It may take a village to raise a child, but it takes a ninja to provide free payment processing and programmatic remarketing to SMEs looking to save money and sell more.

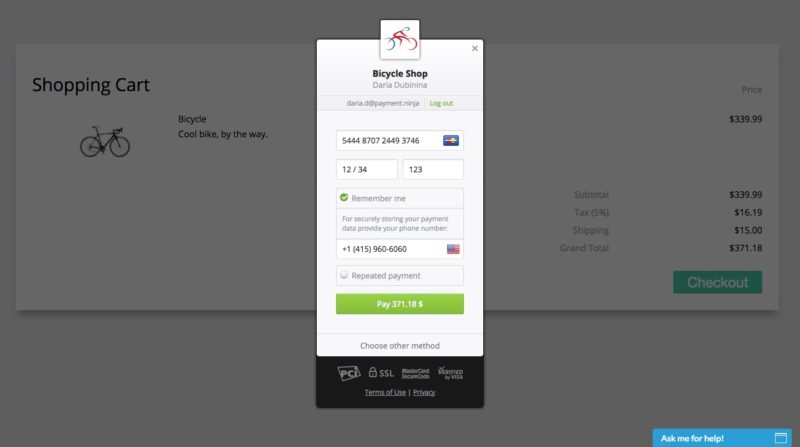

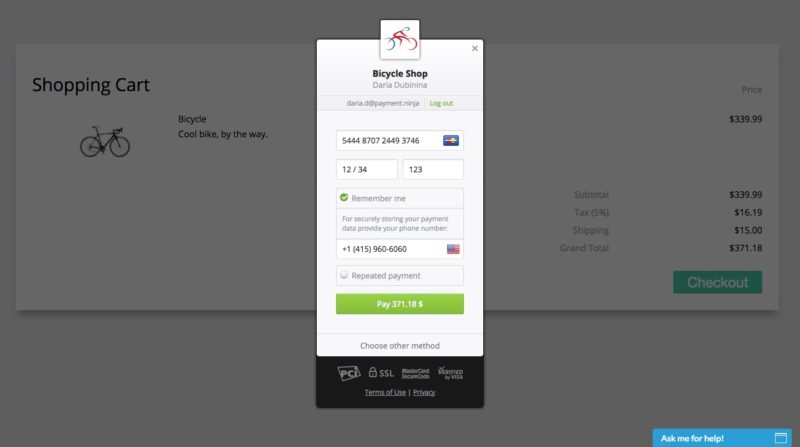

Payment.Ninja, a startup out of San Francisco, demonstrated its payment-processing technology at FinovateSpring 2016 in May. The solution can be added to an existing e-commerce website with a few lines of code, enabling merchants to accept credit and debit cards, as well as a number of alternative local payment methods around the world. Consumers can save card details or set up future automatic payments. Payment.Ninja works with any currency in the world: The technology charges the payment in the domestic currency, and intelligently routes the transaction to the acquirer with the greatest likelihood of immediate acceptance. Keeping decline rates down is critical to making sure the transaction process is efficient, inexpensive, and friction free.

All this without charge to the merchant. “No processing fees, no interchange, no nothing,” said Andrey Morozov.

Pictured (left to right): Co-founder Andrey Morozov and CEO Daria Dubinina demonstrated Payment.Ninja at FinovateSpring 2016 in San Jose.

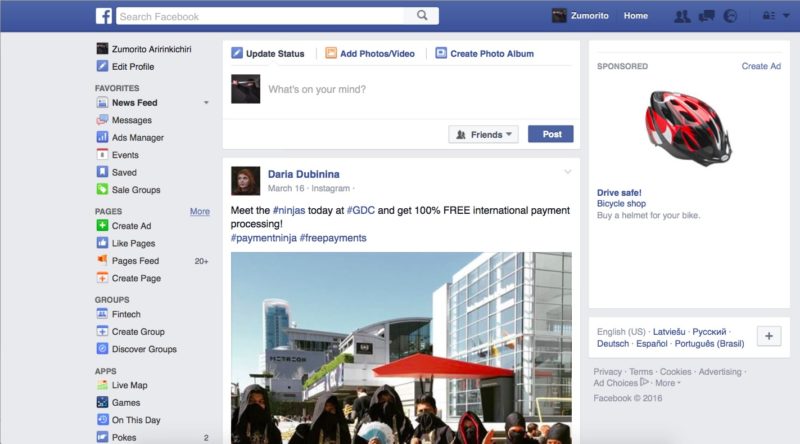

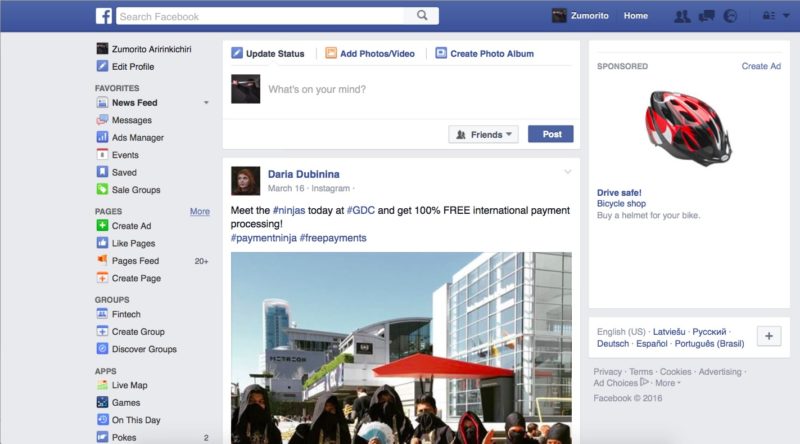

In addition to providing free processing, Payment.Ninja leverages the transaction data it processes to provide powerful remarketing resources for small businesses. For example, the technology can generate a Facebook advertisement based on a recent purchase, or notify an online game-player of an opportunity to save on the price of additional game tokens. “People sometimes pay six times in a row,” Andrey Morozov said from the Finovate stage in May, “and go from $3 to $200 in the process.” He pointed out that in both instances Payment.Ninja was able to make an upsell based on consumer behavior.

This versatility gets to some of the ways Payment.Ninja makes money. With the data collected in its Profile Cloud, Payment.Ninja builds and markets custom data-sets of anonymous user profiles. The company mentions other sources of revenue such as cross-sales, lead generation for FIs, and alternative credit scoring reached by using detailed data analytics and AI to avoid showing the competing offers.

Company facts:

- Founded in February 2015

- Headquartered in San Francisco, California

We spoke briefly with Daria Dubinina and Andrey Morozov during rehearsals at FinovateSpring in May. We followed up with a few questions for Dubinina by e-mail.

We spoke briefly with Daria Dubinina and Andrey Morozov during rehearsals at FinovateSpring in May. We followed up with a few questions for Dubinina by e-mail.

Finovate: What problem does your solution solve?

Daria Dubinina: A quarter of small business profits are being swallowed by payment companies. Think of the impact this money could have to the global economy if it remained in the business. There are two main expenses that eat into the budget of any business: payment processing with high fees and dropped baskets, and marketing with complicated and expensive tools, inefficient spending, and traffic fraud.

Finovate: Who are your primary customers?

Dubinina: We are focused on those who need the fee-relief the most: small and medium businesses or SMBs which are 90% of all the world’s businesses generating more than half the GDP in every country in the world.

Finovate: How does your solution solve the problem better?

Dubinina: Payment.Ninja is the world’s first 100% free payment-processing solution that helps merchants sell more with built-in remarketing technologies. Payment.Ninja is a payment solution, which is easily plugged into any website or mobile app, and then it starts to help to run the business—selling merchandise, managing marketing campaigns, increasing a shopping cart value, and protecting against fraud—and of course it will process payments completely free. No transaction fees, no interchange, no nothing. For the clients that don’t have cards, Payment Ninja is offering alternative payment methods internationally, showing the checkout in any language and processing payments in any currency.

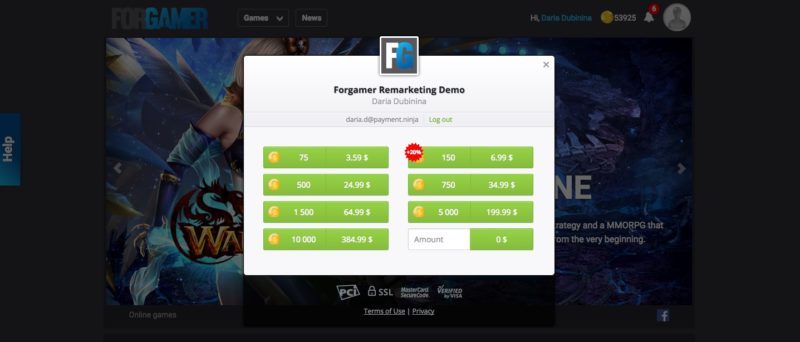

Finovate: Tell us about your favorite implementation of your solution?

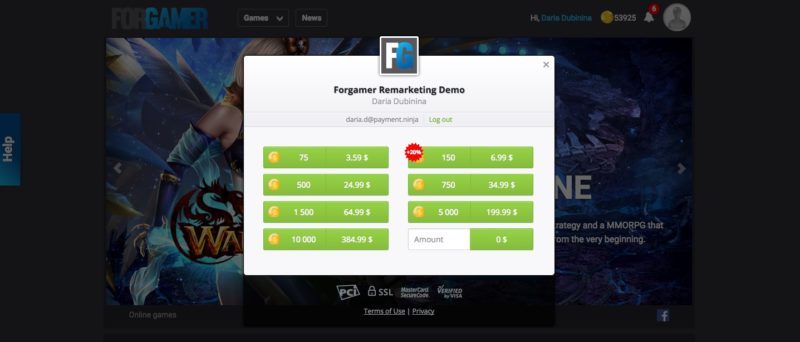

Dubinina: Our favorite example is one of our merchants, ForGamer, a games publishing portal where customers are playing online games and usually paying for coins that bring “ninja-power” to their game character. Payment.Ninja appears there from the moment of choosing the amount of coins to buy. When players pay online with Payment.Ninja and are getting back to the game, a pop-up appears with an offer to buy more coins for less. Players buy that package, return to game and when they see even better options, they keeping buying and buying. What Payment.Ninja does here is analyze customer’s purchase behavior and deliver the most relevant offers. The solution delivers offers to Google network, Facebook, Twitter, Instagram, and other networks.

Finovate: What in your background gave you the confidence to tackle this challenge?

Dubinina: Payment Ninja has three co-founders: myself, Daria Dubinina; Andrey Morozov; and Alexander Novozhenov. Together we share more than 35 years of experience. Andrey and myself have spent most of our careers in international payments. We know what’s important for merchants in terms of payments and how to create a perfect payment solution. Alexander has spent more than 10 years in marketing and knows everything about client retention, programmatic remarketing, and upselling technologies. The unique mix of our expertise allowed us to create completely free payment processing—connected to programmatic remarketing—that is really strong in data analytics.

Finovate: What are some upcoming initiatives from your company that we can look forward to over the next few months?

Dubinina: In a few months we’re launching sales in the U.S. market. Today at our site, merchants can add their companies to the waitlist for getting the Payment.Ninja solution. We’ve just opened a waitlist, but can tell you now that it will be a huge opening.

Finovate: Where do you see Payment.Ninja a year or two from now?

Dubinina: Payment.Ninja is a real industry pioneer. One to two years from now merchants won’t pay processing fees thanks to our solution. And these are not just dreams: think of text messages. A few years ago, each message cost money, but today everybody knows that paying for text messages is nonsense. Payment.Ninja is doing the same for the payments industry. Our technology allows merchants to forget about processing fees forever, and our mission is to help merchants around the world sell more, hire more, spend less, and drive the global economy.

Check out the demonstration video from Payment Ninja from FinovateSpring 2016.

Schiphol Airport Retail B.V. She has several years experience in accounting with Deloitte and Arthur Andersen, and has degrees in business administration and financial auditing from Erasmus Universiteit Rotterdam.

Schiphol Airport Retail B.V. She has several years experience in accounting with Deloitte and Arthur Andersen, and has degrees in business administration and financial auditing from Erasmus Universiteit Rotterdam.

We spoke briefly with Daria Dubinina and Andrey Morozov during rehearsals at FinovateSpring in May. We followed up with a few questions for Dubinina by e-mail.

We spoke briefly with Daria Dubinina and Andrey Morozov during rehearsals at FinovateSpring in May. We followed up with a few questions for Dubinina by e-mail.