically analyze your banking processes, identifying your process behaviour, compliance, performances, the resources involved and the resource collaboration. It provides advanced analytics features to constantly monitor process deviation, KPIs alignment, and the bottlenecks of resources, and activities.

Also, myInvenio is a cross platform, multi-user solution that is available to be used on any device. It is flexible and scalable. You can either start analyzing a single area of your organization’s data using myInvenio cloud online version covering your overall banking processes, or you can move to the on-premise solution when in need to manage big data analysis.

myInvenio has a very friendly user interface, so finance analysts without technical IT backgrounds can quickly get a grip of myInvenio features and to analyze their organization’s processes. It has a well-defined dashboard that ensures 100% analytics reliability besides reducing banking process analysis time and costs.

Finovate: Tell us about your favorite implementation of myInvenio.

Delsante: myInvenio was implemented within a large-scale banking organization, Credem, that has a wide banking network in Italy. Credem used myInvenio to optimise their loan application process and to later constantly monitor the process performance following the events happening in real time.

The bank is moving toward the adoption of myInvenio as the solution for banking process governance and operational intelligence.

Finovate: What in your background gave you the confidence to tackle this challenge?

Delsante: myInvenio team benefits from 20 years of experience in process management and analysis across banking, automotive, and fashion industries. Working with many customers and helping them tackle process-management issues, the development of an effective and easy-to-use Process Mining solution became a necessity.

Finovate: What are some upcoming initiatives that we can look forward to seeing over the next few months?

Delsante: Following the success of Finovate, myInvenio is being presented at many other events and conferences with the focus on financial industries and digital business transformation. On 5th of May, myInvenio will be present at FinTechStage hosted in Milan and the 7th of June, myInvenio success stories in automotive industry will be presented at Ferrari headquarters in Maranello by Ferrari CIO and other important representatives.

Finovate: Where do you see your company a year or two from now?

Delsante: myInvenio’s main goal remains to meet the highest expectations of its customers as well as to become a standard solution for the business process digital transformation in financial, automotive, and manufacturing industries.

Check out myInvenio’s demonstration video from FinovateEurope.

Morris emphasized that while the “lack of full disclosure” during the review process was “unacceptable,” he added that the sum involved was “minor” and would have no financial impact on the company. Lending Club’s Q1 results underscored this, with the company reporting year-over-year operating revenue gains of 87% and an increase of more than 137% in year-over-year, adjusted EBITDA.

Morris emphasized that while the “lack of full disclosure” during the review process was “unacceptable,” he added that the sum involved was “minor” and would have no financial impact on the company. Lending Club’s Q1 results underscored this, with the company reporting year-over-year operating revenue gains of 87% and an increase of more than 137% in year-over-year, adjusted EBITDA.

Who goes all the way to San Jose, California, for a fintech conference, you ask? A better question might be, who doesn’t? On Friday, we learned that

Who goes all the way to San Jose, California, for a fintech conference, you ask? A better question might be, who doesn’t? On Friday, we learned that

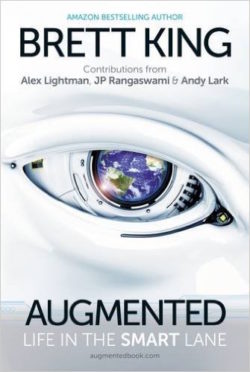

So what are 21st century technological revolutions made of? King sees four key disruptors that will define the way we will live in the decades to come: artificial intelligence, smart infrastructure, healthcare technology, and what he calls embedded and distributed experiences. This last category includes the sort of virtual technologies that companies like Facebook have made major investments in, as well as the “Internet of Things” concept that King describes as a world in which “everything is able to give feedback.”

So what are 21st century technological revolutions made of? King sees four key disruptors that will define the way we will live in the decades to come: artificial intelligence, smart infrastructure, healthcare technology, and what he calls embedded and distributed experiences. This last category includes the sort of virtual technologies that companies like Facebook have made major investments in, as well as the “Internet of Things” concept that King describes as a world in which “everything is able to give feedback.”

Ashley Luke, Director, Data Science

Ashley Luke, Director, Data Science James De Cicco, Head of Sales, Banking and Financial Services

James De Cicco, Head of Sales, Banking and Financial Services Gaurav Mistry, Manager, Business Development, Banking and Financial Services

Gaurav Mistry, Manager, Business Development, Banking and Financial Services

Ryan Wilk, VP of Customer Success

Ryan Wilk, VP of Customer Success Robert Capps, VP of Business Development

Robert Capps, VP of Business Development